Question: This question is related to foreign exchange. it is somewhat mulitlayered and time sensitive, so definite thumbs up for quick/correct answers! Thanks! D Question 7

This question is related to foreign exchange. it is somewhat mulitlayered and time sensitive, so definite thumbs up for quick/correct answers! Thanks!

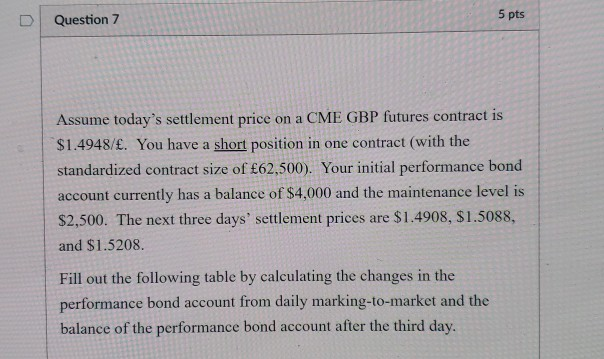

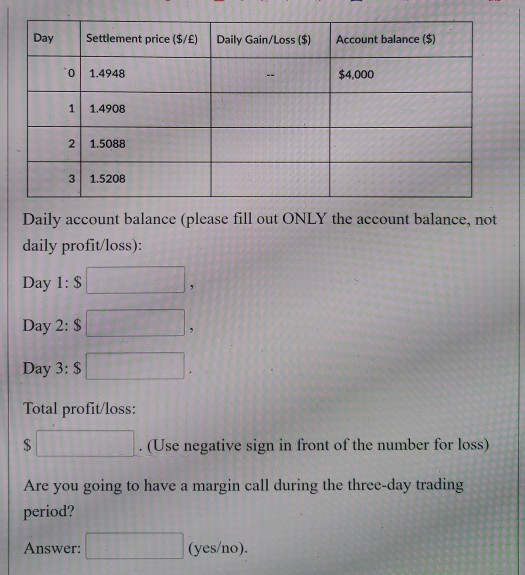

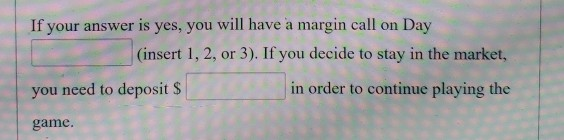

D Question 7 5 pts Assume today's settlement price on a CME GBP futures contract is $1.4948/. You have a short position in one contract (with the standardized contract size of E62.500),. Your initial performance bond account currently has a balance of $4,000 and the maintenance level is $2,500. The next three days' settlement prices are $1.4908, S1.5088, and $1.5208 Fill out the following table by calculating the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. Day Settlement price ($/E) Daily Gain/Loss ($) Account balance ($) 0 1.4948 1 1.4908 2 1.5088 3 1.5208 $4,000 Daily account balance (please fill out ONLY the account balance, not daily profit/loss) Day 1: S Day 2:S Day 3: S Total profit/loss: . (Use negative sign in front of the number for loss) Are you going to have a margin call during the three-day trading period? Answer: (yeso) If your answer is yes, you will have a margin call on Day (insert 1, 2, or 3). If you decide to stay in the market, you need to deposit $ in order to continue playing the game

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts