Question: This question is one question please answer Problem 8-5A (Algo) Preparing a bank reconciliation and recording entries LO P3 [The following information applies to the

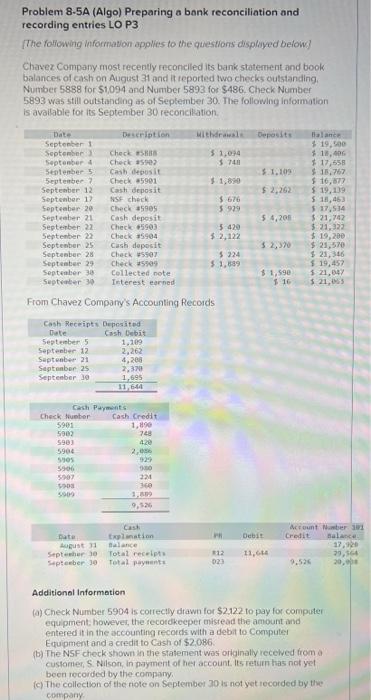

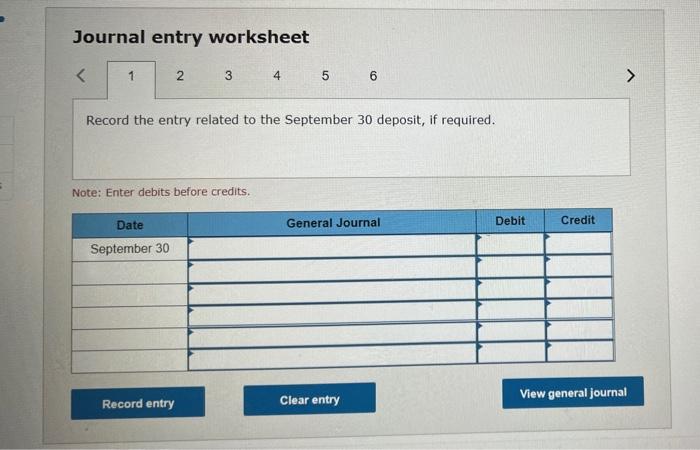

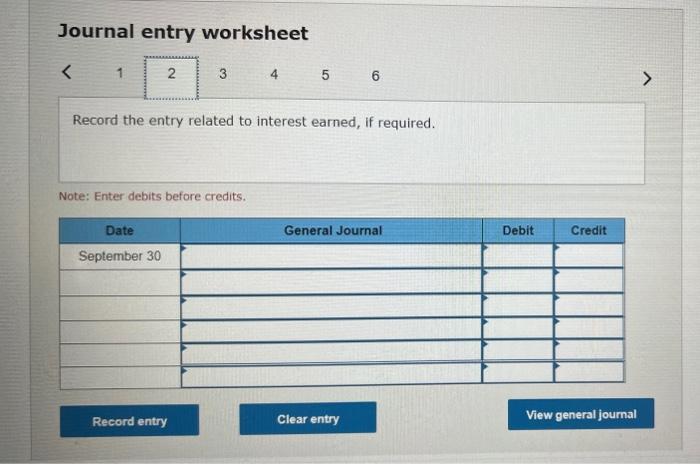

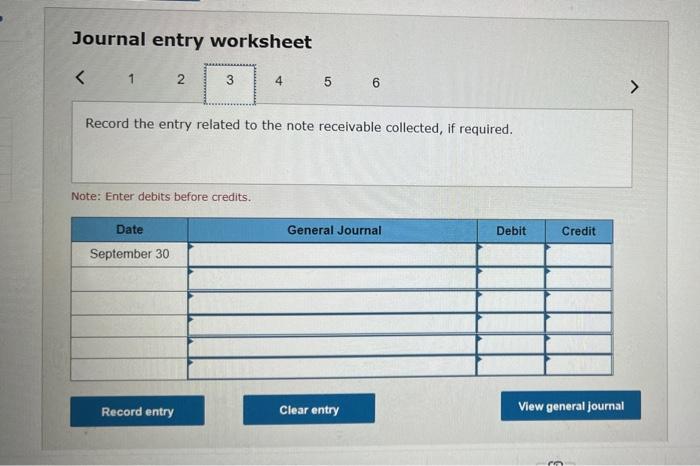

Problem 8-5A (Algo) Preparing a bank reconciliation and recording entries LO P3 [The following information applies to the questions displayed below.) Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, Number 5888 for $1094 and Number 5893 for $486. Check Number 5893 was still outstanding as of September 30. The following information is available for its September 30 reconciliation Date Description Mithdrawal Deposits Balance September 1 $ 19,500 September Check 5 1.014 5.11.06 September 4 Check 2 $ $ 17,658 Sentenbers Cash deposit 5.1.109 $11.767 September Check *5901 $ 16,677 September 12 Cash deposit $2,262 $ 19,19 September 12 NSF check $ 670 $ 11,463 September 20 Check 85905 5929 $ 17,514 September 21 Cash deposit 5.4.200 $ 21,742 September 22 Check 6590) 5.420 $ 21,322 September 22 Check 15904 52,122 $19,200 September 25 Cash deposit $ 2,70 $ 23,570 September 28 Check *5907 $ 21,346 September 29 Check *5905 $1,609 $19.457 September 30 Collected note $ 1,590 $ 21,00 September 30 Interest earned $ 16 5.21,055 From Chavez Company's Accounting Records Cash Receipts Deposited Date Gosh Debit September 5 1,109 September 12 2,262 September 21 4,200 September 25 2.30 September 30 1,495 11,64 $ 224 Cash Payments Check Number Cash Credit 5901 1,090 5002 728 5903 420 5904 2.056 5905 5906 500 22 3 1.1 9.52 50 Debat Cash Date Explanation est lance September 0 Total recept September 30 Total payments Account Number Credit Balance 17,20 29,364 9.526 20. 112 023 11,64 Additional Information (a) Check Number 5904 is correctly drawn for $2122 to pay for computer equipment, however, the recordkeeper mistead the amount and entered it in the accounting records with a debit to Computer Equipment and a credit to Cash of $2,086 (b) The NSF check shown in the statement was originally received from a customer, S. Nilson, in payment of her account. Its return has not yet been recorded by the company (c) The collection of the note on September 30 is not yet recorded by the company Journal entry worksheet Record the entry related to the September 30 deposit, if required. Note: Enter debits before credits. Date General Journal Debit Credit September 30 Record entry Clear entry View general journal Journal entry worksheet Record the entry related to interest earned, if required. Note: Enter debits before credits. General Journal Debit Credit Date September 30 Record entry Clear entry View general journal Journal entry worksheet Record the entry related to the outstanding checks, if required. Note: Enter debits before credits. Date General Journal Debit Credit September 30 Record entry Clear entry View general journal Journal entry worksheet Record the entry related to the NSF check, if required. Note: Enter debits before credits. Date General Journal Debit Credit September 30 Record entry Clear entry View general journal Journal entry worksheet Record the entry related to the error on check 5904, if required. Note: Enter debits before credits. General Journal Debit Credit Date September 30 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts