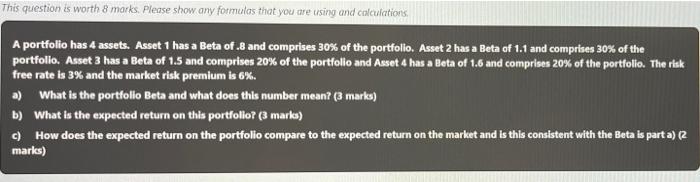

Question: This question is worth 8 marks. Please show any formulas that you are using and calculations A portfolio has 4 assets. Asset 1 has a

This question is worth 8 marks. Please show any formulas that you are using and calculations A portfolio has 4 assets. Asset 1 has a Beta of.8 and comprises 30% of the portfolio. Asset 2 has a Beta of 1.1 and comprises 30% of the portfolio. Asset 3 has a Beta of 1.5 and comprises 20% of the portfolio and Asset 4 has a Beta of 1.6 and comprises 20% of the portfolio. The risk free rate is 3% and the market risk premium is 6%. a) What is the portfolio Beta and what does this number mean? (3 marks) b) What is the expected return on this portfolio? (3 marks) How does the expected return on the portfolio compare to the expected return on the market and is this consistent with the Beta is part a) (2 marks) c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts