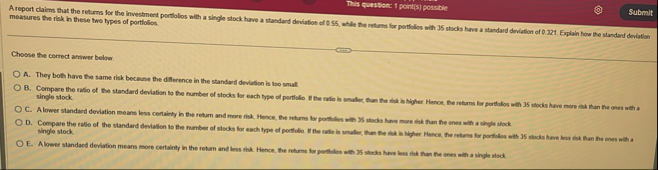

Question: This questitate 1 point ( s ) posstate A report clains that the returns for the investment portiolios with a single stock have a standard

This questitate points posstate

A report clains that the returns for the investment portiolios with a single stock have a standard deviation of while fre returns for portlolios with stocks have a standard deviation of Explain how the standard deviation measures the risk in these two types of portiolics.

Choose the correct answer below.

A They both have the same risk because the difference in the standard deviation is loo small

single stock.

C Alower standard deviation means less centainty in the return and more risk. Hence, the returns for porthles ate stacks have mare fist han the anes with a shople stock

single stock

E Alower standand deviation means more certainty in the retarn and less rikk. Hence, the returns lor poistalos ath stock here less rikk than fie anes with a shyple stock

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock