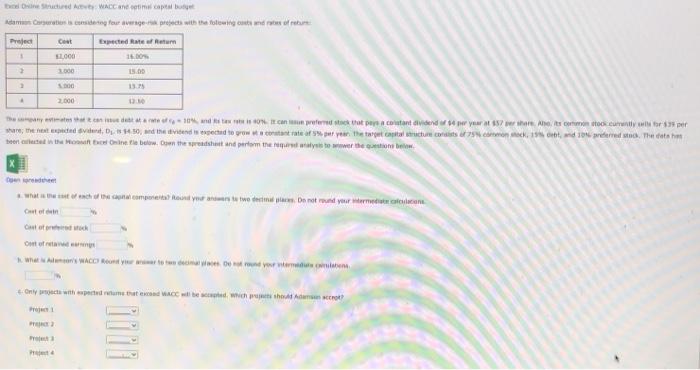

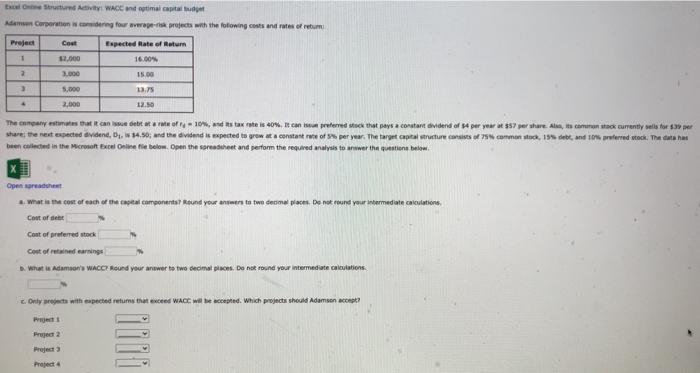

Question: this should be a better picture DAWACC capta Create a considerey four average to predicts with the following costs and rates of return Proje Cont

this should be a better picture

this should be a better picture DAWACC capta Create a considerey four average to predicts with the following costs and rates of return Proje Cont Expected Rate Retur 16.00 LOOD 2000 2 2.000 Demand 10% and can be preferate that constant dividend 4 years. At they will for share the head and the end I had to grow state of year the church and red. The oth been the title on the hit and perform the alloween what the company at two decal Dant und your What A WACO to come round your arms Only when the two be with them? RE Ord Activity WACC and optimal capital Adam Corporation wandering forwap- free with the following costs and rates of return Prej Cost Espected Rate of Return 16.00 1 12.000 2 3.000 15.00 3 13.75 5.000 2.000 4 12.50 The company est that it can det of 4 -10, distante is 40%, a predstock that pays a constant dividend of per year $57 per share. Als, como currently sells for 3 share the next expected viden, D. 14.50, and the dividend is expected to grow at a constant we of per year. The target capital structure of common stock, 155 det, and 10 pred teck. The data has been collected in the Micro Online Mebelow. Open the sheet and perform the required analysis to wwer the question below Open r What is the cost of each of the capital components Round your enten to two decimal place. De not found your intermediate calculations, Cout of Cost of preferred stock Cost of red earnings Was Adamson's WACC Round your answer to two decimalios Do not found your intermediate clovations. Only regts with expected returns that exceed WACC will be accepted. Which projects should Adamson ? !! Project Project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts