Question: This step will illustrate how even smaller purchases cost more when you purchase on a credit card and do not pay the balance in full

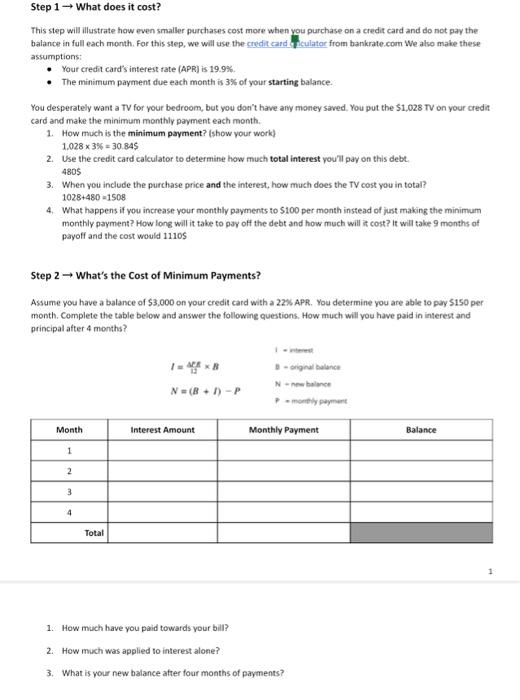

This step will illustrate how even smaller purchases cost more when you purchase on a credit card and do not pay the balance in full each month. For this step, we will use the credit card le culator from bankrate.com We also make these assumptions: - Your credit card's interest rate (APR) is 19.9% - The minimum payment due each month is 3% of your starting balance. You desperately want a TV for your bedroom, but you don't have amy money saved. You put the \$1,028 TV on your credit card and make the minimum monthly payment each month. 1. How much is the minimum payment? (show your work) 1.0283%=30.845 2. Use the credit card calculator to determine how much total interest you'l pay on this debt. 4805 3. When you include the purchase price and the interest, how much does the TV cost you in total? 1028+480=1508 4. What happens if you increase your monthly payments to $100 per month instead of just making the minimum monthly payment? How long will it take to gay off the debt and how much will it cost? it will take 9 months of payoff and the cost would 11105 Step 2 What's the Cost of Minimum Payments? Assume you have a balance of $3,000 on your credit card with a 22\% APR, You determine you are able to pay $150 per month. Complete the table below and answer the followine questions. How much will you have paid in interest and principal after 4 months? I=12ACRBN=(B+D)P1-ntreedNoriginlbulanceNnesbelansePmonelypeyment 1. How much have you paid towards your bill? 2. How much was applied to interest alone? 3. What is your new balance atter four months of payments? This step will illustrate how even smaller purchases cost more when you purchase on a credit card and do not pay the balance in full each month. For this step, we will use the credit card le culator from bankrate.com We also make these assumptions: - Your credit card's interest rate (APR) is 19.9% - The minimum payment due each month is 3% of your starting balance. You desperately want a TV for your bedroom, but you don't have amy money saved. You put the \$1,028 TV on your credit card and make the minimum monthly payment each month. 1. How much is the minimum payment? (show your work) 1.0283%=30.845 2. Use the credit card calculator to determine how much total interest you'l pay on this debt. 4805 3. When you include the purchase price and the interest, how much does the TV cost you in total? 1028+480=1508 4. What happens if you increase your monthly payments to $100 per month instead of just making the minimum monthly payment? How long will it take to gay off the debt and how much will it cost? it will take 9 months of payoff and the cost would 11105 Step 2 What's the Cost of Minimum Payments? Assume you have a balance of $3,000 on your credit card with a 22\% APR, You determine you are able to pay $150 per month. Complete the table below and answer the followine questions. How much will you have paid in interest and principal after 4 months? I=12ACRBN=(B+D)P1-ntreedNoriginlbulanceNnesbelansePmonelypeyment 1. How much have you paid towards your bill? 2. How much was applied to interest alone? 3. What is your new balance atter four months of payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts