Question: This question is from Intermediate Accounting volume 2, 12th edition by Kieso. Please show your calculations. Isabelle Leclerc is the controller at Blossom Pharmaceutical Industries,

This question is from Intermediate Accounting volume 2, 12th edition by Kieso. Please show your calculations.

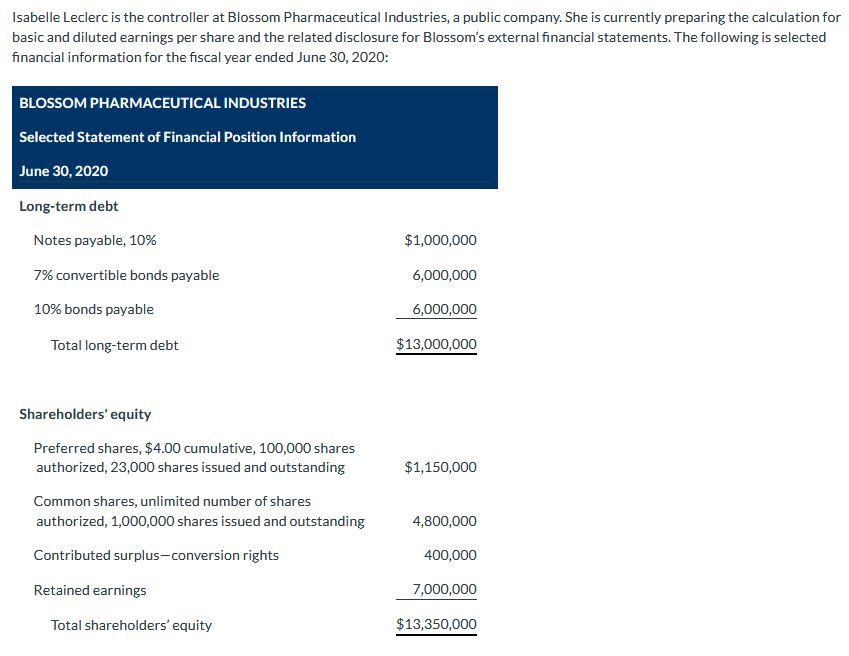

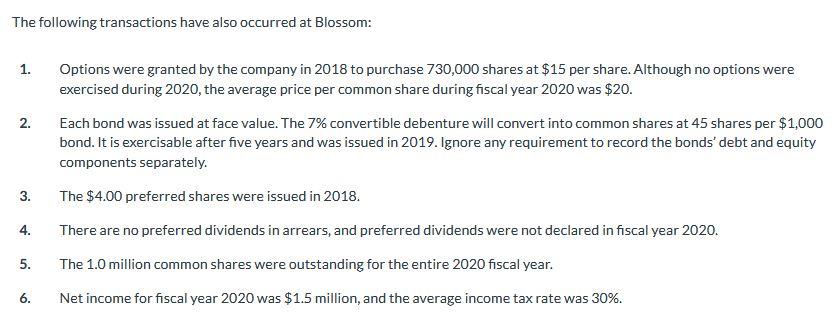

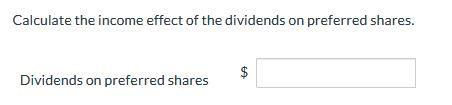

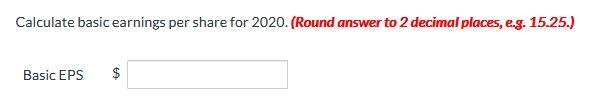

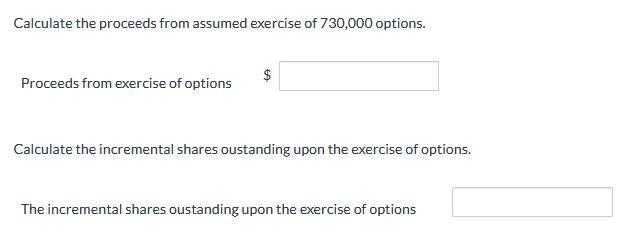

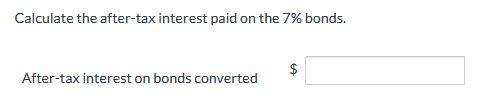

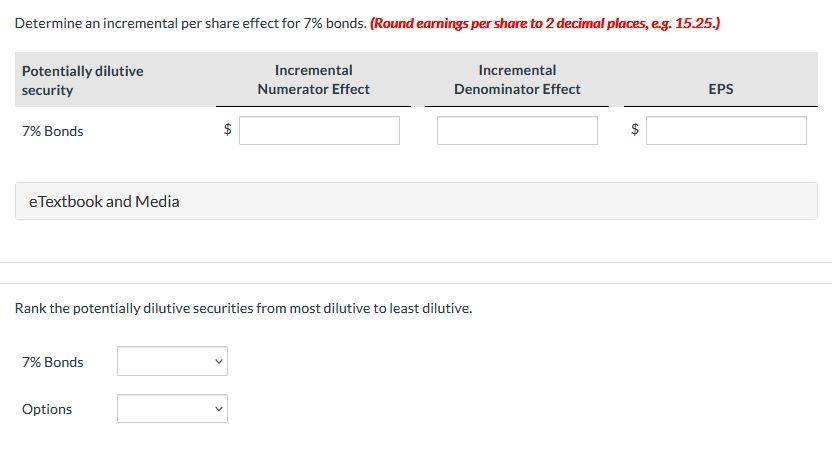

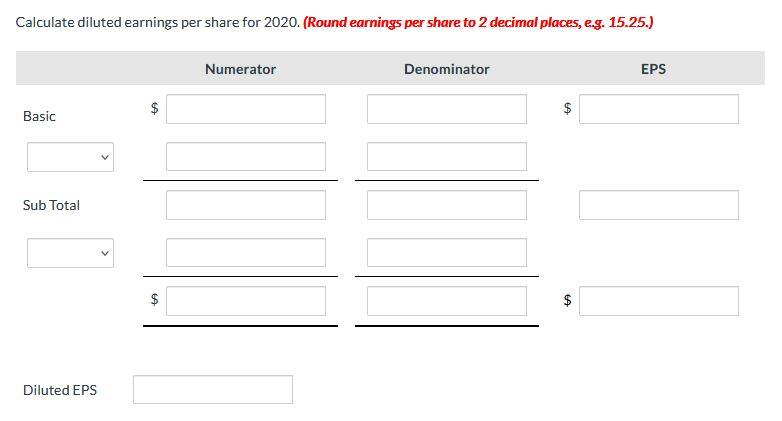

Isabelle Leclerc is the controller at Blossom Pharmaceutical Industries, a public company. She is currently preparing the calculation for basic and diluted earnings per share and the related disclosure for Blossom's external financial statements. The following is selected financial information for the fiscal year ended June 30, 2020: BLOSSOM PHARMACEUTICAL INDUSTRIES Selected Statement of Financial Position Information June 30, 2020 Long-term debt Notes payable, 10% $1,000,000 7% convertible bonds payable 6,000,000 10% bonds payable 6,000,000 Total long-term debt $13,000,000 Shareholders' equity Preferred shares, $4.00 cumulative, 100,000 shares authorized, 23,000 shares issued and outstanding Common shares, unlimited number of shares authorized, 1,000,000 shares issued and outstanding $1,150,000 4,800,000 Contributed surplus-conversion rights 400,000 Retained earnings 7,000,000 Total shareholders' equity $13,350,000 The following transactions have also occurred at Blossom: 1. 2. Options were granted by the company in 2018 to purchase 730,000 shares at $15 per share. Although no options were exercised during 2020, the average price per common share during fiscal year 2020 was $20. Each bond was issued at face value. The 7% convertible debenture will convert into common shares at 45 shares per $1,000 bond. It is exercisable after five years and was issued in 2019. Ignore any requirement to record the bonds' debt and equity components separately. The $4.00 preferred shares were issued in 2018. 3. 4. There are no preferred dividends in arrears, and preferred dividends were not declared in fiscal year 2020. 5. The 1.0 million common shares were outstanding for the entire 2020 fiscal year. Net income for fiscal year 2020 was $1.5 million, and the average income tax rate was 30%. 6. Calculate the income effect of the dividends on preferred shares. $ Dividends on preferred shares Calculate basic earnings per share for 2020. (Round answer to 2 decimal places, e.g. 15.25.) Basic EPS $ Calculate the proceeds from assumed exercise of 730,000 options. $ $ Proceeds from exercise of options Calculate the incremental shares oustanding upon the exercise of options. The incremental shares oustanding upon the exercise of options Calculate the after-tax interest paid on the 7% bonds. $ After-tax interest on bonds converted Determine an incremental per share effect for 7% bonds. (Round earnings per share to 2 decimal places, eg. 15.25.) Potentially dilutive security Incremental Numerator Effect Incremental Denominator Effect EPS 7% Bonds $ $ $ e Textbook and Media Rank the potentially dilutive securities from most dilutive to least dilutive. 7% Bonds Options Calculate diluted earnings per share for 2020. (Round earnings per share to 2 decimal places, eg. 15.25.) Numerator Denominator EPS $ $ Basic Sub Total $ TA $ Diluted EPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts