Question: This question requires you to do 2 things. Firstly, prepare the Bank Reconciliation Statement, but then also prepare the journal entries that are needed, in

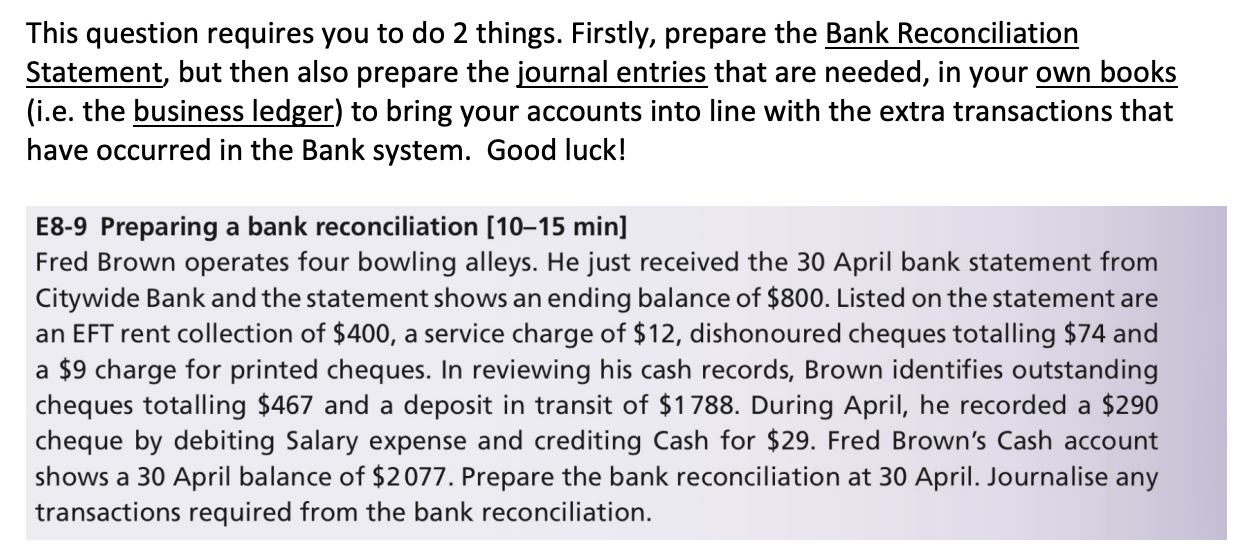

This question requires you to do 2 things. Firstly, prepare the Bank Reconciliation Statement, but then also prepare the journal entries that are needed, in your own books (i.e. the business ledger) to bring your accounts into line with the extra transactions that have occurred in the Bank system. Good luck! E8-9 Preparing a bank reconciliation (1015 min] Fred Brown operates four bowling alleys. He just received the 30 April bank statement from Citywide Bank and the statement shows an ending balance of $800. Listed on the statement are an EFT rent collection of $400, a service charge of $12, dishonoured cheques totalling $74 and a $9 charge for printed cheques. In reviewing his cash records, Brown identifies outstanding cheques totalling $467 and a deposit in transit of $1788. During April, he recorded a $290 cheque by debiting Salary expense and crediting Cash for $29. Fred Brown's Cash account shows a 30 April balance of $2077. Prepare the bank reconciliation at 30 April. Journalise any transactions required from the bank reconciliation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts