Question: This question relates to what we have discussed in class around Taylor's expansion and its application to &L attribution. Consider on Mar 12 you enter

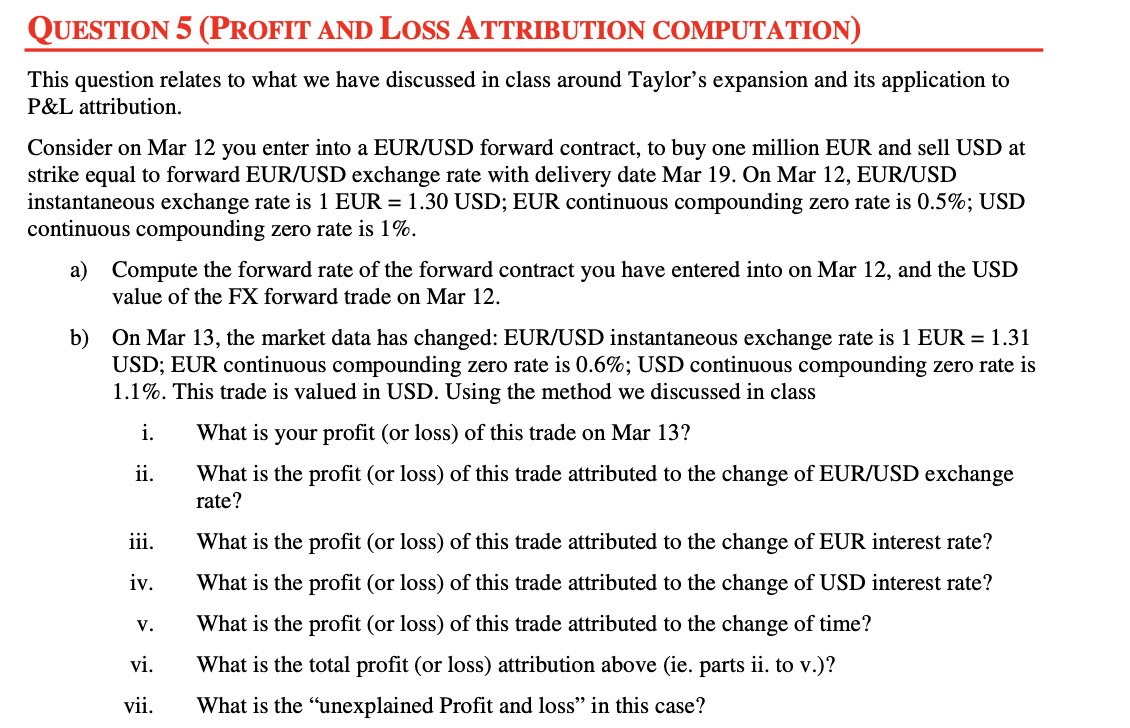

This question relates to what we have discussed in class around Taylor's expansion and its application to \&L attribution. Consider on Mar 12 you enter into a EUR/USD forward contract, to buy one million EUR and sell USD at trike equal to forward EUR/USD exchange rate with delivery date Mar 19. On Mar 12, EUR/USD nstantaneous exchange rate is 1 EUR =1.30 USD; EUR continuous compounding zero rate is 0.5%; USD continuous compounding zero rate is 1%. a) Compute the forward rate of the forward contract you have entered into on Mar 12, and the USD value of the FX forward trade on Mar 12. b) On Mar 13, the market data has changed: EUR/USD instantaneous exchange rate is 1 EUR =1.31 USD; EUR continuous compounding zero rate is 0.6%; USD continuous compounding zero rate is 1.1%. This trade is valued in USD. Using the method we discussed in class i. What is your profit (or loss) of this trade on Mar 13? ii. What is the profit (or loss) of this trade attributed to the change of EUR/USD exchange rate? iii. What is the profit (or loss) of this trade attributed to the change of EUR interest rate? iv. What is the profit (or loss) of this trade attributed to the change of USD interest rate? v. What is the profit (or loss) of this trade attributed to the change of time? vi. What is the total profit (or loss) attribution above (ie. parts ii. to v.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts