Question: This simulation presents the Memo re Sales Invoice Procedures/Results relating to the Keystone Computers & Networks, Inc. (Keystone), audit. Background financial and other information on

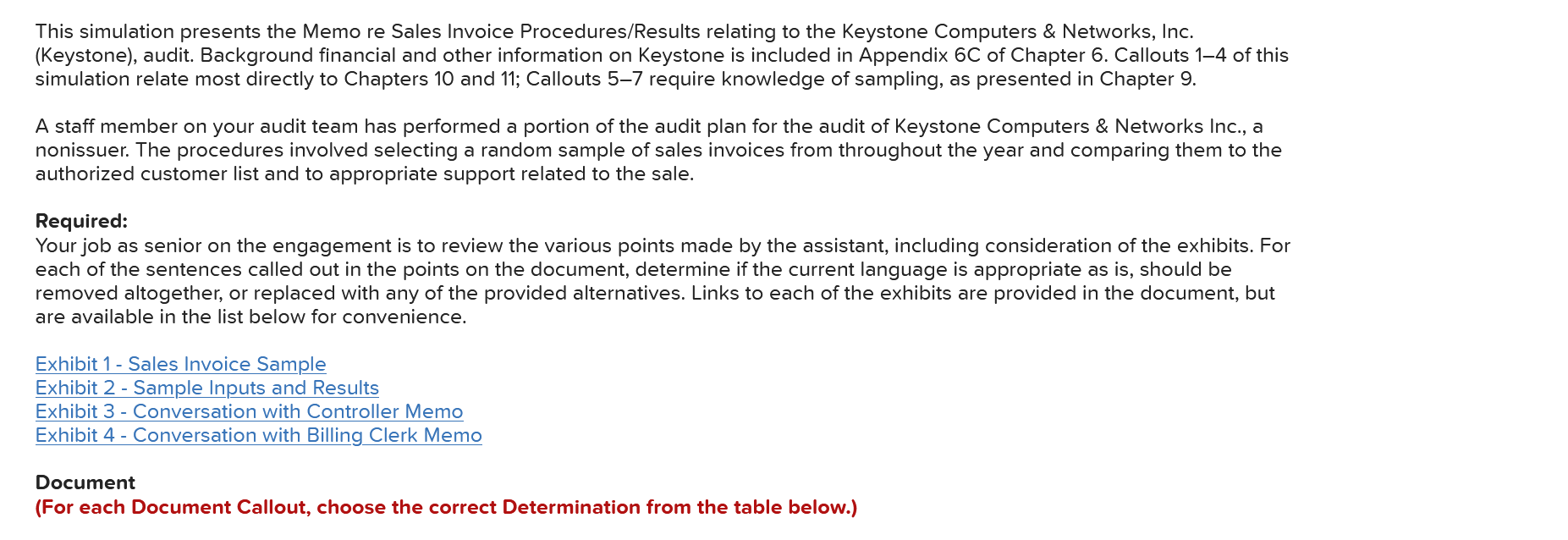

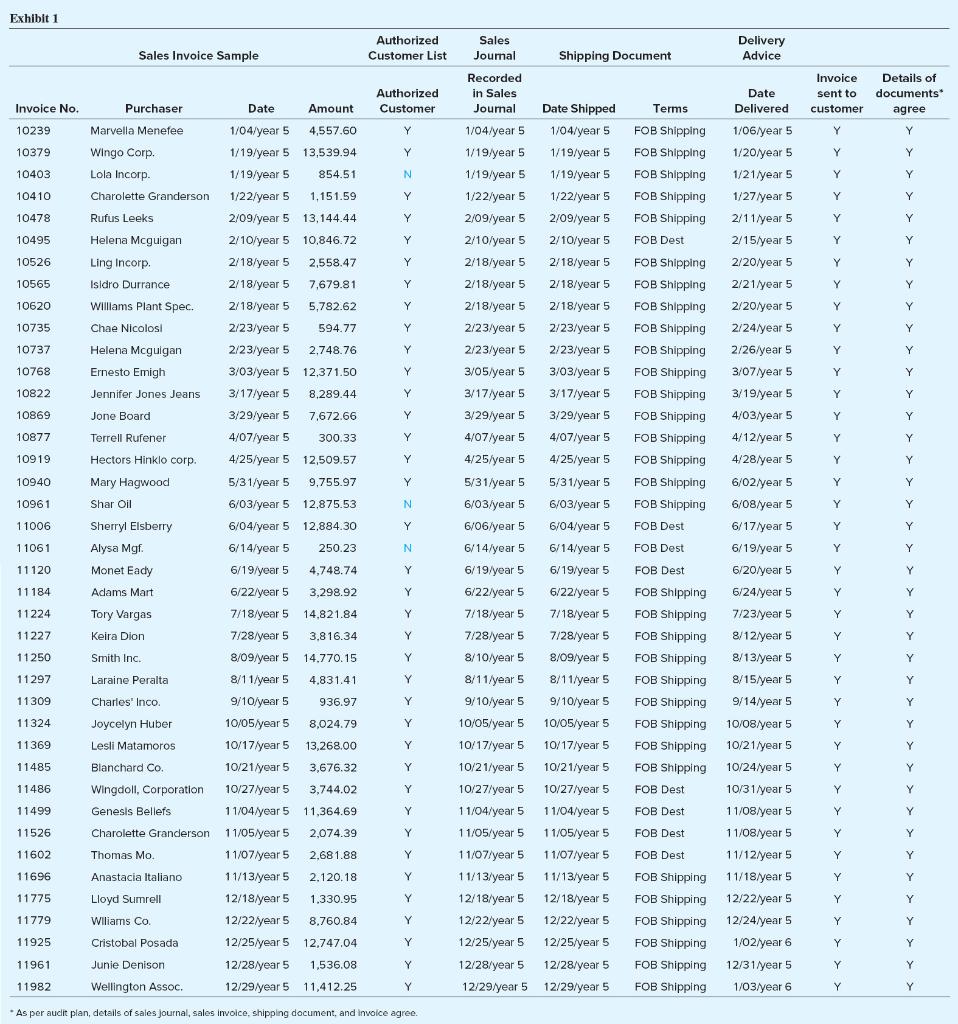

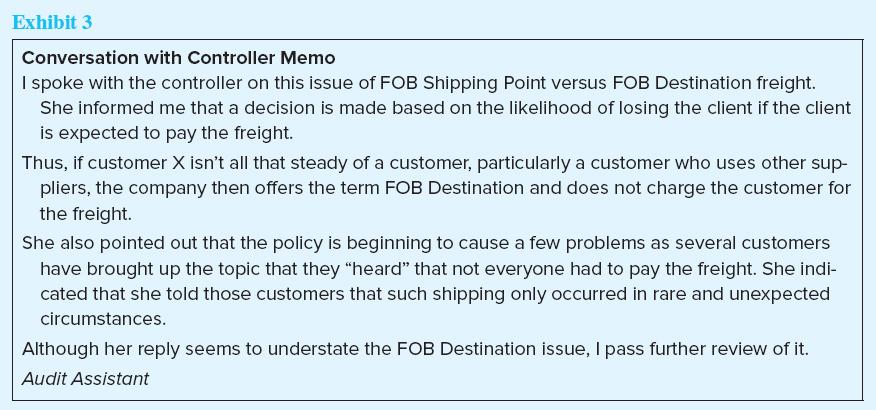

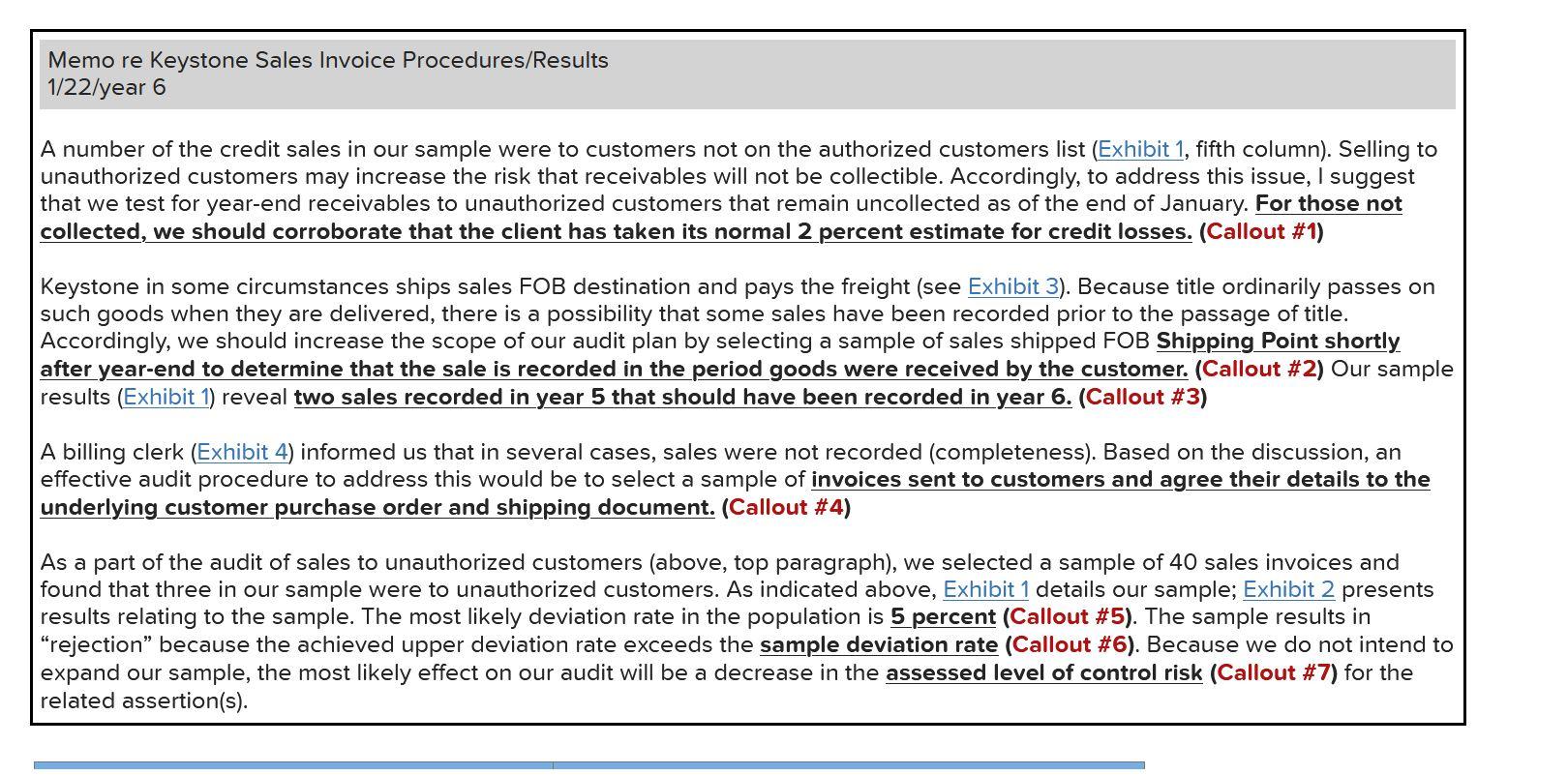

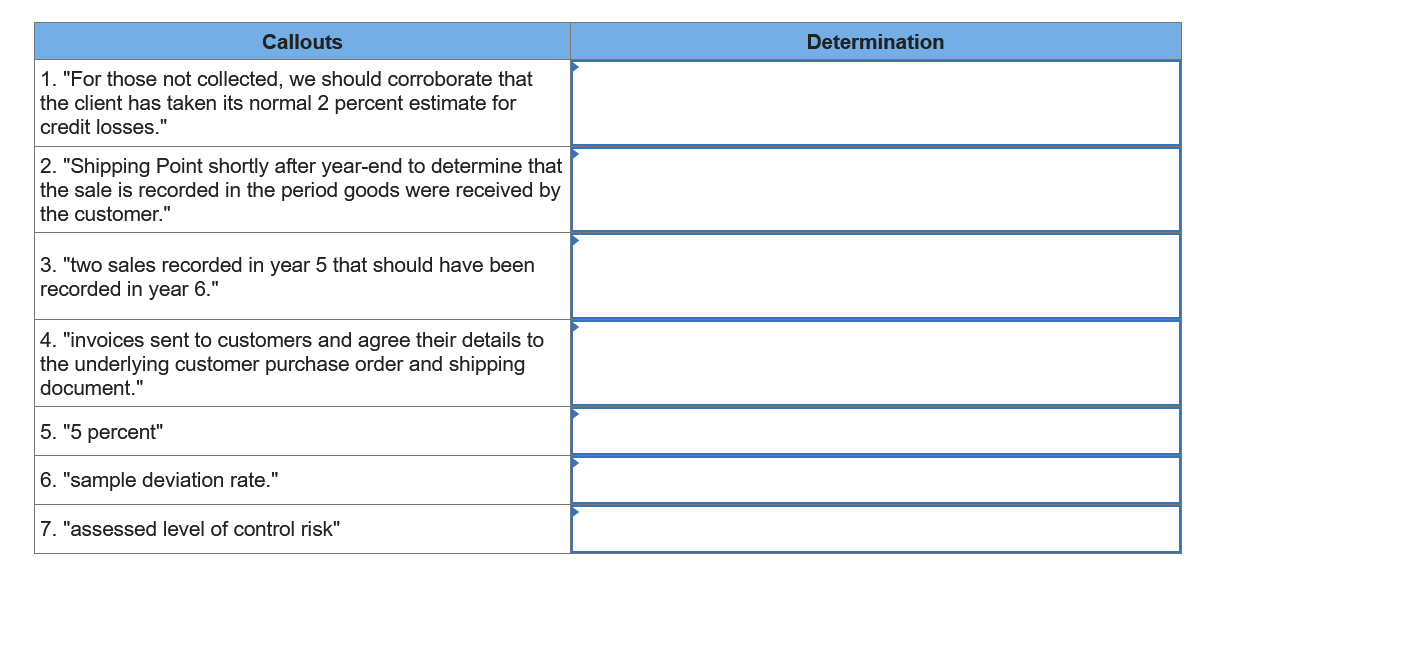

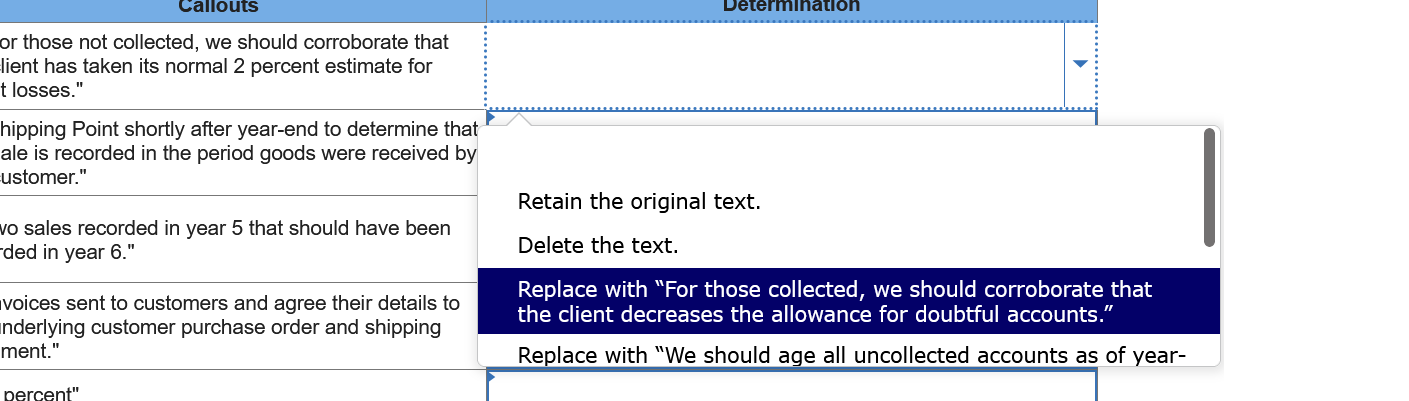

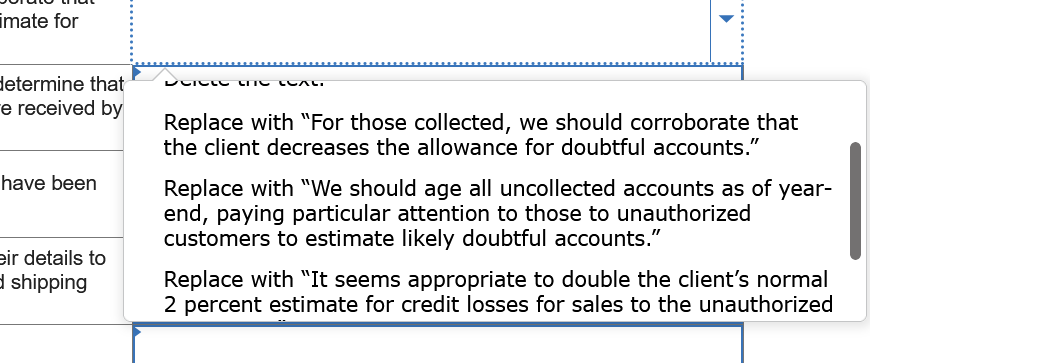

This simulation presents the Memo re Sales Invoice Procedures/Results relating to the Keystone Computers & Networks, Inc. (Keystone), audit. Background financial and other information on Keystone is included in Appendix 6C of Chapter 6. Callouts 14 of this simulation relate most directly to Chapters 10 and 11; Callouts 57 require knowledge of sampling, as presented in Chapter 9. A staff member on your audit team has performed a portion of the audit plan for the audit of Keystone Computers & Networks Inc., a nonissuer. The procedures involved selecting a random sample of sales invoices from throughout the year and comparing them to the authorized customer list and to appropriate support related to the sale. Required: Your job as senior on the engagement is to review the various points made by the assistant, including consideration of the exhibits. For each of the sentences called out in the points on the document, determine if the current language is appropriate as is, should be removed altogether, or replaced with any of the provided alternatives. Links to each of the exhibits are provided in the document, but are available in the list below for convenience. Exhibit 1 - Sales Invoice Sample Exhibit 2 - Sample Inputs and Results Exhibit 3 - Conversation with Controller Memo Exhibit 4 - Conversation with Billing Clerk Memo Document (For each Document Callout, choose the correct Determination from the table below.) Exhibit 1 Sales Invoice Sample Authorized Customer List Authorized Customer Invoice sent to customer Details of documents agree Invoice No. 10239 Y Y Y Y Y Y 10379 10403 N Y Y 10410 Y Y Y 10478 Y Y Y 10495 Y Y Y Y 10526 Y Y Y 10565 Y Y Y 10620 Y Y Y 10735 Y Y Y Y 10737 Y Y Y 10768 Y Y Y 10822 Y Y Y 10869 Y Y Y 10877 Y Y Y 10919 Y Y Y 10940 Y Y Y 10961 N Y Y Sales Delivery Joumal Shipping Document Advice Recorded in Sales Date Joumal Date Shipped Terms Delivered 1/04/year 5 1/04/year 5 FOB Shipping 1/06/year 5 1/19/year 5 1/19/year 5 FOB Shipping 1/20/year 5 1/19/year 5 1/19/year 5 FOB Shipping 1/21/year 5 1/22/year 5 1/22/year 5 FOB Shipping 1/27/year 5 2/09/year 5 2/09/year 5 FOB Shipping 2/11/year 5 2/10/year 5 2/10/year 5 FOB Dest 2/15/year 5 2/18/year 5 2/18/year 5 FOB Shipping 2/20/year 5 2/18/year 5 2/18/year 5 FOB Shipping 2/21/year 5 2/18/year 5 2/18/year 5 FOB Shipping 2/20/year 5 2/23/year 5 2/23/year 5 FOB Shipping 2/24/year 5 2/23/year 5 2/23/year 5 FOB Shipping 2/26/year 5 3/05/year 5 3/03/year 5 FOB Shipping 3/07/year 5 3/17/year 5 3/17/year 5 FOB Shipping 3/19/year 5 3/29/year 5 3/29/year 5 FOB Shipping 4/03/year 5 4/07/year 5 4/07/year 5 FOB Shipping 4/12/year 5 4/25/year 5 4/25/year 5 FOB Shipping 4/28/year 5 5/31/year 5 5/31/year 5 FOB Shipping 6/02/year 5 6/03/year 5 6/03/year 5 FOB Shipping 6/08/year 5 6/06/year 5 6/04/year 5 FOB Dest 6/17/year 5 6/14/year 5 6/14/year 5 FOB Dest 6/19/year 5 6/19/year 5 6/19/year 5 FOB Dest 6/20/year 5 6/22/year 5 6/22/year 5 FOB Shipping 6/24/year 5 7/18/year 5 7/18/year 5 FOB Shipping 7/23/year 5 7/28/year 5 7/28/year 5 FOB Shipping 8/12/year 5 8/10/year 5 8/09/year 5 8/13/year 5 8/11/year 5 8/11/year 5 FOB Shipping 8/15/year 5 9/10/year 5 9/10/year 5 FOB Shipping 9/14/year 5 10/05/year 5 10/05/year 5 FOB Shipping 10/08/year 5 10/17/year 5 10/17/year 5 FOB Shipping 10/21/year 5 10/21/year 5 10/21/year 5 FOB Shipping 10/24/year 5 10/27/year 5 10/27/year 5 FOB Dest 10/31/year 5 11/04/year 5 11/04/year 5 FOB Dest 11/08/year 5 11/05/year 5 11/05/year 5 FOB Dest 11/08/year 5 11/07/year 5 11/07/year 5 FOB Dest 11/12/year 5 11/13/year 5 11/13/year 5 FOB Shipping 11/18/year 5 12/18/year 5 12/18/year 5 FOB Shipping 12/22/year 5 12/22/year 5 12/22/year 5 FOB Shipping 12/24/year 5 12/25/year 5 12/25/year 5 FOB Shipping 1/02/year 6 12/28/year 5 12/28/year 5 FOB Shipping 12/31/year 5 12/29/year 5 12/29/year 5 FOB Shipping 1/03/year 6 11006 Y Y Y Purchaser Date Amount Marvella Menefee 1/04/year 5 4,557.60 Wingo Corp. 1/19/year 5 13,539.94 Lola Incorp. 1/19/year 5 854.51 Charolette Granderson 1/22/year 5 1,151.59 Rufus Leeks 2/09/year 5 13,144.44 Helena Mcguigan 2/10/year 5 10,846.72 Ling Incorp. 2/18/year 5 2,558.47 Isidro Durrance 2/18/year 5 7,679.81 Williams Plant Spec. 2/18/year 5 5,782.62 Chae Nicolosi 2/23/year 5 594.77 Helena Mcguigan 2/23/year 5 2.748.76 Ernesto Emigh 3/03/year 5 12,371.50 Jennifer Jones Jeans 3/17/year 5 8,289.44 Jone Board 3/29/year 5 7,672.66 Terrell Rufener 4/07/year 5 300.33 Hectors Hinklo corp. 4/25/year 5 12,509.57 Mary Hagwood 5/31/year 5 9,755.97 Shar Oil 6/03/year 5 12.875.53 Sherryl Elsberry 6/04/year 5 12,884.30 Alysa Mgf. 6/14/year 5 250.23 Monet Eady 6/19/year 5 4.748.74 Adams Mart 6/22/year 5 3,298.92 Tory Vargas 7/18/year 5 14,821.84 Keira Dion 7/28/year 5 3.816.34 Smith Inc. 8/09/year 5 14.770.15 Laraine Peralta 8/11/year 5 4,831.41 Charles' Inco. ' . 9/10/year 5 936.97 Joycelyn Huber 10/05/year 5 8,024.79 Lesli Matamoros 10/17/year 5 13,268.00 Blanchard Co. 10/21/year 5 3,676.32 Wingdoll, Corporation 10/27/year 5 3,744.02 Genesis Bellefs 11/04/year 5 11,364.69 Charolette Granderson 11/05/year 5 2,074.39 Thomas Mo. 11/07/year 5 2.681.88 Anastacia Italiano 11/13 year 5 2.120.18 Lloyd Sumrell 12/18/year 5 1.330.95 Wiliams Co. 12/22/year 5 8.760.84 Cristobal Posada 12/25/year 5 12,747.04 Junie Denison 12/28/year 5 1,536.08 Wellington Assoc. 12/29/year 5 11,412.25 11061 N Y Y 11120 Y Y Y 11184 Y Y Y 11224 Y Y Y 11227 Y Y Y 11250 Y FOB Shipping Y Y 11297 Y Y Y 11309 Y Y Y 11324 Y Y Y 11369 Y Y Y 11485 Y Y Y 11486 Y Y Y 11499 Y Y Y 11526 Y Y Y 11602 Y Y Y 11696 Y Y Y Y 11775 Y Y Y 11779 Y Y Y 11925 Y Y Y 11961 Y Y Y 11982 Y Y Y Y As per auclit plan, details of sales journal, sales involce, shipping document, and invoice agree. Exhibit 2 Sample Inputs and Results Sales to Unauthorized Customers 5% Attribute Risk of Assessing Control Risk Too Low Expected Deviation Rate Tolerable Deviation Rate Sample Size 5% 15% 40 3 3 Results Deviations Sample Deviation Rate Achieved Upper Deviation Rate Decision 7.5% 18.3% Reject Exhibit 3 Conversation with Controller Memo I spoke with the controller on this issue of FOB Shipping Point versus FOB Destination freight. She informed me that a decision is made based on the likelihood of losing the client if the client is expected to pay the freight. Thus, if customer X isn't all that steady of a customer, particularly a customer who uses other sup- pliers, the company then offers the term FOB Destination and does not charge the customer for the freight She also pointed out that the policy is beginning to cause a few problems as several customers have brought up the topic that they heard that not everyone had to pay the freight. She indi- cated that she told those customers that such shipping only occurred in rare and unexpected circumstances. Although her reply seems to understate the FOB Destination issue, I pass further review of it. Audit Assistant Exhibit 4 Conversation with Billing Clerk Memo I spoke with the Billing Clerk, who helped me organize my thoughts about Keystone's billing sys- tem. The company always bills the day that it ships items to customers. Generally, the customer pays for the shipping, although this is not always the case. When I asked him if there have been any difficulties" during the year, he mentioned that in a few situations, goods had been shipped and no invoice had been prepared for the shipment, and accordingly, no sales journal entry had been prepared until the company discovered the prob- lem, once when a customer returned the goods and several times when customers asked about billing. He assured me that the problem had been rectified and that he believed there were no more such transactions. (A new employee had been involved who didn't completely understand the electronic process.) Audit Assistant Memo re Keystone Sales Invoice Procedures/Results 1/22/year 6 A number of the credit sales in our sample were to customers not on the authorized customers list (Exhibit 1, fifth column). Selling to unauthorized customers may increase the risk that receivables will not be collectible. Accordingly, to address this issue, I suggest that we test for year-end receivables to unauthorized customers that remain uncollected as of the end of January. For those not collected, we should corroborate that the client has taken its normal 2 percent estimate for credit losses. (Callout #1) Keystone in some circumstances ships sales FOB destination and pays the freight (see Exhibit 3). Because title ordinarily passes on such goods when they are delivered, there is a possibility that some sales have been recorded prior to the passage of title. Accordingly, we should increase the scope of our audit plan by selecting a sample of sales shipped FOB Shipping Point shortly after year-end to determine that the sale is recorded in the period goods were received by the customer. (Callout #2) Our sample results (Exhibit 1) reveal two sales recorded in year 5 that should have been recorded in year 6. (Callout #3) A billing clerk (Exhibit 4) informed us that in several cases, sales were not recorded (completeness). Based on the discussion, an effective audit procedure to address this would be to select a sample of invoices sent to customers and agree their details to the underlying customer purchase order and shipping document. (Callout #4) As a part of the audit of sales to unauthorized customers (above, top paragraph), we selected a sample of 40 sales invoices and found that three in our sample were to unauthorized customers. As indicated above, Exhibit 1 details our sample; Exhibit 2 presents results relating to the sample. The most likely deviation rate in the population is 5 percent (Callout #5). The sample results in "rejection because the achieved upper deviation rate exceeds the sample deviation rate (Callout #6). Because we do not intend to expand our sample, the most likely effect on our audit will be a decrease in the assessed level of control risk (Callout #7) for the related assertion(s). Callouts Determination 1. "For those not collected, we should corroborate that the client has taken its normal 2 percent estimate for credit losses." 2. "Shipping Point shortly after year-end to determine that the sale is recorded in the period goods were received by the customer." 3. "two sales recorded in year 5 that should have been recorded in year 6." 4. "invoices sent to customers and agree their details to the underlying customer purchase order and shipping document." 5. "5 percent" 6. "sample deviation rate." 7. "assessed level of control risk" Callouts Determination or those not collected, we should corroborate that lient has taken its normal 2 percent estimate for t losses." hipping Point shortly after year-end to determine that ale is recorded in the period goods were received by ustomer." Retain the original text. vo sales recorded in year 5 that should have been -ded in year 6." Delete the text. voices sent to customers and agree their details to nderlying customer purchase order and shipping ment." Replace with "For those collected, we should corroborate that the client decreases the allowance for doubtful accounts." Replace with "We should age all uncollected accounts as of year- percent" imate for CICLE LITE LEAL determine that e received by Replace with "For those collected, we should corroborate that the client decreases the allowance for doubtful accounts." have been eir details to shipping Replace with "We should age all uncollected accounts as of year- end, paying particular attention to those to unauthorized customers to estimate likely doubtful accounts." Replace with "It seems appropriate to double the client's normal 2 percent estimate for credit losses for sales to the unauthorized nat by end, paying particular attention to those to unauthorized customers to estimate likely doubtful accounts." Replace with "It seems appropriate to double the client's normal 2 percent estimate for credit losses for sales to the unauthorized customers." Replace with "As a conservative approach, we should propose journal entries writing off all uncollected accounts from unauthorized customers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts