Question: This requires you to analyze a potential project using financial tools and present your findings to the executive leadership team in a one - page

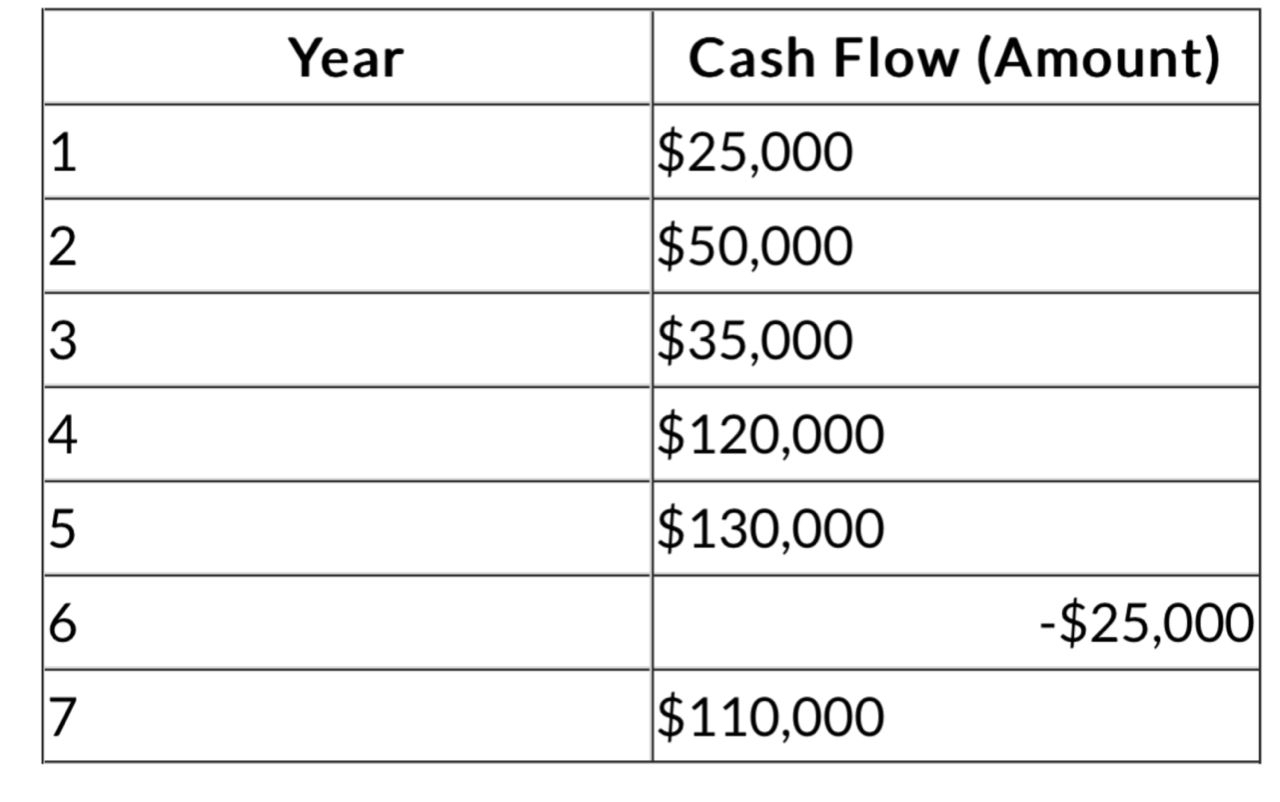

This requires you to analyze a potential project using financial tools and present your findings to the executive leadership team in a onepage Executive Summary. You will need to assess the project's viability and make a final recommendation on whether the company should pursue itYour company is considering a new project with an initial investment of $ The project is expected to generate cash flows over a sevenyear period, as detailed in the project information below. Project details:The executive leadership team has provided two questions they would like you to address in your Executive Summary: Assuming we discount inflation, what is the Internal Rate of Return IRR of this project over a sevenyear span? Given the calculated IRR, and assuming we can earn by investing in alternative securities would you recommend that we pursue the project? Why or why not?Step One:Utilize the financial tools and concepts to analyze the project's cash flows.Step Two:Calculate the project's IRR using a financial calculator or spreadsheet software.Step Three:Develop a onepage Executive Summary that clearly addresses the leadership team's questions. Briefly explain the concept of IRR and its significance in project evaluation. Include your calculated IRR for the project. Based on the IRR and the alternative investment opportunity return provide a recommendation on whether to pursue the project and justify your reasoning. Use clear and concise language suitable for a business audience. Focus on the key financial aspects of the project relevant to the leadership team's decisionmaking. Organize the Executive Summary in a logical and easytofollow format. Proofread your document carefully before submission.tableYearCash Flow Amount$$$$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock