Question: Four fundamental factors affect the cost of money: 1. The return that borrowers expect to earn on their investments 2. The preference of savers

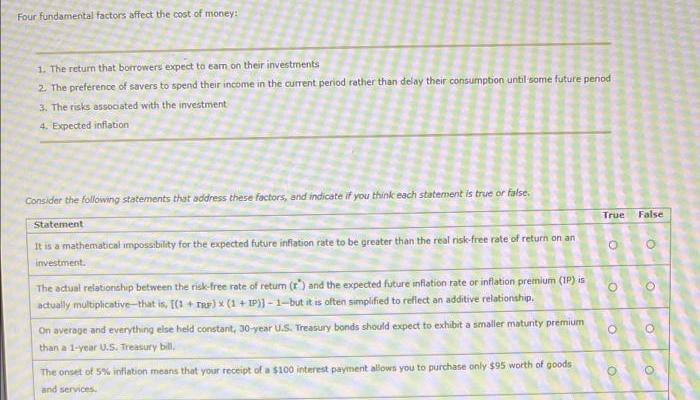

Four fundamental factors affect the cost of money: 1. The return that borrowers expect to earn on their investments 2. The preference of savers to spend their income in the current period rather than delay their consumption until some future penod 3. The risks associated with the investment i 4. Expected inflation Consider the following statements that address these factors, and indicate if you think each statement is true or false. Statement It is a mathematical impossibility for the expected future inflation rate to be greater than the real risk-free rate of return on an investment. The actual relationship between the risk-free rate of return (r) and the expected future inflation rate or inflation premium (IP) is actually multiplicative that is, [(1 + r) x (1 + IP)]-1-but it is often simplified to reflect an additive relationship, On average and everything else held constant, 30-year U.S. Treasury bonds should expect to exhibit a smaller maturity premium than a 1-year U.S. Treasury bill. The onset of 5% inflation means that your receipt of a $100 interest payment allows you to purchase only $95 worth of goods and services. True O O O O False O O

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below ANSWER Lets evaluate each statement Statement 1 It is a mathematical impossibility for th... View full answer

Get step-by-step solutions from verified subject matter experts