Question: This question uses excel. Please provide any formulas or steps necessary to complete it. Thanks! You are currently 35 years old and bave $200,000 saved

This question uses excel. Please provide any formulas or steps necessary to complete it. Thanks!

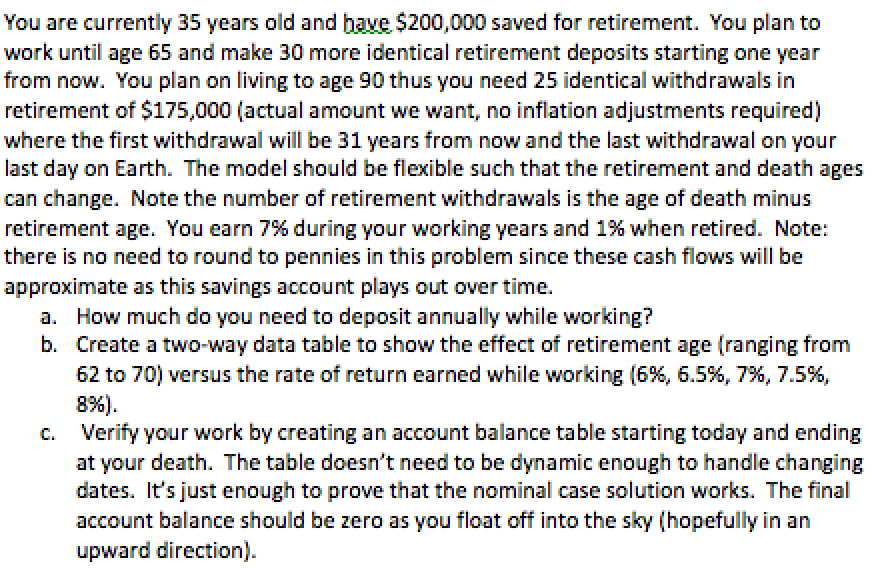

You are currently 35 years old and bave $200,000 saved for retirement. You plan to work unti age 65 and make 30 more identical retirement deposits starting one year from now. You plan on living to age 90 thus you need 25 identical withdrawals in retirement of $175,000 (actual amount we want, no inflation adjustments required) where the first withdrawal will be 31 years from now and the last withdrawal on your last day on Earth. The model should be flexible such that the retirement and death ages can change. Note the number of retirement withdrawals is the age of death minus retirement age. You earn 7% during your working years and 1% when retired. Note: there is no need to round to pennies in this problem since these cash flows will be approximate as this savings account plays out over time. How much do you need to deposit annually while working? Create a two-way data table to show the effect of retirement age (ranging from 62 to 70) versus the rate of return earned while working (6%, 65%, 7%, 7.5%, 8%). Verify your work by creating an account balance table starting today and ending at your death. The table doesn't need to be dynamic enough to handle changing dates. It's just enough to prove that the nominal case solution works. The final account balance should be zero as you float off into the sky (hopefully in an upward direction). a. b. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts