Question: This question is intended for personal knowledge and not for assignment purposes. How to get the solutions? and the rest me on asset with an

This question is intended for personal knowledge and not for assignment purposes. How to get the solutions?

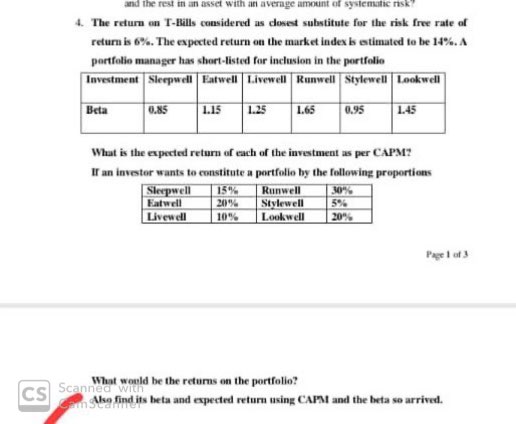

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts