Question: This time we let you put your manager hat on and manage by exception; based on our learning outcomes related to standards and variances. 1)

This time we let you put your manager hat on and "manage by exception"; based on our learning outcomes related to standards and variances.

1) What you feel could have been the underlying (or root) cause (do not just repeat the shown calculations, manage to it, what could have caused this to happen?) your specifically assigned variance, AND...

2) Based on your answer to 1) above, what would you, as a manager or owner, do about it? (Be very specific, not just something like "do better") Also do NOT suggest "change the standards (or budget)", as the standards were carefully and properly set!

Scenario #3 (labor efficiency variance in the CPA tax preparation business)

Scenario #3 (at the CPA tax preparation firm that you own during busy tax season!)

(Labor Variance Exercise)

You pay your employees by the hour (of work that they "clock")

Last week you paid your employees $1,200 for 80 hours of work.

45 tax forms got prepared last week.

The standard time expected per tax form is 2 hours. The standard rate of pay is $20.

per hour.

Calculate the labor rate and efficiency variance for last week's output (including whether these variances are favorable or unfavorable)

Hint: Set up the 3 columns, AH x AR, AH x SR, SH x SR

Try calculating it before looking at the solutions below:

Solutions:

AH x AR AH x SR SH x SR

80 x $15 80 x $20 90 x $20

$1,200 $1,600 $1,800

Bottom of Form

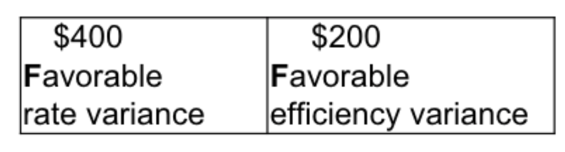

$400 $200 Favorable Favorable rate variance efficiency variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts