Question: This question is designed to generate a dual-panel figure like Carlton and Perloff Figure 4.6. Begin by deriving the residual demand function for the dominant

This question is designed to generate a dual-panel figure like Carlton and Perloff Figure 4.6. Begin by deriving the residual demand function for the dominant firm, and then the inverse residual demand function. Should find that = 157.62 and that = $45,967.07 or so. Need help graphing the question though and steps would help.

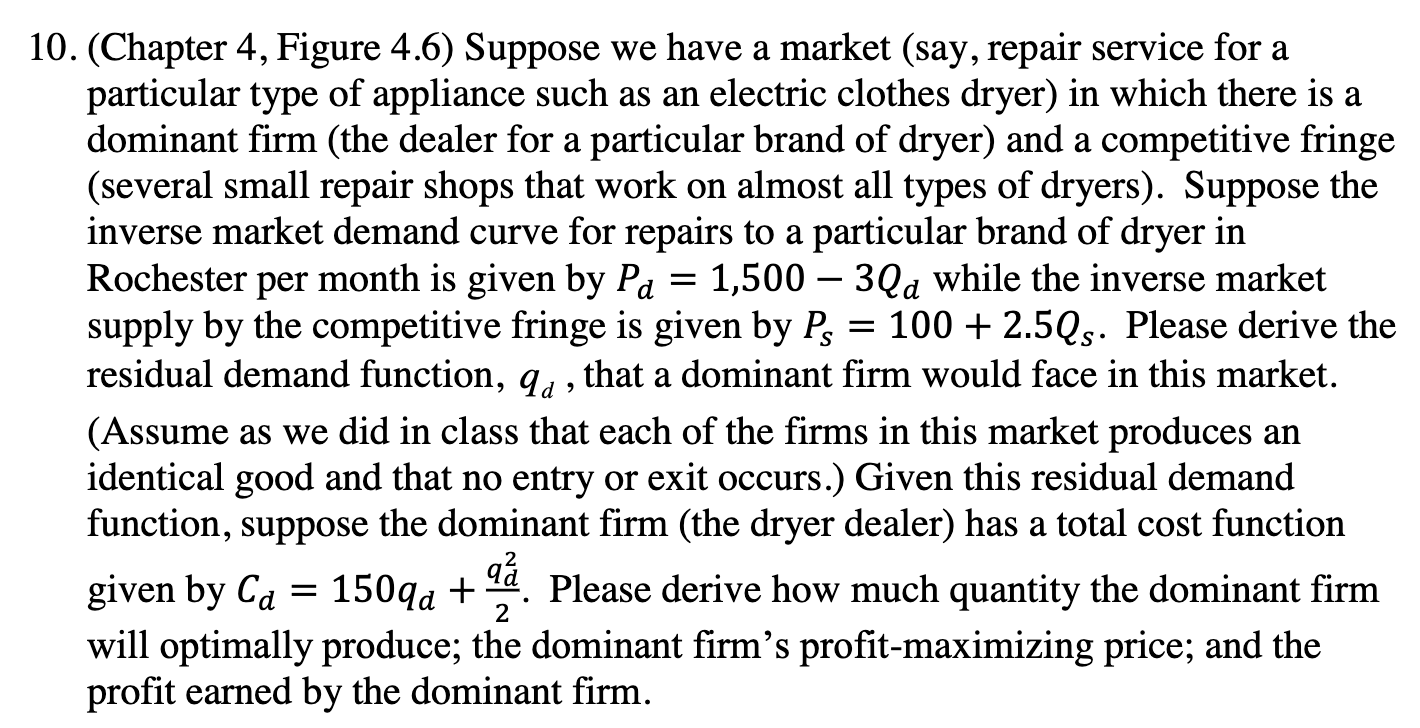

0. (Chapter 4, Figure 4.6) Suppose we have a market (say, repair service for a particular type of appliance such as an electric clothes dryer) in which there is a dominant firm (the dealer for a particular brand of dryer) and a competitive fringe (several small repair shops that work on almost all types of dryers). Suppose the inverse market demand curve for repairs to a particular brand of dryer in Rochester per month is given by Pd=1,5003Qd while the inverse market supply by the competitive fringe is given by Ps=100+2.5Qs. Please derive the residual demand function, qd, that a dominant firm would face in this market. (Assume as we did in class that each of the firms in this market produces an identical good and that no entry or exit occurs.) Given this residual demand function, suppose the dominant firm (the dryer dealer) has a total cost function given by Cd=150qd+2qd2. Please derive how much quantity the dominant firm will optimally produce; the dominant firm's profit-maximizing price; and the profit earned by the dominant firm. 0. (Chapter 4, Figure 4.6) Suppose we have a market (say, repair service for a particular type of appliance such as an electric clothes dryer) in which there is a dominant firm (the dealer for a particular brand of dryer) and a competitive fringe (several small repair shops that work on almost all types of dryers). Suppose the inverse market demand curve for repairs to a particular brand of dryer in Rochester per month is given by Pd=1,5003Qd while the inverse market supply by the competitive fringe is given by Ps=100+2.5Qs. Please derive the residual demand function, qd, that a dominant firm would face in this market. (Assume as we did in class that each of the firms in this market produces an identical good and that no entry or exit occurs.) Given this residual demand function, suppose the dominant firm (the dryer dealer) has a total cost function given by Cd=150qd+2qd2. Please derive how much quantity the dominant firm will optimally produce; the dominant firm's profit-maximizing price; and the profit earned by the dominant firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts