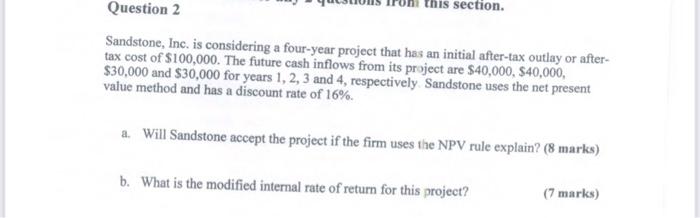

Question: this section. Question 2 Sandstone, Inc. is considering a four-year project that has an initial after-tax outlay or after- tax cost of $100,000. The future

this section. Question 2 Sandstone, Inc. is considering a four-year project that has an initial after-tax outlay or after- tax cost of $100,000. The future cash inflows from its project are $40,000, $40,000, $30,000 and $30,000 for years 1, 2, 3 and 4, respectively. Sandstone uses the net present value method and has a discount rate of 16%. a. Will Sandstone accept the project if the firm uses the NPV rule explain? (8 marks) b. What is the modified internal rate of return for this project? (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts