Question: This question should be answer follow the guideline given above note 1 trade receivable note 2 trade payable Set below are financial information of Bob

This question should be answer follow the guideline given above

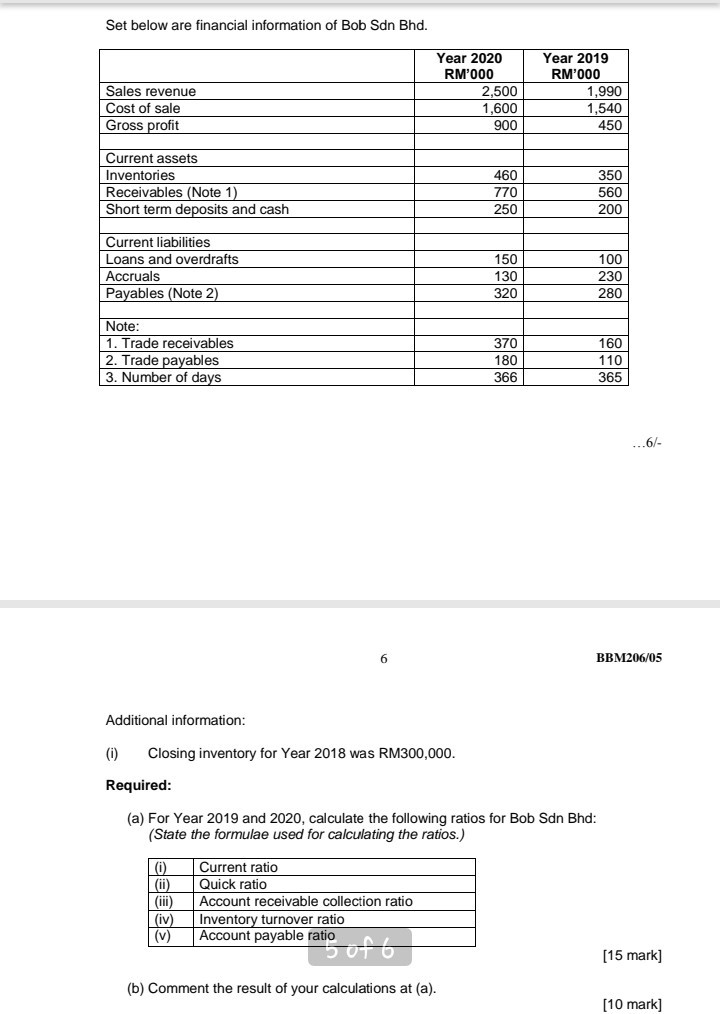

note 1 trade receivable note 2 trade payable

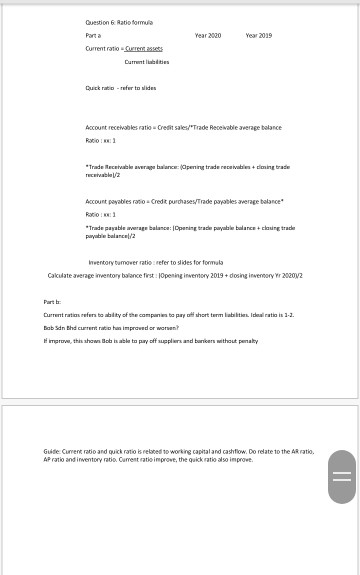

Set below are financial information of Bob Sdn Bhd. Sales revenue Cost of sale Gross profit Year 2020 RM'000 2,500 1,600 900 Year 2019 RM'000 1,990 1,540 450 350 Current assets Inventories Receivables (Note 1) Short term deposits and cash 460 770 250 200 Current liabilities Loans and overdrafts Accruals Payables (Note 2) 150 130 320 100 230 280 370 Note: 1. Trade receivables 2. Trade payables 3. Number of days 180 366 365 BBM206/05 Additional information: (0) Closing inventory for Year 2018 was RM300,000. Required: (a) For Year 2019 and 2020, calculate the following ratios for Bob Sdn Bhd: (State the formulae used for calculating the ratios.) (0) (ii) (iii) (iv) (v) Current ratio Quick ratio Account receivable collection ratio Inventory turnover ratio Account payable ratio SON [15 mark] (b) Comment the result of your calculations at (a). (10 mark] Question 6 Ratio fomu Porta Year 2020 Year 2019 Current ration es Durantes Quick refer to wides Credit sales/Trade Receivable average balance Account receivables ratio Ratio *Trade cette TH /2 peintrade recibeloning trade Account poyables ratio Credit purchase Trade pables average balance Ratio *Trade payable w age balance Opening payable barceloning trade puyable balance/2 Inwentary tumover ratio refer to slides for formula Calculate average inventory balance first: Opening inventory 2019 + dosing inventory Yr202012 Current ratio refer to bity of the composto pay short term labi arata is 1-2. Bob Sdn Bhd improve or more! grow, this shown Bob is able to pay off suppliers and bunkers without penalty Guide Current ratio and quick ratio is related to working capital and cash flow. Do date to the AR ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts