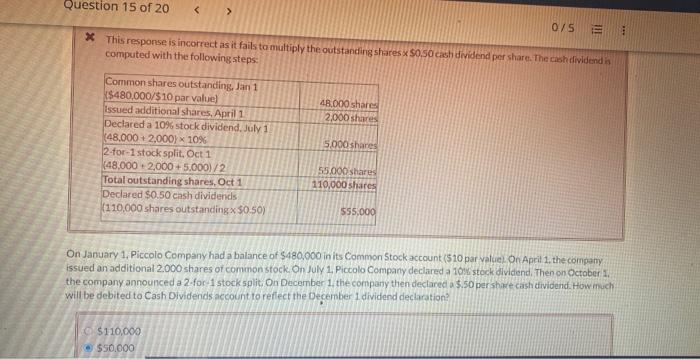

Question: *. This response is incorrect as it fails ta multiply the outstancing shares 50.50 cash d midend per share. The cish diwidend is computed with

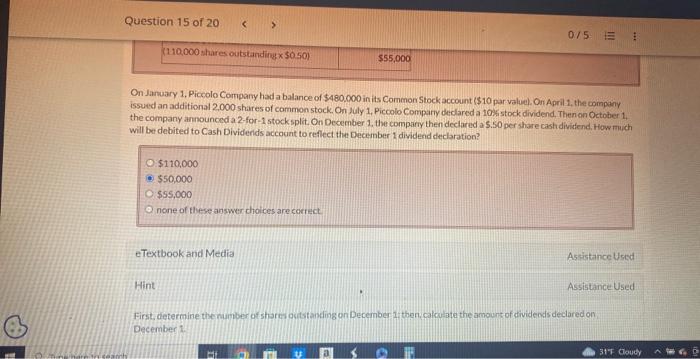

*. This response is incorrect as it fails ta multiply the outstancing shares 50.50 cash d midend per share. The cish diwidend is computed with the following steps: On January 1, Piccolo Company had a balance of $480,000 in its Commen Stock account ( $10 par vatue) On Aprit 1, the company issued an additional 2,000 shares of compon stock. On July 1, Piccolo Company declared a 10. stock olvidend, Then on October 1. the company announced a 2-for-1 stock split On December 1 , the company then declared a 5.50 per share cash cividend. How inuch will be debited to Cash Dividenids account to reffect the December 1 dividend declaration? 5110,000 $50.000 On January 1. Piccolo Company had a balance of $480.000 in its Common Stock account (\$10 par valuel. On April 1, the coinpany issued an additional 2,000 shares of common stock. On July 1. Piccolo Comparyy declared a 10.6 stock dividend, Then on Octoher 1 . the company announced a 2 -for-1 stocksplit. On December 1 , the compary then declared a 5.50 per share cash dividend, How muich will be debited to Cash Dividends accocunt to reflect thet December 2 dividend declaration? eTextbook and Media Astistance Used Hint. Asstitance Used First, determine the number of shares outstanding on becember 1 then, calculata the amount of dividends declared on: December

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts