Question: This question is compulsory and must be attempted 1. You have applied for a job with a local bank. As part of its evaluation

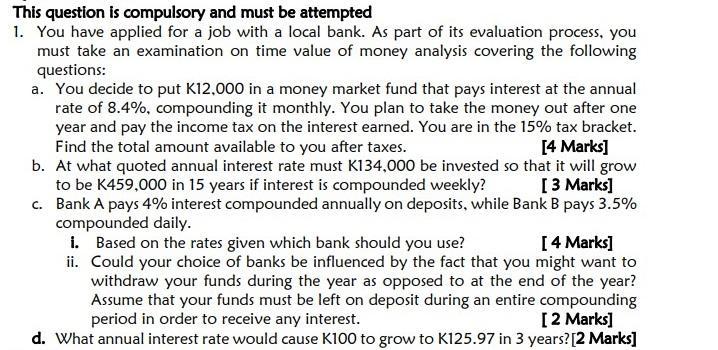

This question is compulsory and must be attempted 1. You have applied for a job with a local bank. As part of its evaluation process, you must take an examination on time value of money analysis covering the following questions: a. You decide to put K12,000 in a money market fund that pays interest at the annual rate of 8.4%, compounding it monthly. You plan to take the money out after one year and pay the income tax on the interest earned. You are in the 15% tax bracket. Find the total amount available to you after taxes. [4 Marks] b. At what quoted annual interest rate must K134,000 be invested so that it will grow to be K459,000 in 15 years if interest is compounded weekly? [ 3 Marks] c. Bank A pays 4% interest compounded annually on deposits, while Bank B pays 3.5% compounded daily. i. Based on the rates given which bank should you use? [4 Marks] ii. Could your choice of banks be influenced by the fact that you might want to withdraw your funds during the year as opposed to at the end of the year? Assume that your funds must be left on deposit during an entire compounding period in order to receive any interest. [2 marks] d. What annual interest rate would cause K100 to grow to K125.97 in 3 years? [2 marks]

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

a First we need to find the total amount of interest earned on the K12000 investment over one year at an 84 annual rate compounded monthly To do this ... View full answer

Get step-by-step solutions from verified subject matter experts