Question: This section requires the use of a spreadsheet. Continue to use your calculated value for x in this section of the assignment. (Don't worry that

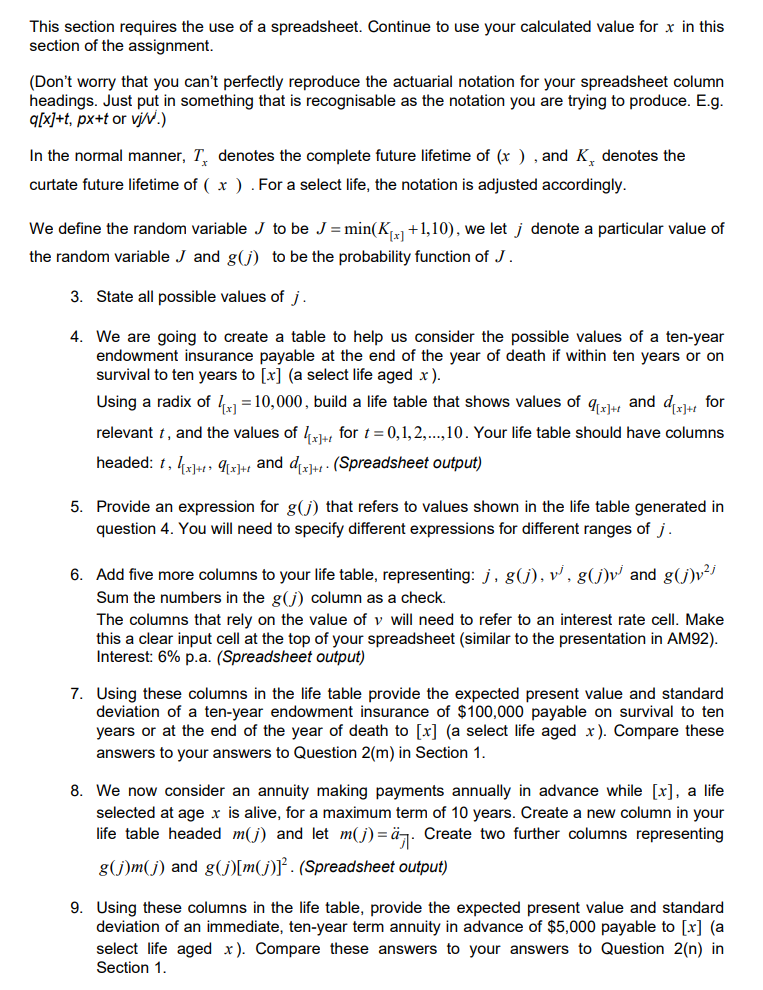

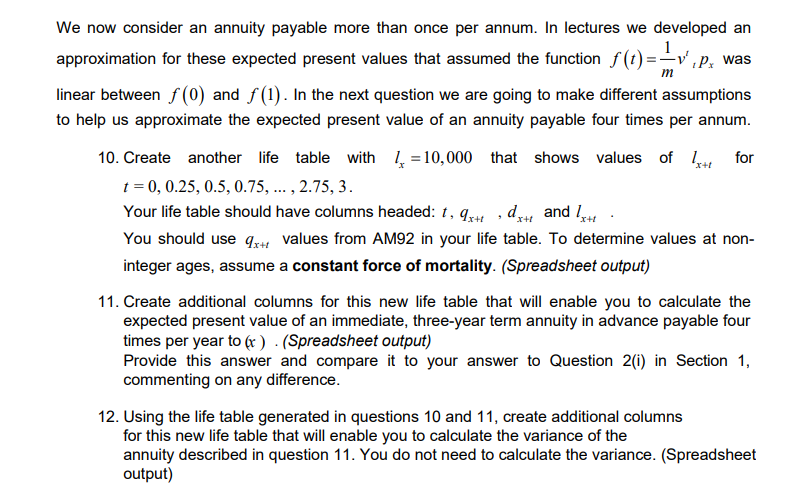

This section requires the use of a spreadsheet. Continue to use your calculated value for x in this section of the assignment. (Don't worry that you can't perfectly reproduce the actuarial notation for your spreadsheet column headings. Just put in something that is recognisable as the notation you are trying to produce. E.g. qlxj+t, px+t or wii.) In the normal manner, T denotes the complete future lifetime of (x ) ,and K_ denotes the curtate future lifetime of ( x ) . For a select life, the notation is adjusted accordingly. We define the random variable ./ to be J =min(X |, +1,10). we let j denote a particular value of the random variable J and g(j) to be the probability function of ./ . 3 4. State all possible values of ;. We are going to create a table to help us consider the possible values of a ten-year endowment insurance payable at the end of the year of death if within ten years or on survival to ten years to [x] (a select life aged x). Using a radix of / , =10,000. build a life table that shows values of g, ,,, and d,,, for x]4+t relevant , and the values of /., for 1=0,1,2,...,10. Your life table should have columns headed: 1. [,.,. 4., and d,,,,,. (Spreadsheet output) Provide an expression for g(j) that refers to values shown in the life table generated in question 4. You will need to specify different expressions for different ranges of ;. Add five more columns to your life table, representing: j, g(j). v/, g(j and g(j"' Sum the numbers in the g(j) column as a check. The columns that rely on the value of v will need to refer to an interest rate cell. Make this a clear input cell at the top of your spreadsheet (similar to the presentation in AM92). Interest: 6% p.a. (Spreadsheet output) Using these columns in the life table provide the expected present value and standard deviation of a ten-year endowment insurance of $100,000 payable on survival to ten years or at the end of the year of death to [x] (a select life aged x). Compare these answers to your answers to Question 2(m) in Section 1. We now consider an annuity making payments annually in advance while [x]. a life selected at age x is alive, for a maximum term of 10 years. Create a new column in your life table headed m(j) and let m(j):z'i. Create two further columns representing g(jym(j) and g(j)[m( j}]z. (Spreadsheet output) Using these columns in the life table, provide the expected present value and standard deviation of an immediate, ten-year term annuity in advance of $5,000 payable to [x] (a select life aged x). Compare these answers to your answers to Question 2(n) in Section 1. We now consider an annuity payable more than once per annum. In lectures we developed an 1 approximation for these expected present values that assumed the function f(1)=v' p, was m linear between f(0) and f(1). In the next question we are going to make different assumptions to help us approximate the expected present value of an annuity payable four times per annum. 10. 11. 12. Create another life table with [ =10,000 that shows values of [, for r=0,025,05,075, ...,2.75,3. Your life table should have columns headed: t.q_, .d X+t and [, You should use g,,, values from AM92 in your life table. To determine values at non- integer ages, assume a constant force of mortality. (Spreadsheet output) Create additional columns for this new life table that will enable you to calculate the expected present value of an immediate, three-year term annuity in advance payable four times per yearto (v ) . (Spreadsheet output) Provide this answer and compare it to your answer to Question 2(i) in Section 1, commenting on any difference. Using the life table generated in questions 10 and 11, create additional columns for this new life table that will enable you to calculate the variance of the annuity described in question 11. You do not need to calculate the variance. (Spreadsheet output)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts