Question: This question/answer has already been posted, but is incomplete. Please answer #5 In 2020 they find that 5,000 is clearly uncollectable . Make the journal

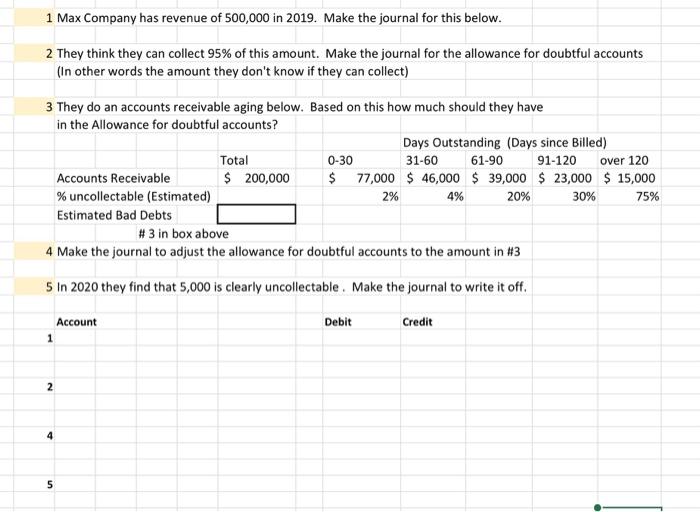

1 Max Company has revenue of 500,000 in 2019. Make the journal for this below. 2 They think they can collect 95% of this amount. Make the journal for the allowance for doubtful accounts (In other words the amount they don't know if they can collect) 3 They do an accounts receivable aging below. Based on this how much should they have in the Allowance for doubtful accounts? Days Outstanding (Days since Billed) Total 0-30 31-60 61-90 91-120 over 120 Accounts Receivable $ 200,000 $ 77,000 $ 46,000 $ 39,000 $ 23,000 $ 15,000 % uncollectable (Estimated) 4% 20% 30% 75% Estimated Bad Debts #3 in box above 4 Make the journal to adjust the allowance for doubtful accounts to the amount in #3 2% 5 In 2020 they find that 5,000 is clearly uncollectable. Make the journal to write it off. Debit Account 1 Credit 2 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts