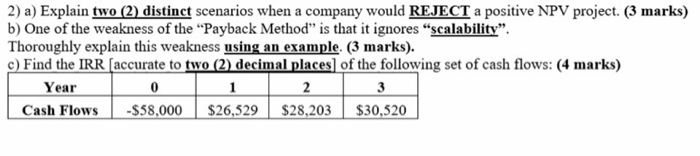

Question: This question is in the pic thanks 2) a) Explain two (2) distinct scenarios when a company would REJECT a positive NPV project. (3 marks)

2) a) Explain two (2) distinct scenarios when a company would REJECT a positive NPV project. (3 marks) b) One of the weakness of the "Payback Method" is that it ignores "scalability": Thoroughly explain this weakness using an example. (3 marks). c) Find the IRR [accurate to two (2) decimal places) of the following set of cash flows: (4 marks) Year 0 1 2 3 Cash Flows -$58,000 $26,529 $28,203 $30,520

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts