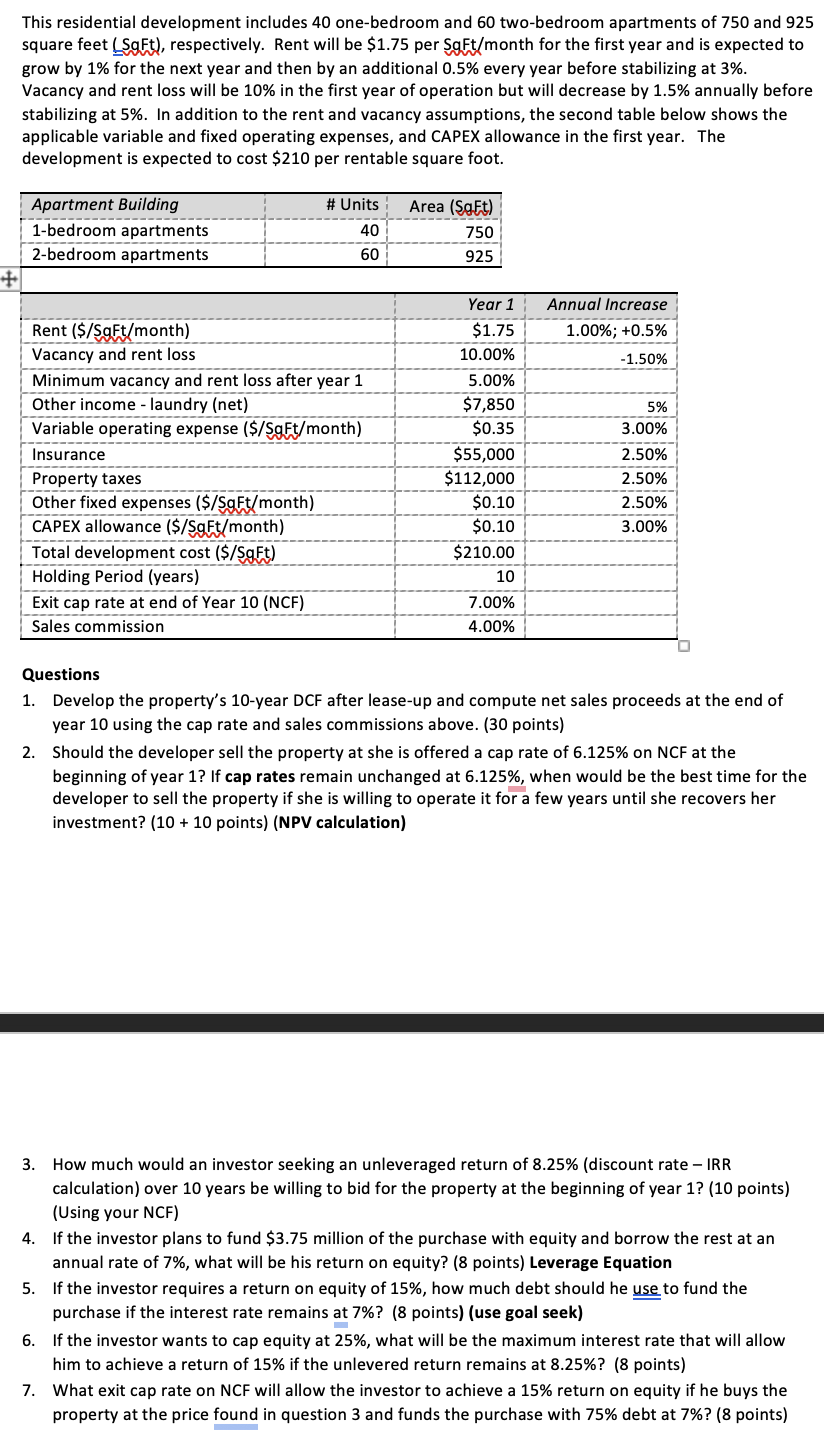

Question: This residential development includes 4 0 one - bedroom and 6 0 two - bedroom apartments of 7 5 0 and 9 2 5 square

This residential development includes onebedroom and twobedroom apartments of and

square feet SgFt respectively. Rent will be $ per onth for the first year and is expected to

grow by for the next year and then by an additional every year before stabilizing at

Vacancy and rent loss will be in the first year of operation but will decrease by annually before

stabilizing at In addition to the rent and vacancy assumptions, the second table below shows the

applicable variable and fixed operating expenses, and CAPEX allowance in the first year. The

development is expected to cost $ per rentable square foot.

Questions

Develop the property's year DCF after leaseup and compute net sales proceeds at the end of

year using the cap rate and sales commissions above. points

Should the developer sell the property at she is offered a cap rate of on NCF at the

beginning of year If cap rates remain unchanged at when would be the best time for the

developer to sell the property if she is willing to operate it for a few years until she recovers her

investment? pointsNPV calculation

How much would an investor seeking an unleveraged return of discount rate IRR

calculation over years be willing to bid for the property at the beginning of year points

Using your NCF

If the investor plans to fund $ million of the purchase with equity and borrow the rest at an

annual rate of what will be his return on equity? points Leverage Equation

If the investor requires a return on equity of how much debt should he use to fund the

purchase if the interest rate remains at pointsuse goal seek

If the investor wants to cap equity at what will be the maximum interest rate that will allow

him to achieve a return of if the unlevered return remains at points

What exit cap rate on NCF will allow the investor to achieve a return on equity if he buys the

property at the price found in question and funds the purchase with debt at points

Question please on excel

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock