Question: this question is like this , maybe there is a trick in the question , just try again please (2) 2 Haidy purchase 2 years

this question is like this , maybe there is a trick in the question , just try again please

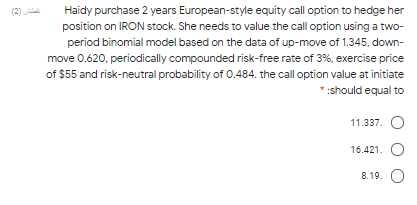

(2) 2 Haidy purchase 2 years European-style equity call option to hedge her position on IRON stock. She needs to value the call option using a two- period binomial model based on the data of up-move of 1.345, down- move 0.620. periodically compounded risk-free rate of 3%, exercise price of $55 and risk-neutral probability of 0.484. the call option value at initiate * should equal to 11.337. O 16.421. O 8.19. O (2) 2 Haidy purchase 2 years European-style equity call option to hedge her position on IRON stock. She needs to value the call option using a two- period binomial model based on the data of up-move of 1.345, down- move 0.620. periodically compounded risk-free rate of 3%, exercise price of $55 and risk-neutral probability of 0.484. the call option value at initiate * should equal to 11.337. O 16.421. O 8.19. O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts