Question: This question will require you to use Excel's IRR function. A firm invests $100,000 in a project today. It receives $15,000 a year from now,

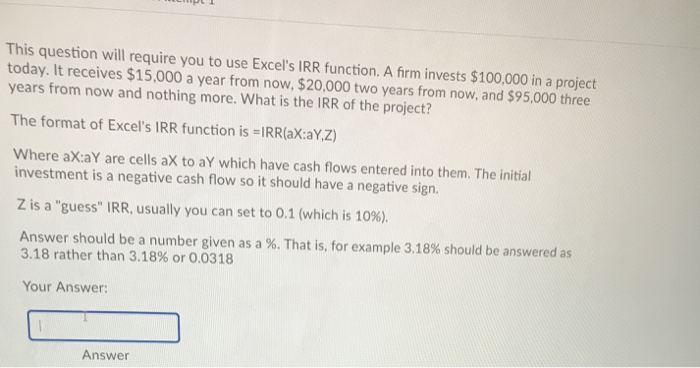

This question will require you to use Excel's IRR function. A firm invests $100,000 in a project today. It receives $15,000 a year from now, $20,000 two years from now, and $95,000 three years from now and nothing more. What is the IRR of the project? The format of Excel's IRR function is-IRR(aX:aY,Z) Where aX:aY are cells aX to aY which have cash flows entered into them. The initial investment is a negative cash flow so it should have a negative sign. Z is a "guess" IRR, usually you can set to 0.1 (which is 10%. Answer should be a number given as a %. That is, for example 3.18% should be answered as 3.18 rather than 3.1896 or 0.0318 Your Answer: Answer This question will require you to use Excel's IRR function. A firm invests $100,000 in a project today. It receives $15,000 a year from now, $20,000 two years from now, and $95,000 three years from now and nothing more. What is the IRR of the project? The format of Excel's IRR function is-IRR(aX:aY,Z) Where aX:aY are cells aX to aY which have cash flows entered into them. The initial investment is a negative cash flow so it should have a negative sign. Z is a "guess" IRR, usually you can set to 0.1 (which is 10%. Answer should be a number given as a %. That is, for example 3.18% should be answered as 3.18 rather than 3.1896 or 0.0318 Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts