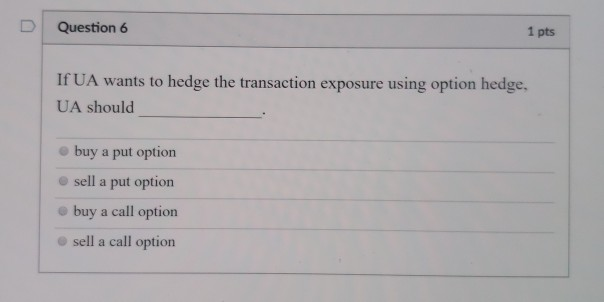

Question: This question is multi tiered, but I ONLY need answer for #6. I have included the other parts of the question to provide needed information

This question is multi tiered, but I ONLY need answer for #6. I have included the other parts of the question to provide needed information and context, without violating the 1 question rule. Again, I ONLY need answer for #6. Please and thanks!

This is the question I need answer for, only #6.

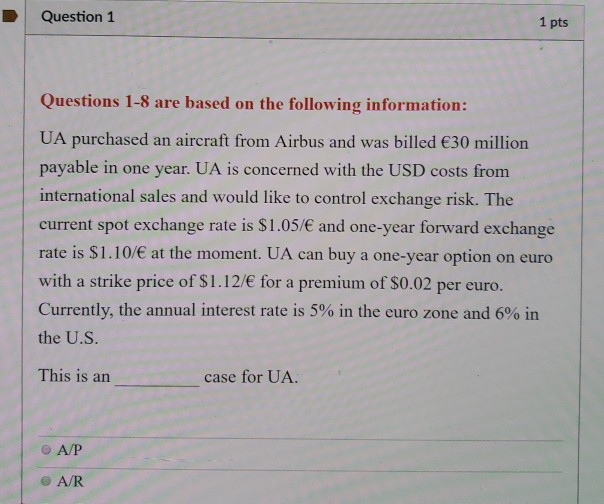

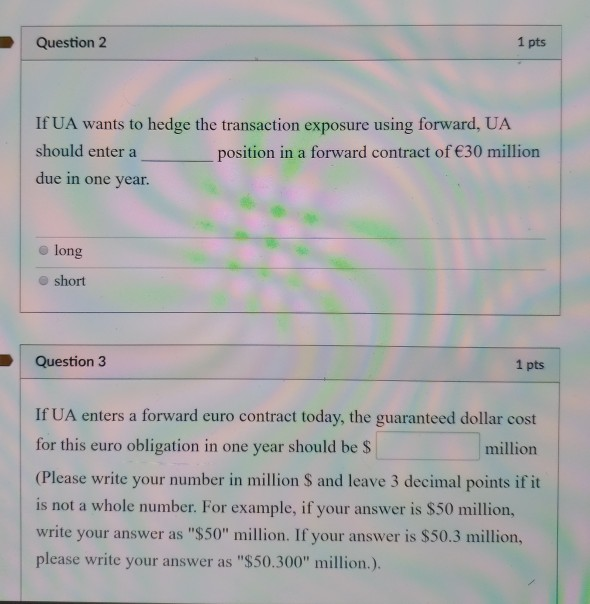

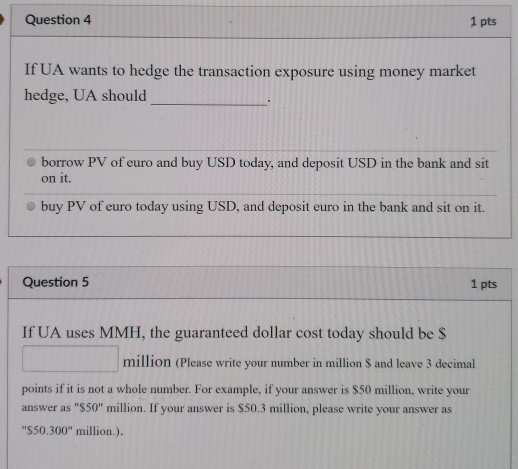

Question 2 1 pts If UA wants to hedge the transaction exposure using forward, UA should enter a due in one year position in a forward contract of 30 million e long O short Question 3 1 pts If UA enters a forward euro contract today, the guaranteed dollar cost for this euro obligation in one year should be S (Please write your number in million S and leave 3 decimal points if it is not a whole number. For example, if your answer is $50 million, write your answer as "$50" million. If your answer is $50.3 million, please write your answer as "$50.300" million.). million Question 4 1 pts If UA wants to hedge the transaction exposure using money market hedge, UA should o borrow PV of euro and buy USD today, and deposit USD in the bank and sit on it. 0 buy PV of euro today using USD, and deposit euro in the bank and sit on it. Question 5 1 pts If UA uses MMH, the guaranteed dollar cost today should be S million (Please write your number in million S and leave 3 decimal points if it is not a whole number. For example, if your answer is $50 million, write your answer as "$50" million. If your answer is $50.3 million, please write your answer as "S50.300" million.). D Question 6 1 pts If UA wants to hedge the transaction exposure using option hedge. UA should o buy a put option O sell a put option e buy a call option sell a call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts