Question: This question is intended to help you understand that the Expected Net Returns framework can be used outside of insurance decisions as well, wherever uncertainty

This question is intended to help you understand that the Expected Net Returns framework can be used outside of insurance decisions as well, wherever uncertainty is present. Here, we will use it to make a hiring decision.

- Agri-Food Inc. has a budget to hire a new employee. The Vice President for Finance has identified a top candidate named Efficient Ed. Ed excels at finding ways to contain costs. The Vice President for Marketing has identified a different top candidate, Creative Karen. Karen has a gift for developing marketing programs that boost sales. The CEO must choose between them. The choice depends upon the future state of demand, which in turn depends on national economic prosperity. He believes that there is a 20% chance that the economy is strong, so demand will be strong. There is a 40% chance of medium demand and a 40%chance of weak demand (due to an economic slump). He estimates that the weekly payoff to the firm (after salary) for Efficient Ed would be $400 no matter what the economy does, because Ed would cut costs. By contrast, the weekly payoff to the firm (after salary) for Creative Karen would be higher if the economy is strong. For her, the payoff would be $1,100 if demand is strong, $400 if demand is medium, and $100 if demand is weak.

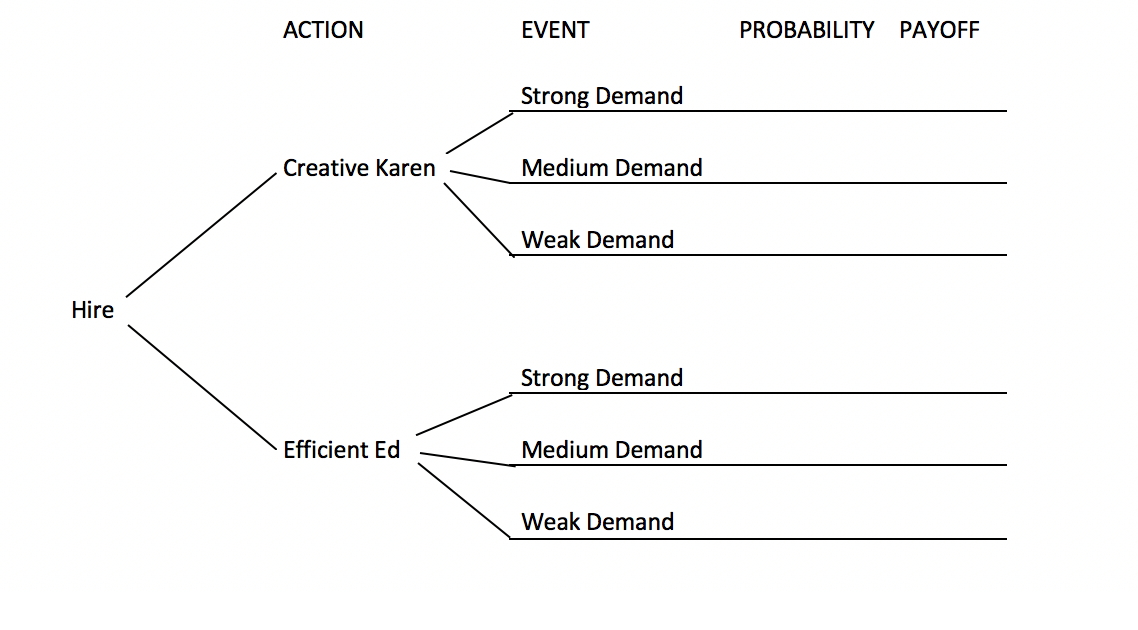

- (18) Organize the information above into a decision tree that shows Actions, Probabilities, Events (also called states of nature), and Payoffs (also called Outcomes). Use the space below.

- (12) What is the Expected Value of the weekly payoff from hiring (show work for partial credit):

- Efficient Ed?

- Creative Karen?

Note: I provide the definitions of maximax decisionmaking strategy and maxmin decisionmaking strategy below. If they are confusing; you can look up the definitions of maximax decisionmaking strategy and maxmin decisionmaking strategy.

- (5) Define maximax strategy as hiring the worker with the highest possible weekly payoff regardless of the state of the economy. What is the best option if using a maximax strategy? Why?

- (5) Define maxmin strategy as hiring the worker with the least downside risk. What is the best option if using a maxmin strategy? Why?

(Hint: downside risk is the risk of making the worst possible outcome/payoff)

- (10) Define safety first strategy as hiring the worker which covers all the costs.

In fact, the CEO decides to use a safety first strategy, because on top of employee salary, the company must pay $300 weekly in health insurance and fringe benefits. What is the best option if using a safety-first strategy that earns at least $300 weekly? Why?

ACTION EVENT PROBABILITY PAYOFF Strong Demand Creative Karen Medium Demand Weak Demand Hire Strong Demand Efficient Ed Medium Demand Weak Demand ACTION EVENT PROBABILITY PAYOFF Strong Demand Creative Karen Medium Demand Weak Demand Hire Strong Demand Efficient Ed Medium Demand Weak Demand

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts