Question: This question uses the same data as the previous question, repeated below: On December 31, 2016, Silver Lane Partners, a private equity firm, acquired the

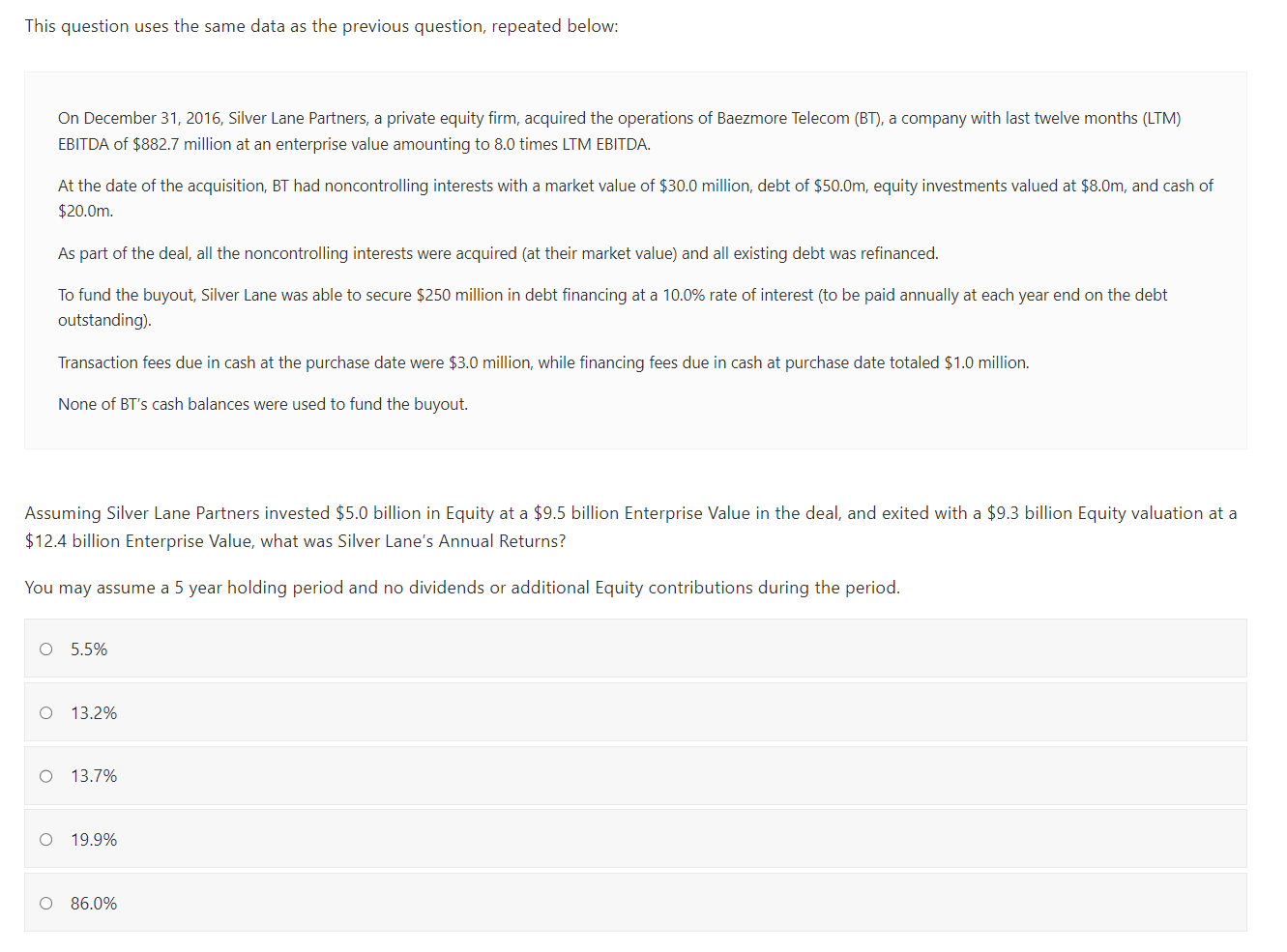

This question uses the same data as the previous question, repeated below: On December 31, 2016, Silver Lane Partners, a private equity firm, acquired the operations of Baezmore Telecom (BT), a company with last twelve months (LTM) EBITDA of $882.7 million at an enterprise value amounting to 8.0 times LTM EBITDA. At the date of the acquisition, BT had noncontrolling interests with a market value of $30.0 million, debt of $50.0m, equity investments valued at $8.0m, and cash of $20.0m. As part of the deal, all the noncontrolling interests were acquired (at their market value) and all existing debt was refinanced. To fund the buyout, Silver Lane was able to secure $250 million in debt financing at a 10.0% rate of interest (to be paid annually at each year end on the debt outstanding). Transaction fees due in cash at the purchase date were $3.0 million, while financing fees due in cash at purchase date totaled $1.0 million. None of BT's cash balances were used to fund the buyout. Assuming Silver Lane Partners invested $5.0 billion in Equity at a $9.5 billion Enterprise Value in the deal, and exited with a $9.3 billion Equity valuation at a $12.4 billion Enterprise Value, what was Silver Lane's Annual Returns? You may assume a 5 year holding period and no dividends or additional Equity contributions during the period. 5.5% 13.2% 13.7% 19.9% 86.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts