Question: this question is based on the same numbers as my last question Enter the December 1 balances in the ledger T-accounts and post the December

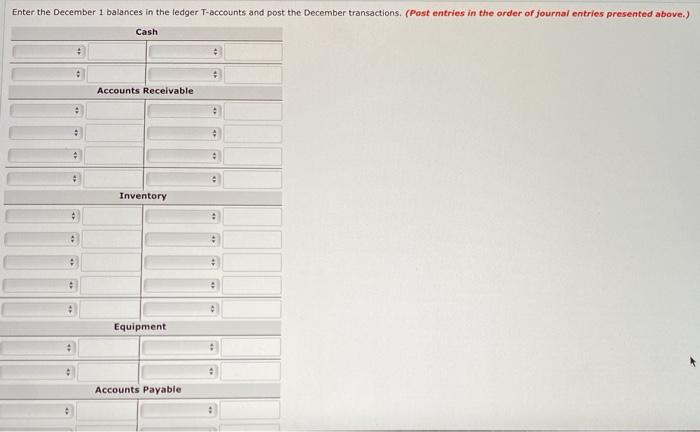

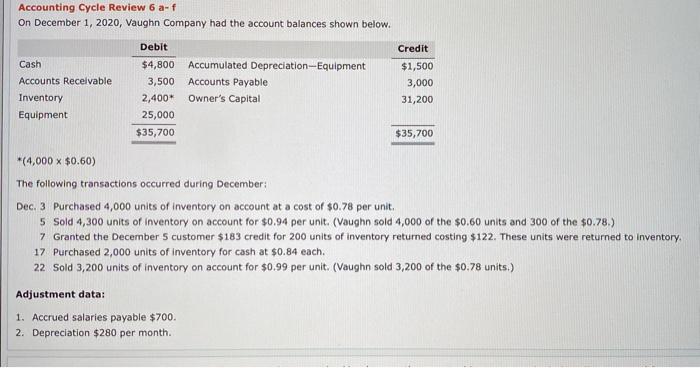

Enter the December 1 balances in the ledger T-accounts and post the December transactions. (Post entries in the order of journal entries presented above.) Cash Accounts Receivable . + Inventory 2 . . : . . Equipment . Accounts Payable Accounting Cycle Review 6a-f On December 1, 2020, Vaughn Company had the account balances shown below. Cash Accounts Receivable Inventory Equipment Debit $4,800 Accumulated Depreciation-Equipment 3,500 Accounts Payable 2,400* Owner's Capital 25,000 $35,700 Credit $1,500 3,000 31,200 $35,700 *(4,000 x $0.60) The following transactions occurred during December: Dec. 3 Purchased 4,000 units of inventory on account at a cost of $0.78 per unit. 5 Sold 4,300 units of Inventory on account for $0.94 per unit. (Vaughn sold 4,000 of the $0.60 units and 300 of the $0.78.) 7 Granted the December S customer $183 credit for 200 units of inventory returned costing $122. These units were returned to inventory. 17 Purchased 2,000 units of inventory for cash at $0.84 each. 22 Sold 3,200 units of inventory on account for $0.99 per unit. (Vaughn sold 3,200 of the $0.78 units.) Adjustment data: 1. Accrued salaries payable $700. 2. Depreciation $280 per month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts