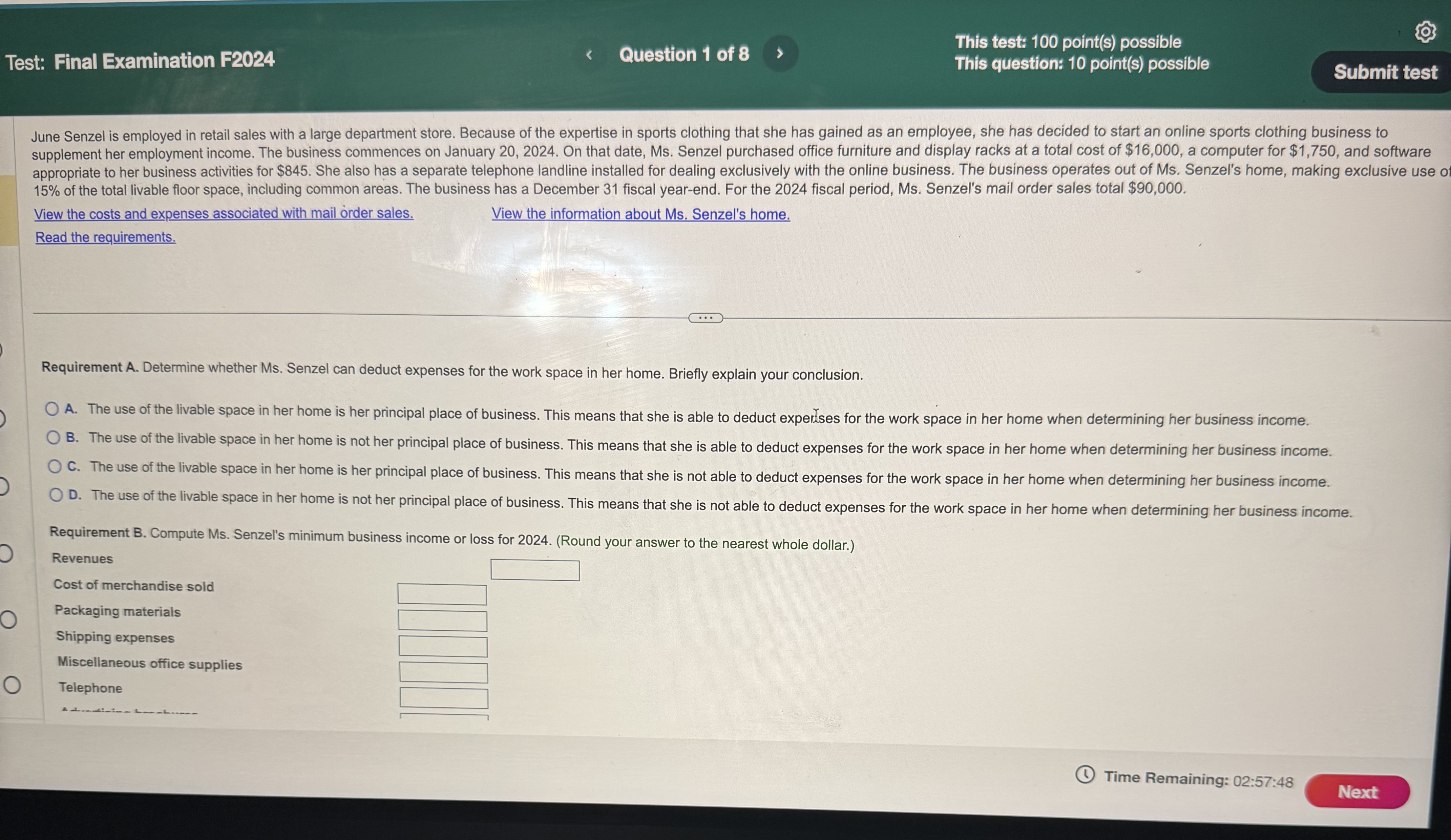

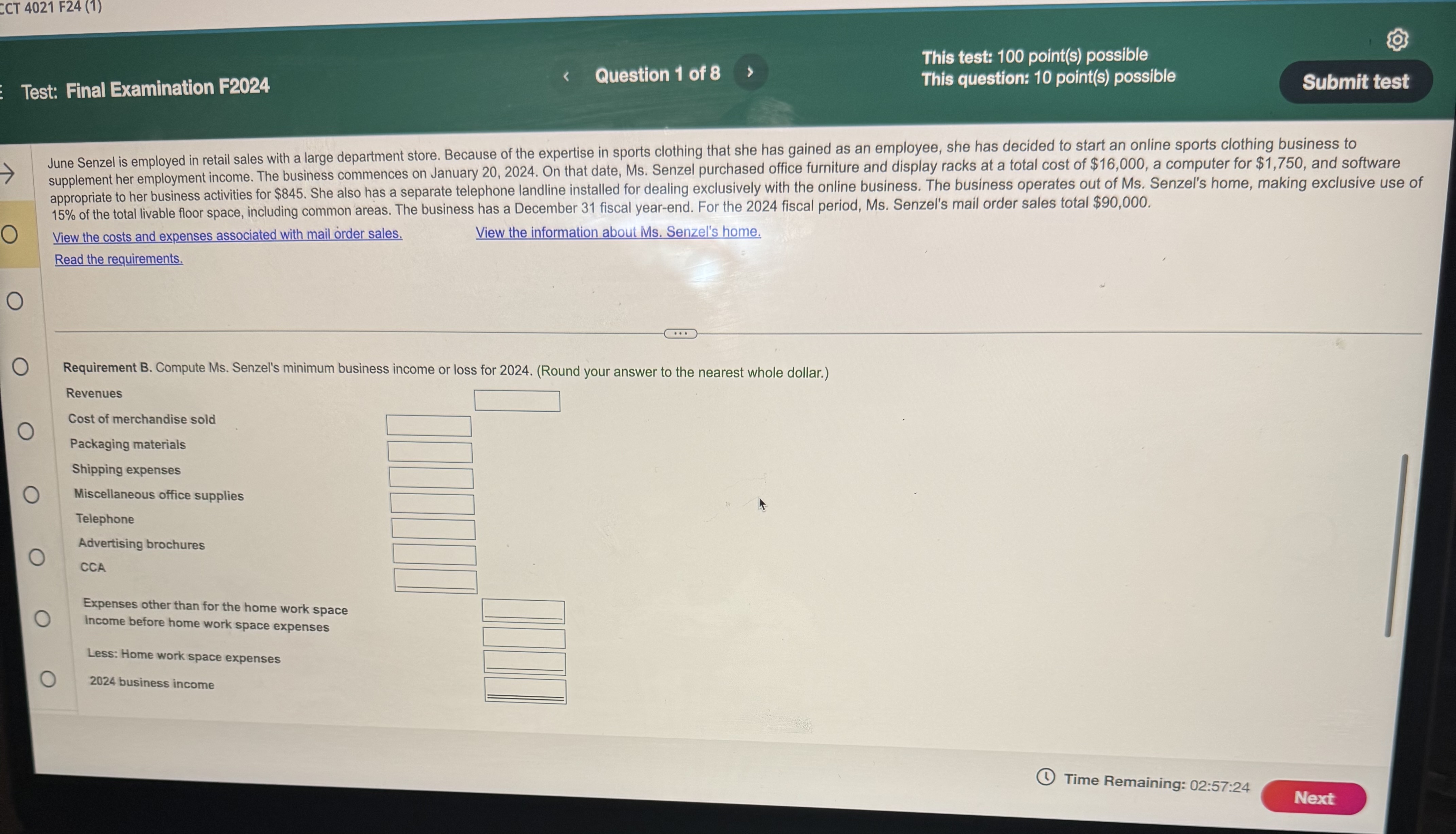

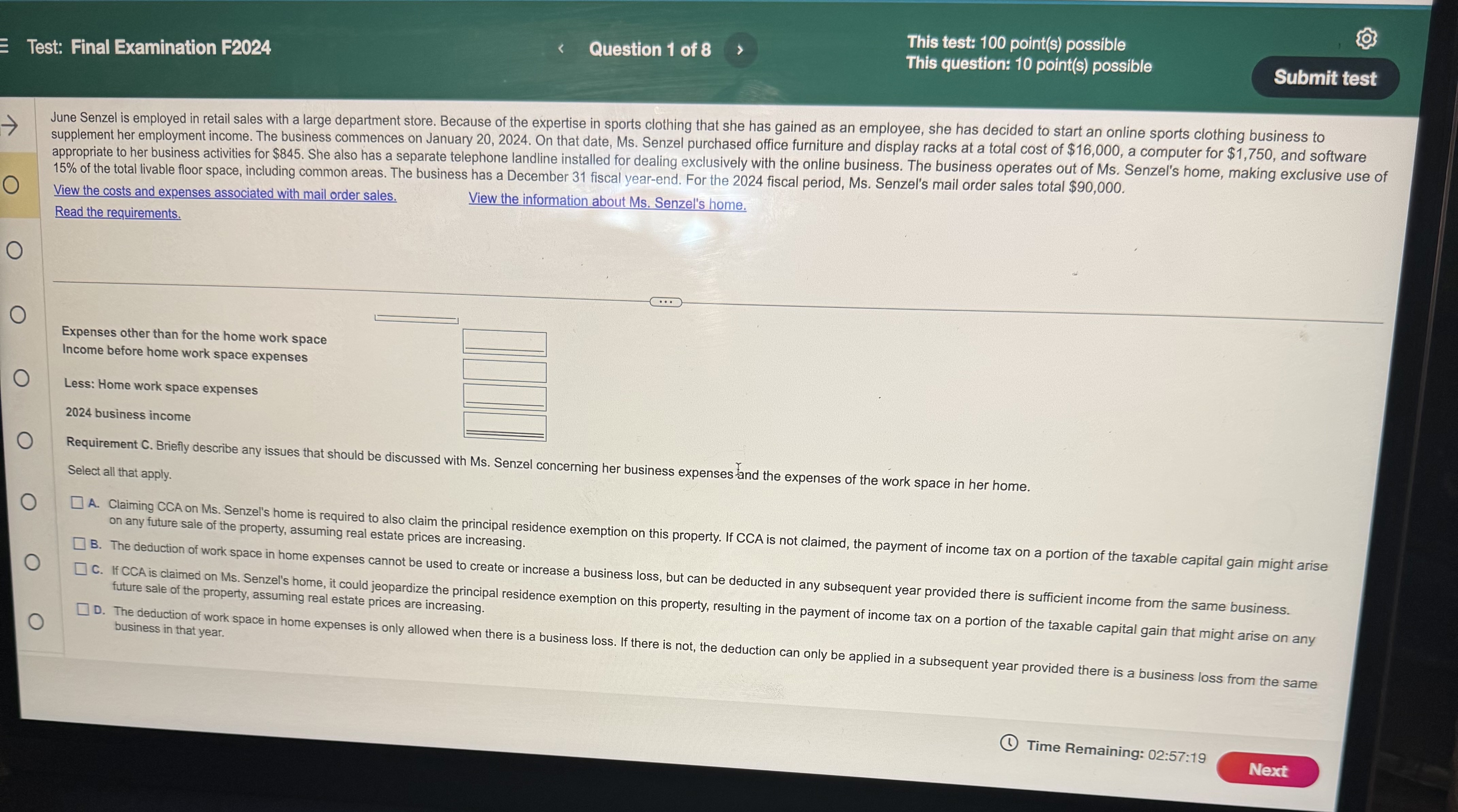

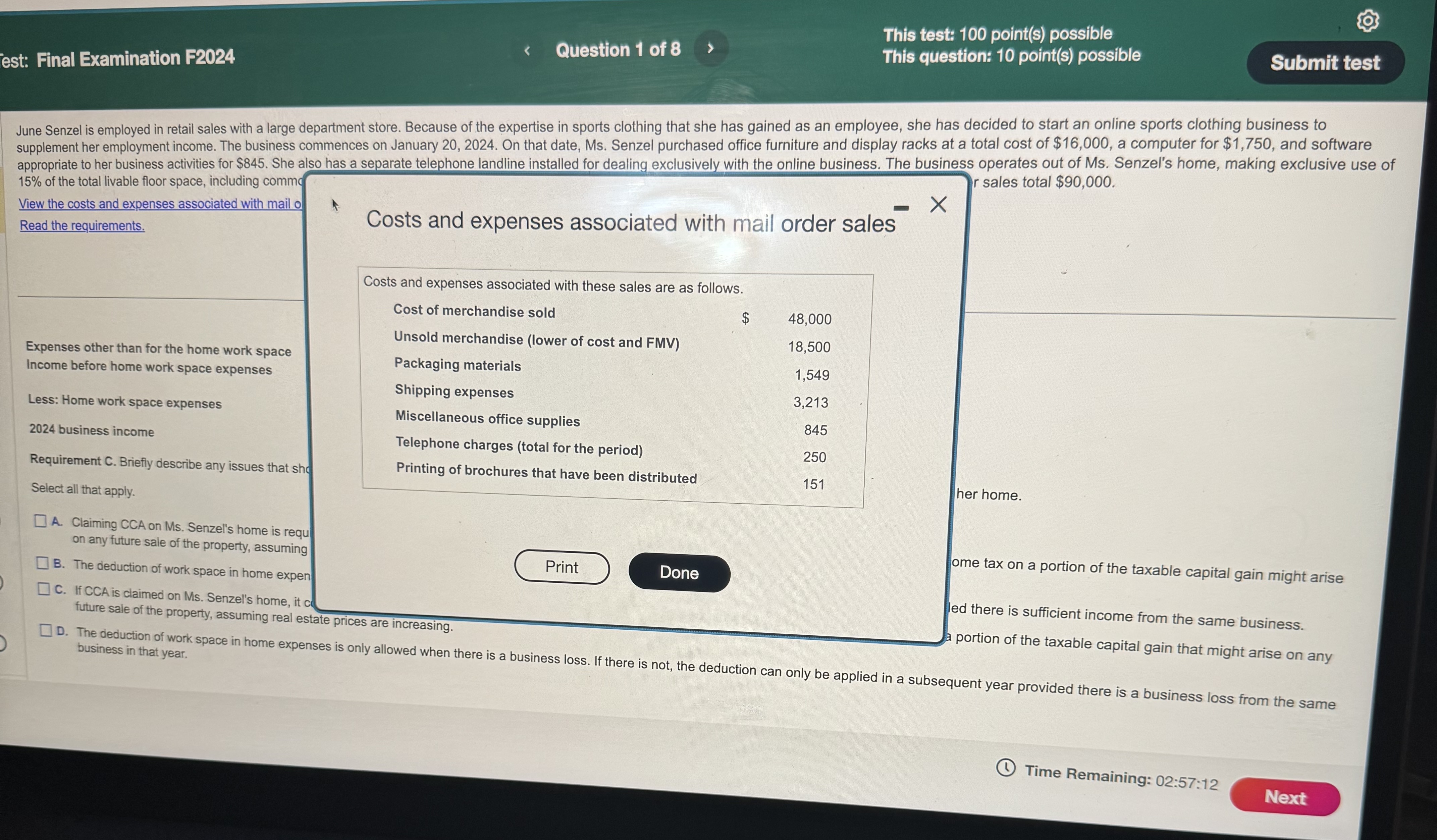

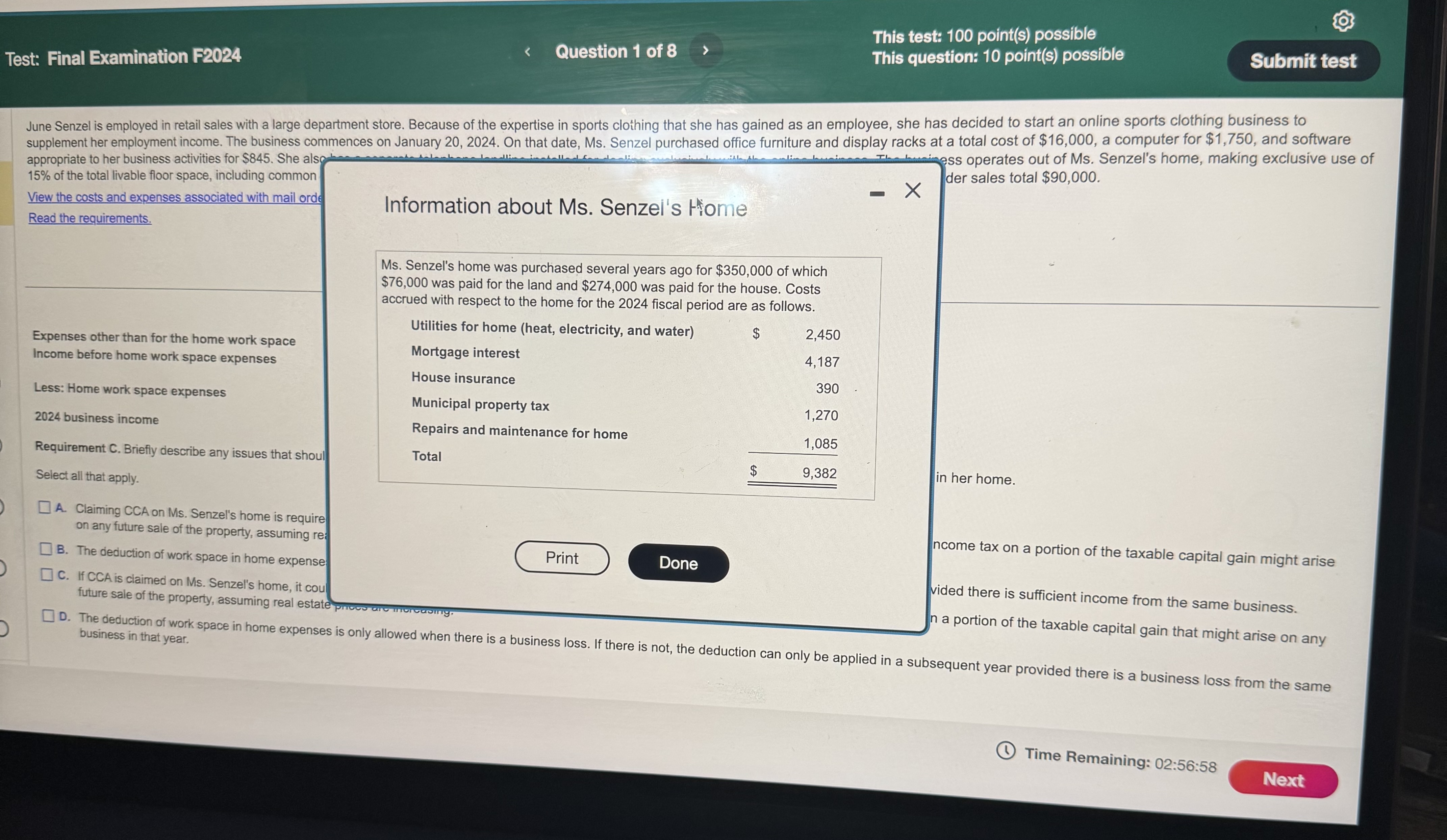

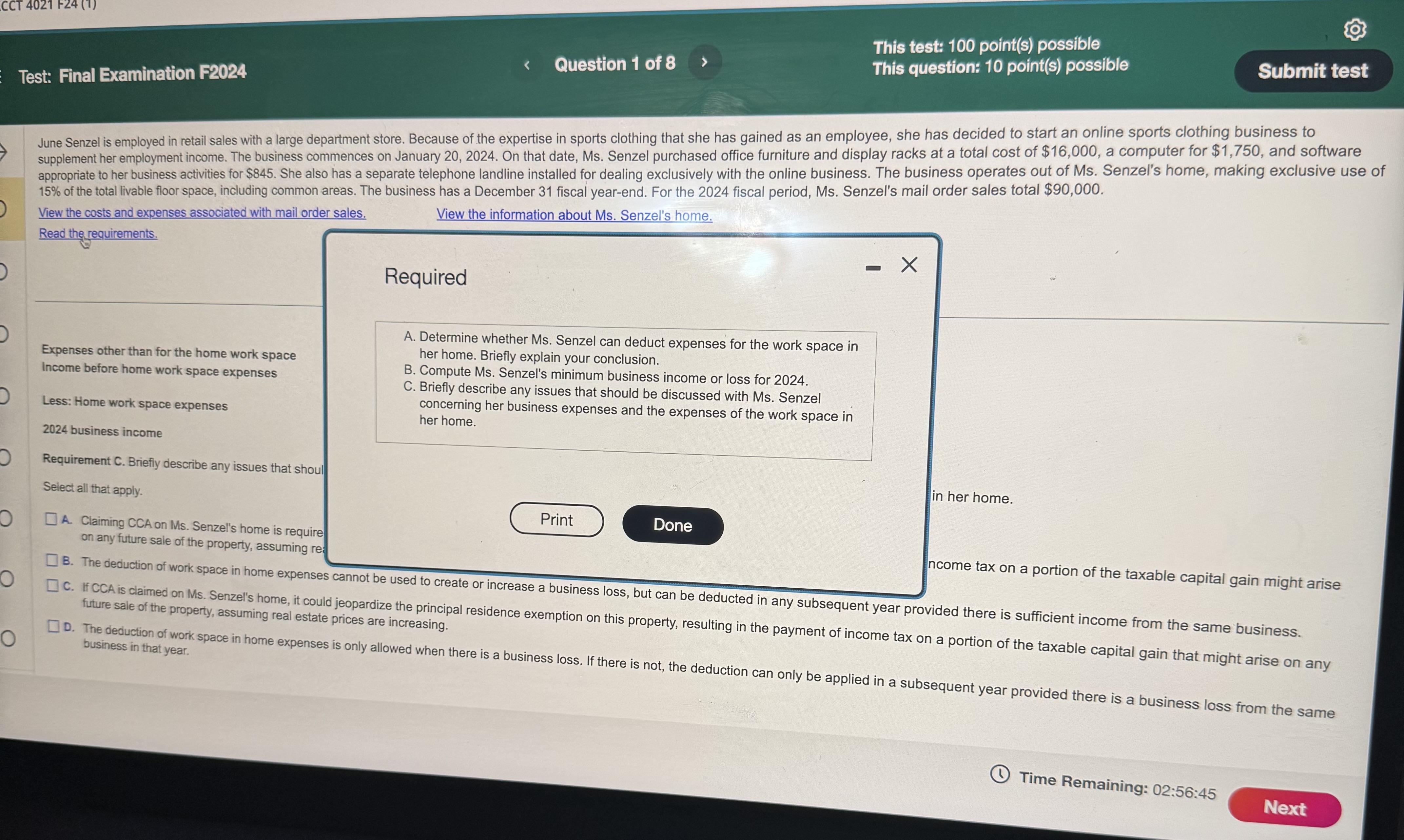

Question: This test: 100 point(s) possible Test: Final Examination F2024 Question 1 of 8 This question: 10 point(s) possible Submit test June Senzel is employed in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts