Question: = THIS THIS TIS Question 8 Not yet 1 2 3 2 3 4 5 6 7 9 answered Marked out of 15.00 Finish attempt

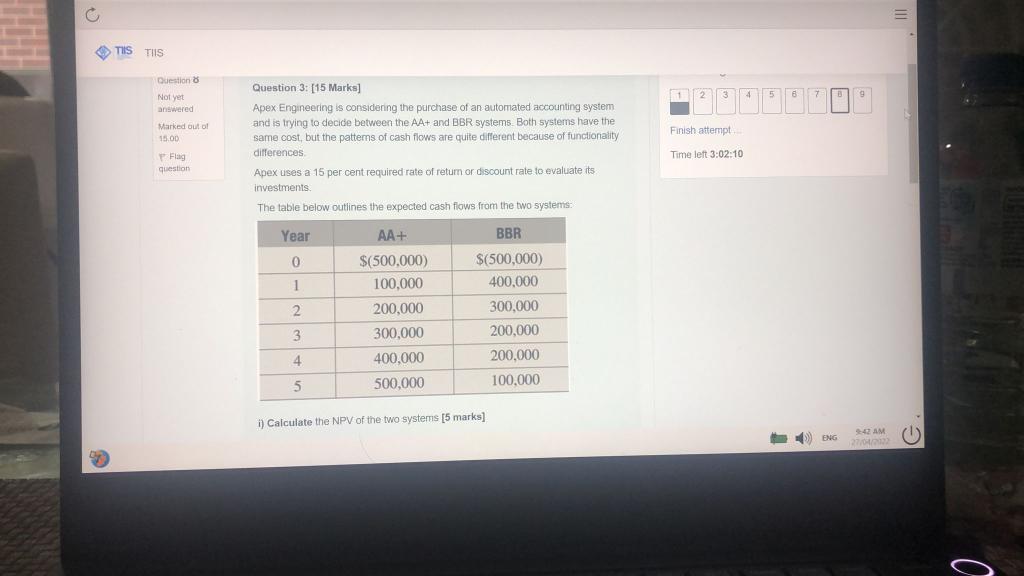

= THIS THIS TIS Question 8 Not yet 1 2 3 2 3 4 5 6 7 9 answered Marked out of 15.00 Finish attempt Question 3: [15 Marks) Apex Engineering is considering the purchase of an automated accounting system and is trying to decide between the AA+ and BBR systems. Both systems have the same cost, but the patterns of cash flows are quite different because of functionality differences Apex uses a 15 per cent required rate of return or discount rate to evaluate its a investments The table below outlines the expected cash flows from the two systems: Time left 3:02:10 Flag question Year 0 1 AA+ $(500.000) 100,000 2. 200,000 BBR $(500,000) 400.000 300,000 200,000 200.000 100,000 3 4. 300,000 400.000 500,000 5 i) Calculate the NPV of the two systems (5 marks] ENG 42 AM 270 o 5 500,000 100,000 i) Calculate the NPV of the two systems [5 marks] II) Define Profitability Index (PI). Calculate Pl for the two systems and assess the two options [5 marks] iii) Define the Payback Period and outline its limitations. Calculate the Payback Period for the two systems and assess the best alternative for Apex Engineering [5 marks] 7 A B 1 E S3 PA ENG 9:43 AM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts