Question: this should be clear enough for everybody to see. please answer the ones that are wrong. 10 What is the net operating profit after taxes

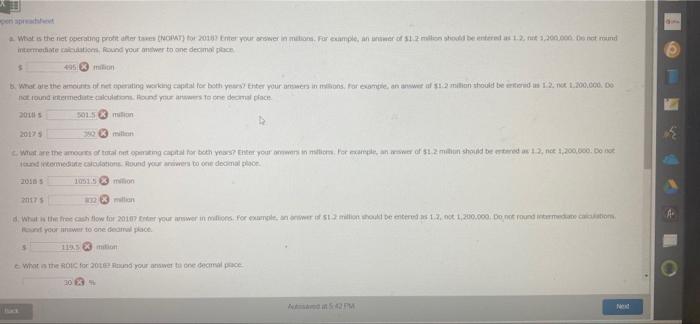

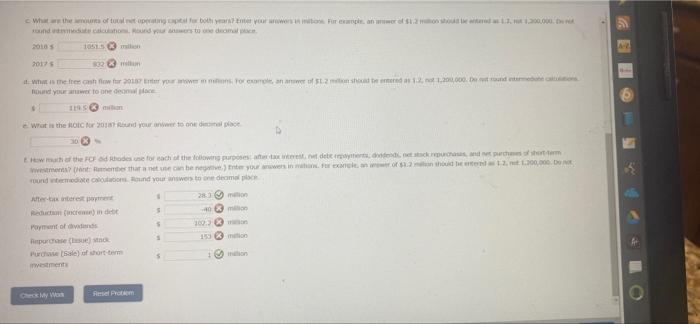

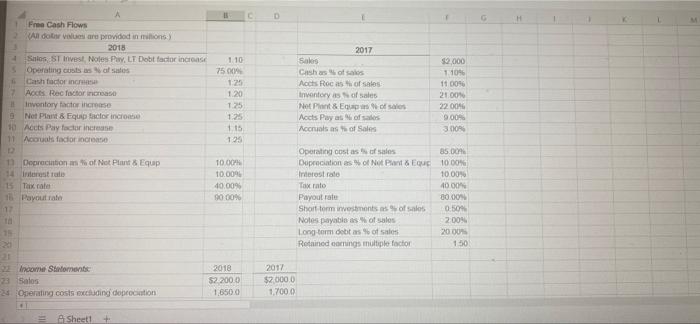

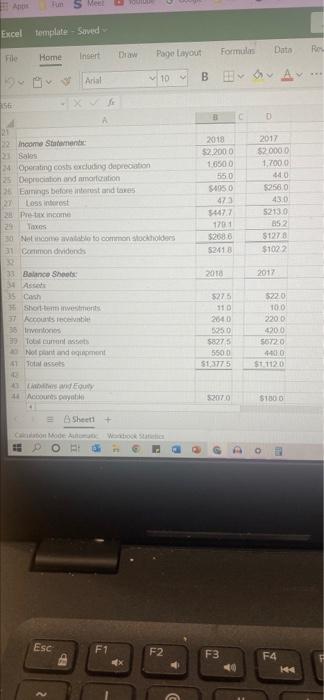

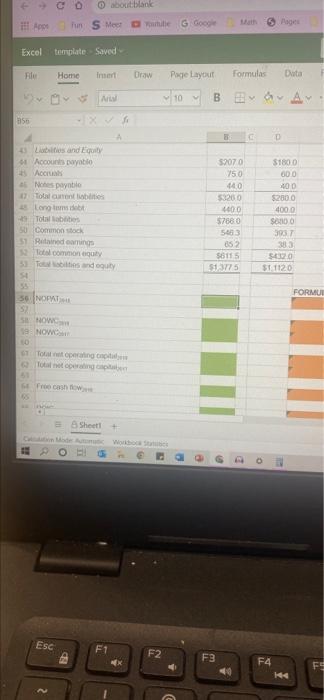

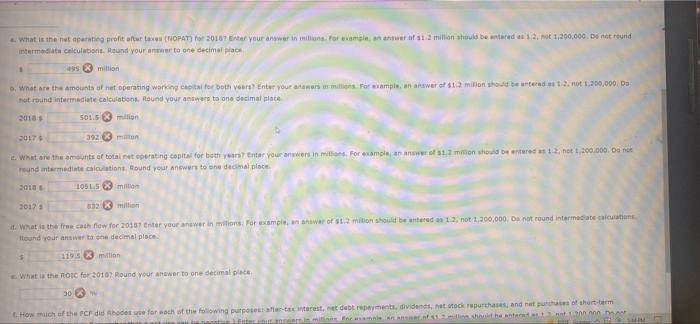

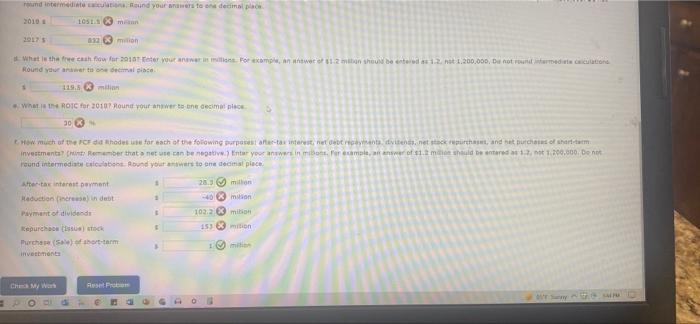

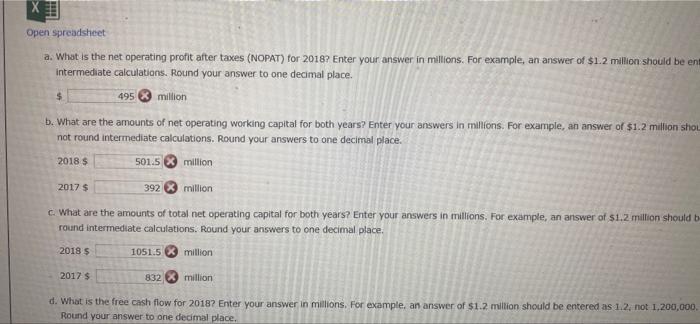

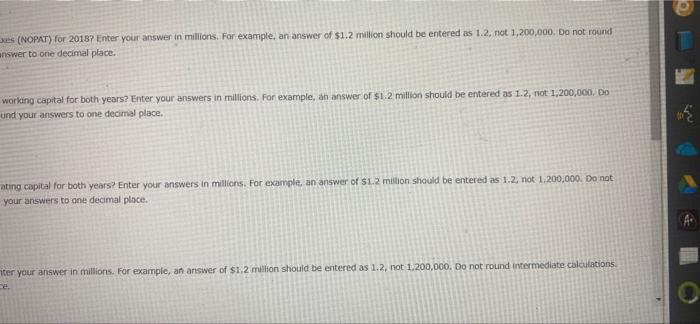

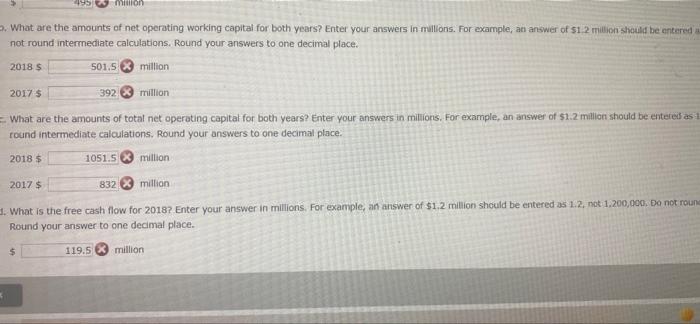

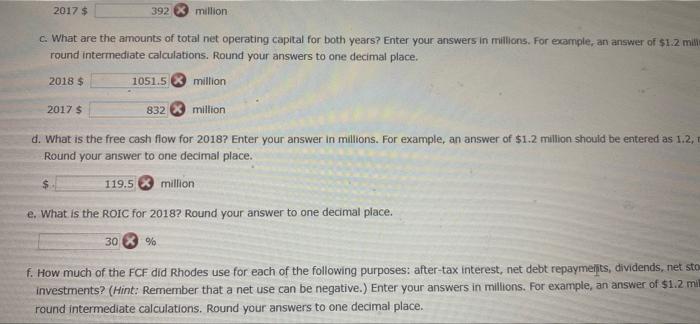

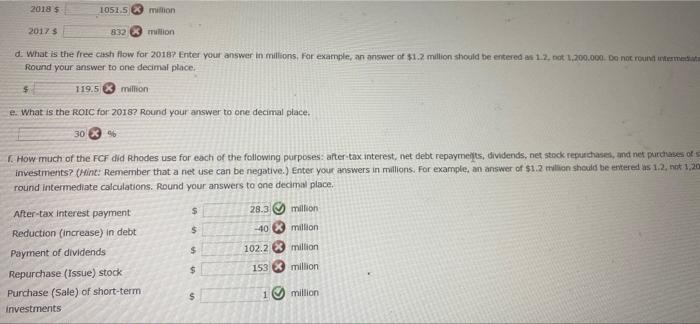

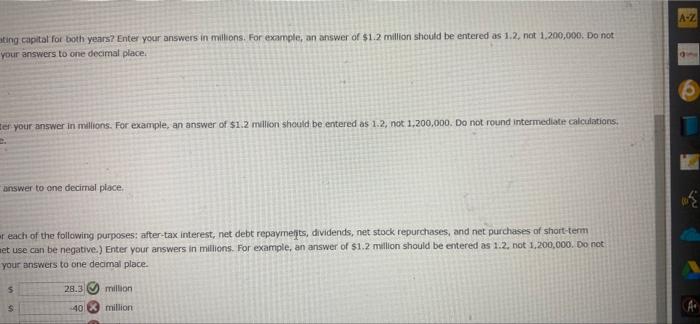

10 What is the net operating profit after taxes [NOPAT) for 2018) Enter your answer in mitions. For example, an answer of $1.2 million should be entered as 1-2, nt 1,200,000. Do not mound intermediate calculations. Round your answer to one decimal place $ 495 milion 8. What are the amounts of net operating working capital for both years? Enter your answers in milions, for example, an answer of $1.2 million should be entered us 1.2, not 1.200.000. Do not found intermediate calculations. Round your answers to one decimal place 2018 s 501.5 milion 2017 5 350 million What are the amounts of total net operating capital for both years? Enter your answers in millions. For example, an answer of $1.2 milion should be entered as 12, note 1,200,000. Do not und intermediate calculations. Round your answers to one decimal place. 2018 s 1051.5 milion million 2017 5 A d. What is the free cash flow for 20107 Enter your answer in milions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200.000. Do not found intermediate calculations. Round your answer to one deamal place. S 119.5 milion What is the ROI1C for 20167 Round your answer to one decmal prace 303 % 54PM What are the amounts of total net operating capital for both years? Enter your answers in mitons For example, on anwer of $1.2 mon should be entered as 12, 1.200,000. round mediate calculation. Round your answers to one decimal place. 2010 S 10515 Act 2017 932 mun B d. What is the free cash flow for 20187 Enter your answer mn mons. For example, an answer of $1.2 mton should be entered as 1.2, not 1,200,000. De tround entermedhe cautions Round your answer to one deomal place 115 milion What is the ROIC for 20187 Round your answer to one dismal place 30 E How much of the FCF did Rhodes use for each of the following purposes after tax interest, net debe repayments, didendi, net stack repurchases, and net purchases of short term investments? (Hint: Remember that a net use can be negative.) Enter your answers in mations. For exangle, an awer of $3.2 million should be entered as 12, net 1.200,000. Do round intermediate calculations. Round your answers to one deamal place 1 28.3 milion After-tax interest payment Reduction (increase) in debt Payment of dividends Repurchase (sue) stack Purchase [Sale) of short-term -40 102.2 153 milion mon mation investments Check My Wo Reset Protiem S $ S 9 A Free Cash Flows 2 (All dolar values are provided in millions) 3 2018 4 Salos, ST Invest, Notes Pay, LT Debt factor increase S Operating costs as % of sales 6 Cash factor increase 7 Accts Rec factor increase Inventory factor increase 9 Not Plant & Equip factor increase 10 Accts Pay factor increase 11 Accruals factor increase 12 13 Depreciation as % of Not Plant & Equip 14 interest rate 15 Tax rates 16 Payout rate 17 10 20 21 22 Income Statements 23 Sales 24 Operating costs excluding depreciation d A A Sheet! + 11 1.10 75.00% 1:25 1.20 1.25 1.25 1.15 1:25 10.00% 10.00% 40.00% 90.00% 2018 $2,200.0 1,650.0 D 2017 $2,000.0 1,700.0 2017 Sales $2,000 1:10% Cash as % of sales Accts Roc as % of sales 11.00% Inventory as of sales 21.00% Net Plant & Equip of sales 22.00% Accts Pay as % of sales 9.00% Accruals as % of Sales 3.00% Operating cost as % of sales 85.00% Depreciation as % of Not Plant & Equp 10.00% Interest rate 10.00% Tax rato 40.00% Payout rate 80.00% Short-term investments as % of sales 0.50% Notes payable as % of sales 2.00% Long-term debt as % of sales 20.00% Retained earnings multiple factor 150 G H Apps Fun S Meet Excel template-Saved File Home Insert 56 Le 22 Income Statements 23 Sales 24 Operating costs excluding depreciation 25 Depreciation and amortization 25 Earnings before interest and taxes 27 Loss interest 28 Pre-tax income 29 Taxes 30 Net income available to common stockholders 31 Common dividends 32 33 Balance Sheets: 34 Assets 35 Cash Short-term investments 37 Accounts receivable 35 Inventones 39 Tobal current assets a Not plant and equipment 41 Total assets 42 43 Liabits and Equity 44 Accounts payable 4 Sheet1 + Calculation Mode Automatic Workbook static POE Esc F1 F2 Arial Draw Page Layout 10 Formulas BE B 2018 $2,2000 1.6500 55.0 $495.0 47.3 $447.7 179 1 $268.6 $241.8 2018 $27.5 F3 110 264.0 525.0 $827 5 5500 $1,377.5 $207.0 Data 761 C D 2017 $2.000.0 1,700.0 44.0 $256.0 43.0 5213.0 852 $127 8 $102.2 2017 $22.0 10.0 220.0 420.0 5672:0 4400 $1.112.0 $180.0 POE F4 144 M Res www 44 CO about blank Apps Fun S Meer Excel template Saved File Home immert Arial 856 43 Liabilities and Equity 44 Accounts payablo 45 Accruals 46 Notes payable 47 Total current liabilities 45 Long toms debt Total sobeities 50 Common stock 51 Retained camnings 32 Total common equity 53 Total abilities and equity 54 36 NOPAT 57 SNOW 19 NOWC 10 ST Tofat net operating capital 62 Total net operating capitaben 64 Free cash flow 45 now O E&Sheet! + Calon Mode Automatic Workbook Sta #9 Esc F1 A Youtube G Google Draw Page Layout 10 F2 Pages Formulas Data BA MAA B C $207.0 75.0 44.0 $320.0 4400 $766.0 5483 652 $611.5 $13775 4 F3 40 D $180.0 60.0 400 $280.0 400.0 $6000 393.7 38.3 $432.0 $1,1120 F4 144 FORMUL CE What is the net operating profit aftur taxes (NOPAT) for 20187 Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. De not round intermediata celculations. Round your answer to one decimal place 1 million D. What are the amounts of net operating working capital for both years? Enter your answers in millions. For example, an answer of $1.2 milion should be entered as 1-2. not 1.200,000. Da not round intermediate calculations. Round your answers to one decimal place 2018 501.5 milion 2017 392 milion e. What are the amounts of total net operating capital for both years? Enter your answers in mitions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answers to one decimal place. 2018 1051.5 million 2017 532 million d. What is the free cash flow for 20107 Enter your answer in milions. For example, an answer of $1.2 milion should be entered as 12, not 1,200,000, Do not round intermediate calculations Bound your answer to one decimal place. $ 119.5 million What is the ROIC for 20107 Round your answer to one decimal place. 30 % How much of the PCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term negative Enter nur anceers in milions For example an answer.of $1.2 million should he anteradas not 100.000 D BA ASHIN round intermediate calculations. Round your answers to ena decimal place 2010 1051. minn 2017 S 632 milion What is the free cash flow for 2018 Enter your answer in millions. For example, an answer of $1.2 miban should be entered as 1.2. not 1.200,000, De not round intermediate ciculations Round your answer to one decimal place. 119.5 milion What is the ROIC for 2010? Round your answer to one decimal place 30 % How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stack repurchases, and het purchases of short-term investments? (Hint: Remember that net use can be negative.) Enter your answers in midons. For example, an answer of $1.2 million should be entered as 12, not 1.200.000. De not round intermediate calculations. Round your answers to one decimal place After-tax interest payment 28.3 millon milion Reduction (increase) in debt Payment of dividends 102.2 milion milion Repurchase (Issue) stock milion Purchase (Sale) of short-term investments Check My Wor 153 G Open spreadsheet a. What is the net operating profit after taxes (NOPAT) for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be ent intermediate calculations. Round your answer to one decimal place. 495 million b. What are the amounts of net operating working capital for both years? Enter your answers in millions. For example, an answer of $1.2 million shou not round intermediate calculations. Round your answers to one decimal place. 2018 $ 501.5 million 2017 $ 392 million c. What are the amounts of total net operating capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should b round intermediate calculations. Round your answers to one decimal place. 2018 $ 1051.5 million 2017 $ 832 million d. What is the free cash flow for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answer to one decimal place. xes (NOPAT) for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round answer to one decimal place. working capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000, Do und your answers to one decimal place. ating capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not your answers to one decimal place. ter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. million . What are the amounts of net operating working capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered a not round intermediate calculations. Round your answers to one decimal place. 2018 $ 501.5 million 2017 $ 392 million What are the amounts of total net operating capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1 round intermediate calculations. Round your answers to one decimal place. 2018 $ 1051.5 million 2017 $ 832 million. 3. What is the free cash flow for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1.200,000. Do not round Round your answer to one decimal place. $ 119.5 million 2017 $ 392 million c. What are the amounts of total net operating capital for both years? Enter your answers in millions. For example, an answer of $1.2 millis round intermediate calculations. Round your answers to one decimal place. 2018 $ 1051.5 million 2017 $ 832 million d. What is the free cash flow for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, r Round your answer to one decimal place. 119.5 million e. What is the ROIC for 2018? Round your answer to one decimal place. 30 % f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stor investments? (Hint: Remember that a net use can be negative.) Enter your answers in millions. For example, an answer of $1.2 mill round intermediate calculations. Round your answers to one decimal place. 2018 S 1051.5 million 2017 S 832 million d. What is the free cash flow for 2018? Enter your answer in millions, For example, an answer of $1.2 million should be entered as 1.2, not 1,200.000. Do not round intermediata Round your answer to one decimal place. 119.5 million e. What is the ROIC for 2018? Round your answer to one decimal place. 30 % f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of s investments? (Hint: Remember that a net use can be negative.) Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200 round intermediate calculations. Round your answers to one decimal place. $ 28.3 million $ -40 After-tax interest payment - Reduction (increase) in debt Payment of dividends million 102.2 million 153 million Repurchase (Issue) stock Purchase (Sale) of short-term 1 million investments $ $ $ &* ating capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not your answers to one decimal place. er your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. answer to one decimal place. reach of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term met use can be negative.) Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not your answers to one decimal place. S 28.3 million $ -40 million A-Z a 6 10 What is the net operating profit after taxes [NOPAT) for 2018) Enter your answer in mitions. For example, an answer of $1.2 million should be entered as 1-2, nt 1,200,000. Do not mound intermediate calculations. Round your answer to one decimal place $ 495 milion 8. What are the amounts of net operating working capital for both years? Enter your answers in milions, for example, an answer of $1.2 million should be entered us 1.2, not 1.200.000. Do not found intermediate calculations. Round your answers to one decimal place 2018 s 501.5 milion 2017 5 350 million What are the amounts of total net operating capital for both years? Enter your answers in millions. For example, an answer of $1.2 milion should be entered as 12, note 1,200,000. Do not und intermediate calculations. Round your answers to one decimal place. 2018 s 1051.5 milion million 2017 5 A d. What is the free cash flow for 20107 Enter your answer in milions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200.000. Do not found intermediate calculations. Round your answer to one deamal place. S 119.5 milion What is the ROI1C for 20167 Round your answer to one decmal prace 303 % 54PM What are the amounts of total net operating capital for both years? Enter your answers in mitons For example, on anwer of $1.2 mon should be entered as 12, 1.200,000. round mediate calculation. Round your answers to one decimal place. 2010 S 10515 Act 2017 932 mun B d. What is the free cash flow for 20187 Enter your answer mn mons. For example, an answer of $1.2 mton should be entered as 1.2, not 1,200,000. De tround entermedhe cautions Round your answer to one deomal place 115 milion What is the ROIC for 20187 Round your answer to one dismal place 30 E How much of the FCF did Rhodes use for each of the following purposes after tax interest, net debe repayments, didendi, net stack repurchases, and net purchases of short term investments? (Hint: Remember that a net use can be negative.) Enter your answers in mations. For exangle, an awer of $3.2 million should be entered as 12, net 1.200,000. Do round intermediate calculations. Round your answers to one deamal place 1 28.3 milion After-tax interest payment Reduction (increase) in debt Payment of dividends Repurchase (sue) stack Purchase [Sale) of short-term -40 102.2 153 milion mon mation investments Check My Wo Reset Protiem S $ S 9 A Free Cash Flows 2 (All dolar values are provided in millions) 3 2018 4 Salos, ST Invest, Notes Pay, LT Debt factor increase S Operating costs as % of sales 6 Cash factor increase 7 Accts Rec factor increase Inventory factor increase 9 Not Plant & Equip factor increase 10 Accts Pay factor increase 11 Accruals factor increase 12 13 Depreciation as % of Not Plant & Equip 14 interest rate 15 Tax rates 16 Payout rate 17 10 20 21 22 Income Statements 23 Sales 24 Operating costs excluding depreciation d A A Sheet! + 11 1.10 75.00% 1:25 1.20 1.25 1.25 1.15 1:25 10.00% 10.00% 40.00% 90.00% 2018 $2,200.0 1,650.0 D 2017 $2,000.0 1,700.0 2017 Sales $2,000 1:10% Cash as % of sales Accts Roc as % of sales 11.00% Inventory as of sales 21.00% Net Plant & Equip of sales 22.00% Accts Pay as % of sales 9.00% Accruals as % of Sales 3.00% Operating cost as % of sales 85.00% Depreciation as % of Not Plant & Equp 10.00% Interest rate 10.00% Tax rato 40.00% Payout rate 80.00% Short-term investments as % of sales 0.50% Notes payable as % of sales 2.00% Long-term debt as % of sales 20.00% Retained earnings multiple factor 150 G H Apps Fun S Meet Excel template-Saved File Home Insert 56 Le 22 Income Statements 23 Sales 24 Operating costs excluding depreciation 25 Depreciation and amortization 25 Earnings before interest and taxes 27 Loss interest 28 Pre-tax income 29 Taxes 30 Net income available to common stockholders 31 Common dividends 32 33 Balance Sheets: 34 Assets 35 Cash Short-term investments 37 Accounts receivable 35 Inventones 39 Tobal current assets a Not plant and equipment 41 Total assets 42 43 Liabits and Equity 44 Accounts payable 4 Sheet1 + Calculation Mode Automatic Workbook static POE Esc F1 F2 Arial Draw Page Layout 10 Formulas BE B 2018 $2,2000 1.6500 55.0 $495.0 47.3 $447.7 179 1 $268.6 $241.8 2018 $27.5 F3 110 264.0 525.0 $827 5 5500 $1,377.5 $207.0 Data 761 C D 2017 $2.000.0 1,700.0 44.0 $256.0 43.0 5213.0 852 $127 8 $102.2 2017 $22.0 10.0 220.0 420.0 5672:0 4400 $1.112.0 $180.0 POE F4 144 M Res www 44 CO about blank Apps Fun S Meer Excel template Saved File Home immert Arial 856 43 Liabilities and Equity 44 Accounts payablo 45 Accruals 46 Notes payable 47 Total current liabilities 45 Long toms debt Total sobeities 50 Common stock 51 Retained camnings 32 Total common equity 53 Total abilities and equity 54 36 NOPAT 57 SNOW 19 NOWC 10 ST Tofat net operating capital 62 Total net operating capitaben 64 Free cash flow 45 now O E&Sheet! + Calon Mode Automatic Workbook Sta #9 Esc F1 A Youtube G Google Draw Page Layout 10 F2 Pages Formulas Data BA MAA B C $207.0 75.0 44.0 $320.0 4400 $766.0 5483 652 $611.5 $13775 4 F3 40 D $180.0 60.0 400 $280.0 400.0 $6000 393.7 38.3 $432.0 $1,1120 F4 144 FORMUL CE What is the net operating profit aftur taxes (NOPAT) for 20187 Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. De not round intermediata celculations. Round your answer to one decimal place 1 million D. What are the amounts of net operating working capital for both years? Enter your answers in millions. For example, an answer of $1.2 milion should be entered as 1-2. not 1.200,000. Da not round intermediate calculations. Round your answers to one decimal place 2018 501.5 milion 2017 392 milion e. What are the amounts of total net operating capital for both years? Enter your answers in mitions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answers to one decimal place. 2018 1051.5 million 2017 532 million d. What is the free cash flow for 20107 Enter your answer in milions. For example, an answer of $1.2 milion should be entered as 12, not 1,200,000, Do not round intermediate calculations Bound your answer to one decimal place. $ 119.5 million What is the ROIC for 20107 Round your answer to one decimal place. 30 % How much of the PCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term negative Enter nur anceers in milions For example an answer.of $1.2 million should he anteradas not 100.000 D BA ASHIN round intermediate calculations. Round your answers to ena decimal place 2010 1051. minn 2017 S 632 milion What is the free cash flow for 2018 Enter your answer in millions. For example, an answer of $1.2 miban should be entered as 1.2. not 1.200,000, De not round intermediate ciculations Round your answer to one decimal place. 119.5 milion What is the ROIC for 2010? Round your answer to one decimal place 30 % How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stack repurchases, and het purchases of short-term investments? (Hint: Remember that net use can be negative.) Enter your answers in midons. For example, an answer of $1.2 million should be entered as 12, not 1.200.000. De not round intermediate calculations. Round your answers to one decimal place After-tax interest payment 28.3 millon milion Reduction (increase) in debt Payment of dividends 102.2 milion milion Repurchase (Issue) stock milion Purchase (Sale) of short-term investments Check My Wor 153 G Open spreadsheet a. What is the net operating profit after taxes (NOPAT) for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be ent intermediate calculations. Round your answer to one decimal place. 495 million b. What are the amounts of net operating working capital for both years? Enter your answers in millions. For example, an answer of $1.2 million shou not round intermediate calculations. Round your answers to one decimal place. 2018 $ 501.5 million 2017 $ 392 million c. What are the amounts of total net operating capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should b round intermediate calculations. Round your answers to one decimal place. 2018 $ 1051.5 million 2017 $ 832 million d. What is the free cash flow for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answer to one decimal place. xes (NOPAT) for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round answer to one decimal place. working capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000, Do und your answers to one decimal place. ating capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not your answers to one decimal place. ter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. million . What are the amounts of net operating working capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered a not round intermediate calculations. Round your answers to one decimal place. 2018 $ 501.5 million 2017 $ 392 million What are the amounts of total net operating capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1 round intermediate calculations. Round your answers to one decimal place. 2018 $ 1051.5 million 2017 $ 832 million. 3. What is the free cash flow for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1.200,000. Do not round Round your answer to one decimal place. $ 119.5 million 2017 $ 392 million c. What are the amounts of total net operating capital for both years? Enter your answers in millions. For example, an answer of $1.2 millis round intermediate calculations. Round your answers to one decimal place. 2018 $ 1051.5 million 2017 $ 832 million d. What is the free cash flow for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, r Round your answer to one decimal place. 119.5 million e. What is the ROIC for 2018? Round your answer to one decimal place. 30 % f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stor investments? (Hint: Remember that a net use can be negative.) Enter your answers in millions. For example, an answer of $1.2 mill round intermediate calculations. Round your answers to one decimal place. 2018 S 1051.5 million 2017 S 832 million d. What is the free cash flow for 2018? Enter your answer in millions, For example, an answer of $1.2 million should be entered as 1.2, not 1,200.000. Do not round intermediata Round your answer to one decimal place. 119.5 million e. What is the ROIC for 2018? Round your answer to one decimal place. 30 % f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of s investments? (Hint: Remember that a net use can be negative.) Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200 round intermediate calculations. Round your answers to one decimal place. $ 28.3 million $ -40 After-tax interest payment - Reduction (increase) in debt Payment of dividends million 102.2 million 153 million Repurchase (Issue) stock Purchase (Sale) of short-term 1 million investments $ $ $ &* ating capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not your answers to one decimal place. er your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. answer to one decimal place. reach of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term met use can be negative.) Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not your answers to one decimal place. S 28.3 million $ -40 million A-Z a 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts