Question: This question is broken down into multiple parts. Can you please help me out with these answers. I am struggling very bad. I would appreciate

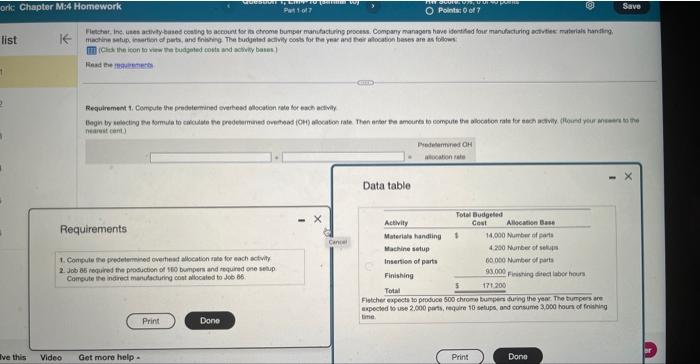

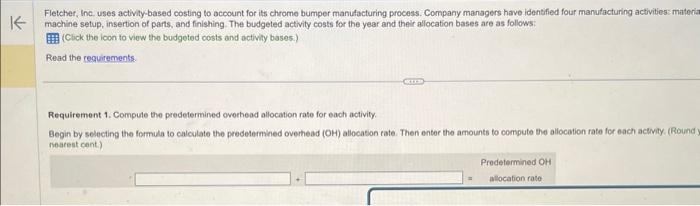

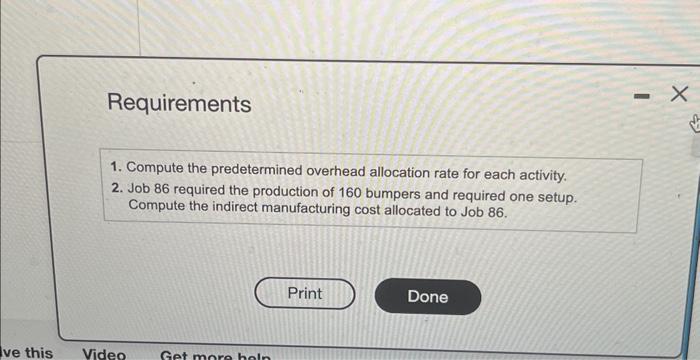

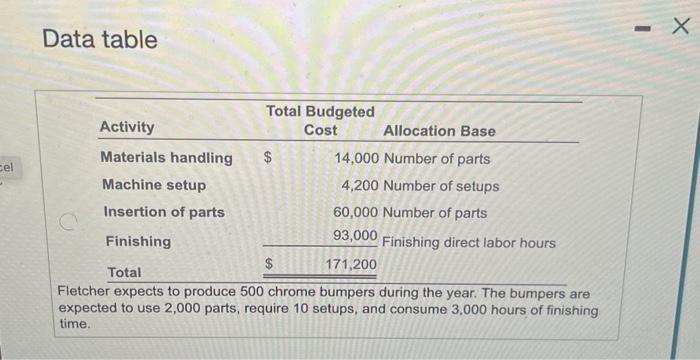

Fletcher, Inc. uses activity-based costing to acoount for its chrome bumper manufacturing process. Company managers have identified four manufacturing activities: materia machine setup, insertion of parts, and finishing. The budgeted activity costs for the year and their allocation bases are as follows: (Click the loon to view the budgeted costs and activity bases.) Read the reguirements. Requirement 1. Compute the predetermined overhead allocation rate for each activity. Begin by selecting the formula to calculate the predelermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate for each activity. (Round nearest cent.) Resd the rmagemerbs - Requirement 1, Compute the pondetemined evertees alocation rute foc ench actively nearest cents) Pretelammed OH atocation rats Requirements 1. Conguie the predeleminod overtiest allocation nuto for each sctwity 2. Job as required fle prosicion of 160 bumpens and tequined one seap. Correvite the indred mandacturing cost allocated to Job 65 . Data table eapecied 10 use 2.000 parts, require 10 setupa, and consume 3,000 houn of foinking trie. Data table Fletcher expects to produce 500 chrome bumpers during the year. The bumpers are expected to use 2,000 parts, require 10 setups, and consume 3,000 hours of finishing time. Requirements 1. Compute the predetermined overhead allocation rate for each activity. 2. Job 86 required the production of 160 bumpers and required one setup. Compute the indirect manufacturing cost allocated to Job 86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts