Question: This question is based on Exhibit 13.3 on page 388 in chapter 13 of the textbook. In this example, Nestles cost of equity is calculated

This question is based on Exhibit 13.3 on page 388 in chapter 13 of the textbook. In this example, Nestles cost of equity is calculated using two different market portfolios, a domestic market portfolio and a global market portfolio. Which of these is more appropriate? Support your answer with appropriate arguments.

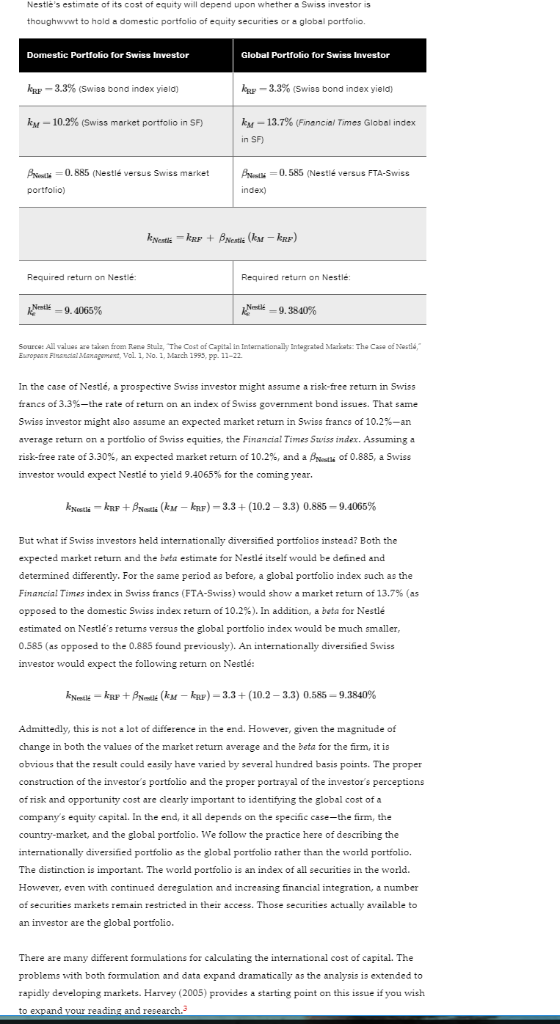

Exhibit 13.3:

Nestle's estimate of its cost of equity will depend upon whether a Swiss investor is thoughwwwt to hold a domestic portfolio of equity securities or a global portfolio Domestic Portfolio for Swiss Investor Global Portfolio for Swiss Investor koge-3.3% (Swipo bond index yield) - loge-3.3% (Swiss bond index yield) % ku - 10.2% (Swiss market portfolio in SF) kv-13.7% (Financial Times Global index - in SF) B=0.885 (Nestl versus Swiss market portfolio) Brisa=0.585 (Nestl versus FTA-Swiss index) kentlere + Bratli (ken - krp) Required return on Nestl Required return on Nestl Net -9.4065% Nestl -9.3840% % Source: All values are taken from Rase Stulz, The Cost of Capital in Internationally integrated Markets: The Case of Nestle" Eropose la Monument, Vol. 1, No. 1, March 1995, pp. 11-22 In the case of Nestl, a prospective Swiss investor might assume a risk-free return in Swiss franes of 3.3%-the rate of return on an index of Swiss government bond issues. That same Swiss investor might also assume an expected market return in Swiss francs of 10.2%-an average return on a portfolio of Swiss equities, the Financial Times Swiss index. Assuming a risk-free rate of 3.30%, an expected market return of 10.2%, and a Brostla of 0.885, a Swiss investor would expect Nestl to yield 9.4065% for the coming year. kNestle-knr+ Post (km - KRF) -3.3+(10.2 -3.3) 0.885-9.4065% But what if Swiss investors held internationally diversified portfolios instead? Both the expected market return and the beta estimate for Nestl itself would be defined and determined differently. For the same period as before, a global portfolio index such as the Financial Times index in Swiss francs (FTA-Swiss) would show a market return of 13.7% (as opposed to the domestic Swiss index return of 10.2%). In addition, a buta for Nestl estimated on Nestle's returns versus the global portfolio index would be much smaller, 0.585 (as opposed to the 0.885 found previously). An internationally diversified Swiss investor would expect the following return on Nestl: kNestle - Rp + Nestle (ku - krP) -3.3+(10.2 -3.3) 0.585 - 9.3840% Admittedly, this is not a lot of difference in the end. However, given the magnitude of change in both the values of the market return average and the beta for the firm, it is obvious that the result could easily have varied by several hundred basis points. The proper construction of the investor's portfolio and the proper portrayal of the investor's perceptions of risk and opportunity cost are clearly important to identifying the global cost of a company's equity capital. In the end, it all depends on the specific case-the firm, the country-market, and the global portfolio. We follow the practice here of describing the internationally diversified portfolio as the global portfolio rather than the world portfolio The distinction is important. The world portfolio is an index of all securities in the world. However, even with continued deregulation and increasing financial integration, a number of securities markets remain restricted in their access. Those securities actually available to an investor are the global portfolio. There are many different formulations for calculating the international cost of capital. The problems with both formulation and data expand dramatically as the analysis is extended to rapidly developing markets. Harvey (2005) provides a starting point on this issue if you wish to expand your reading and research. Nestle's estimate of its cost of equity will depend upon whether a Swiss investor is thoughwwwt to hold a domestic portfolio of equity securities or a global portfolio Domestic Portfolio for Swiss Investor Global Portfolio for Swiss Investor koge-3.3% (Swipo bond index yield) - loge-3.3% (Swiss bond index yield) % ku - 10.2% (Swiss market portfolio in SF) kv-13.7% (Financial Times Global index - in SF) B=0.885 (Nestl versus Swiss market portfolio) Brisa=0.585 (Nestl versus FTA-Swiss index) kentlere + Bratli (ken - krp) Required return on Nestl Required return on Nestl Net -9.4065% Nestl -9.3840% % Source: All values are taken from Rase Stulz, The Cost of Capital in Internationally integrated Markets: The Case of Nestle" Eropose la Monument, Vol. 1, No. 1, March 1995, pp. 11-22 In the case of Nestl, a prospective Swiss investor might assume a risk-free return in Swiss franes of 3.3%-the rate of return on an index of Swiss government bond issues. That same Swiss investor might also assume an expected market return in Swiss francs of 10.2%-an average return on a portfolio of Swiss equities, the Financial Times Swiss index. Assuming a risk-free rate of 3.30%, an expected market return of 10.2%, and a Brostla of 0.885, a Swiss investor would expect Nestl to yield 9.4065% for the coming year. kNestle-knr+ Post (km - KRF) -3.3+(10.2 -3.3) 0.885-9.4065% But what if Swiss investors held internationally diversified portfolios instead? Both the expected market return and the beta estimate for Nestl itself would be defined and determined differently. For the same period as before, a global portfolio index such as the Financial Times index in Swiss francs (FTA-Swiss) would show a market return of 13.7% (as opposed to the domestic Swiss index return of 10.2%). In addition, a buta for Nestl estimated on Nestle's returns versus the global portfolio index would be much smaller, 0.585 (as opposed to the 0.885 found previously). An internationally diversified Swiss investor would expect the following return on Nestl: kNestle - Rp + Nestle (ku - krP) -3.3+(10.2 -3.3) 0.585 - 9.3840% Admittedly, this is not a lot of difference in the end. However, given the magnitude of change in both the values of the market return average and the beta for the firm, it is obvious that the result could easily have varied by several hundred basis points. The proper construction of the investor's portfolio and the proper portrayal of the investor's perceptions of risk and opportunity cost are clearly important to identifying the global cost of a company's equity capital. In the end, it all depends on the specific case-the firm, the country-market, and the global portfolio. We follow the practice here of describing the internationally diversified portfolio as the global portfolio rather than the world portfolio The distinction is important. The world portfolio is an index of all securities in the world. However, even with continued deregulation and increasing financial integration, a number of securities markets remain restricted in their access. Those securities actually available to an investor are the global portfolio. There are many different formulations for calculating the international cost of capital. The problems with both formulation and data expand dramatically as the analysis is extended to rapidly developing markets. Harvey (2005) provides a starting point on this issue if you wish to expand your reading and research

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts