Question: This the Instructions, follow these requrments to complete the excel B D E F G . 1 Estimate revenue growth for the first ten years

This the Instructions, follow these requrments to complete the excel

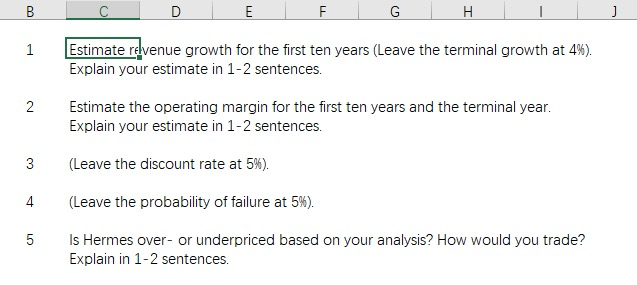

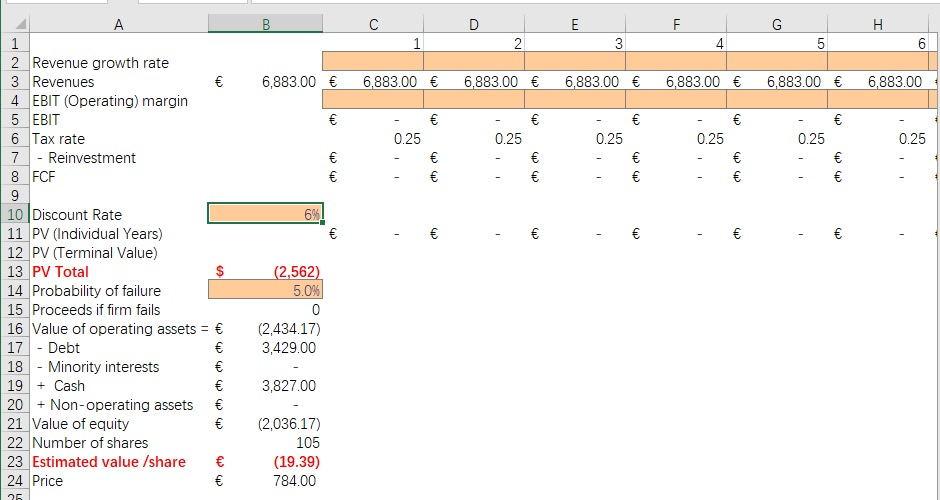

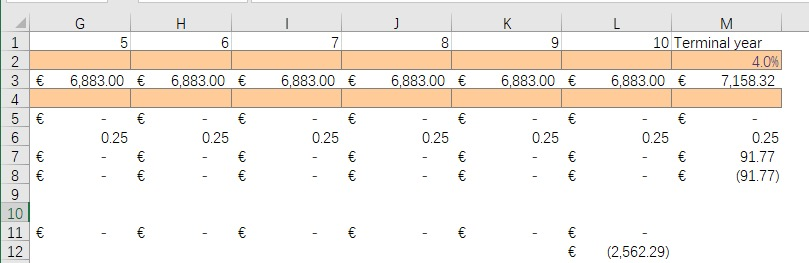

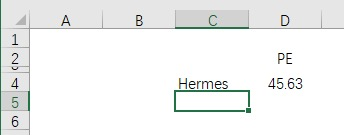

B D E F G . 1 Estimate revenue growth for the first ten years (Leave the terminal growth at 4%). Explain your estimate in 1-2 sentences. N Estimate the operating margin for the first ten years and the terminal year. Explain your estimate in 1-2 sentences. 3 (Leave the discount rate at 5%). 4 (Leave the probability of failure at 5%). 01 Is Hermes over- or underpriced based on your analysis? How would you trade? Explain in 1-2 sentences. B C D E F G H 1 1 2 3 4 01 6 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 w 0.25 0.25 0.25 0.25 0.25 0.25 (( ct (th ( (th 6% () w ( 2 Revenue growth rate 3 Revenues 4. EBIT (Operating) margin 5 EBIT 6 Tax rate 7 - Reinvestment 8 FCF 9 10 Discount Rate 11 PV (Individual Years) 12 PV (Terminal Value) 13 PV Total 14 Probability of failure 15 Proceeds if firm fails 16 Value of operating assets = 17 - Debt 18 - Minority interests 19 + Cash 20 + Non-operating assets 21 Value of equity 22 Number of shares 23 Estimated value /share 24 Price (2,562) 5.0% 0 (2,434.17) 3,429.00 ( ( ( ( (1) 3,827.00 (2,036.17) 105 (19.39) 784.00 26 G H K 1 5 7 8 9 L M 10 Terminal year 4.0% 6,883.00 7,158.32 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 - ( 0.25 0.25 0.25 0.25 0.25 0.25 2 3 4 5 6 7 8 9 10 11 12 - cth (th 0.25 91.77 (91.77) ch (th) (2,562.29) A B D 1 2 PE 45.63 Hermes 4 5 6 B D E F G . 1 Estimate revenue growth for the first ten years (Leave the terminal growth at 4%). Explain your estimate in 1-2 sentences. N Estimate the operating margin for the first ten years and the terminal year. Explain your estimate in 1-2 sentences. 3 (Leave the discount rate at 5%). 4 (Leave the probability of failure at 5%). 01 Is Hermes over- or underpriced based on your analysis? How would you trade? Explain in 1-2 sentences. B C D E F G H 1 1 2 3 4 01 6 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 w 0.25 0.25 0.25 0.25 0.25 0.25 (( ct (th ( (th 6% () w ( 2 Revenue growth rate 3 Revenues 4. EBIT (Operating) margin 5 EBIT 6 Tax rate 7 - Reinvestment 8 FCF 9 10 Discount Rate 11 PV (Individual Years) 12 PV (Terminal Value) 13 PV Total 14 Probability of failure 15 Proceeds if firm fails 16 Value of operating assets = 17 - Debt 18 - Minority interests 19 + Cash 20 + Non-operating assets 21 Value of equity 22 Number of shares 23 Estimated value /share 24 Price (2,562) 5.0% 0 (2,434.17) 3,429.00 ( ( ( ( (1) 3,827.00 (2,036.17) 105 (19.39) 784.00 26 G H K 1 5 7 8 9 L M 10 Terminal year 4.0% 6,883.00 7,158.32 6,883.00 6,883.00 6,883.00 6,883.00 6,883.00 - ( 0.25 0.25 0.25 0.25 0.25 0.25 2 3 4 5 6 7 8 9 10 11 12 - cth (th 0.25 91.77 (91.77) ch (th) (2,562.29) A B D 1 2 PE 45.63 Hermes 4 5 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts