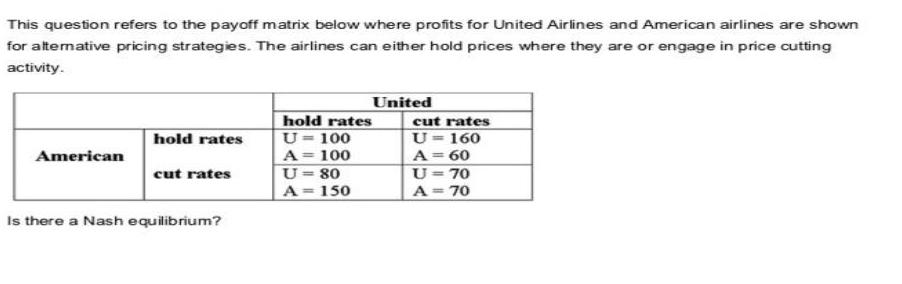

Question: This question refers to the payoff matrix below where profits for United Airlines and American airlines are shown for altemative pricing strategies. The airlines

This question refers to the payoff matrix below where profits for United Airlines and American airlines are shown for altemative pricing strategies. The airlines can either hold prices where they are or engage in price cutting activity. United hold rates U= 100 A= 100 cut rates U= 160 A = 60 U= 70 A = 70 hold rates %3D American U= 80 A = 150 cut rates %3D Is there a Nash equilibrium?

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

If U wants to hold rates the optimal strategy that gives the maximum profit ... View full answer

Get step-by-step solutions from verified subject matter experts