Question: this question is security and risk portfolio please solve all requirement if you want to solve excel please show all calculations as well Q2) You

this question is security and risk portfolio please solve all requirement if you want to solve excel please show all calculations as well

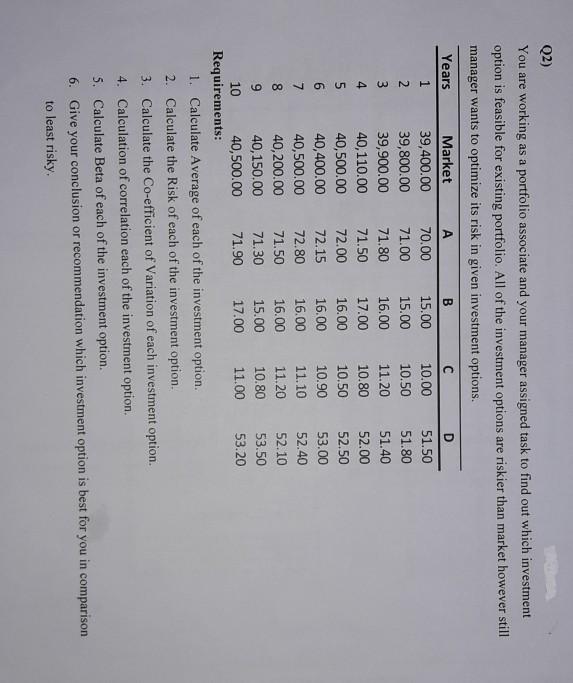

Q2) You are working as a portfolio associate and your manager assigned task to find out which investment option is feasible for existing portfolio. All of the investment options are riskier than market however still manager wants to optimize its risk in given investment options. Years Market A B D 1 39,400.00 70.00 15.00 10.00 51.50 2 39,800.00 71.00 15.00 10.50 51.80 39,900.00 71.80 16.00 11.20 51.40 4 40,110.00 71.50 17.00 10.80 52.00 5 40,500.00 72.00 16.00 10.50 52.50 6 40,400.00 72.15 16.00 10.90 53.00 7 40,500.00 72.80 16.00 11.10 52.40 8 40,200.00 71.50 16.00 11.20 52.10 9 40,150.00 71.30 15.00 10.80 53.50 10 40,500.00 71.90 17.00 11.00 53.20 Requirements: 1. Calculate Average of each of the investment option. 2. Calculate the Risk of each of the investment option. 3. Calculate the Co-efficient of Variation of each investment option. 4. Calculation of correlation each of the investment option 5. Calculate Beta of each of the investment option. 6. Give your conclusion or recommendation which investment option is best for you in comparison to least risky

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts