Question: this topic is over power On this assignment. you are to state and explain 2 ratios per industry that you used to identify the respective

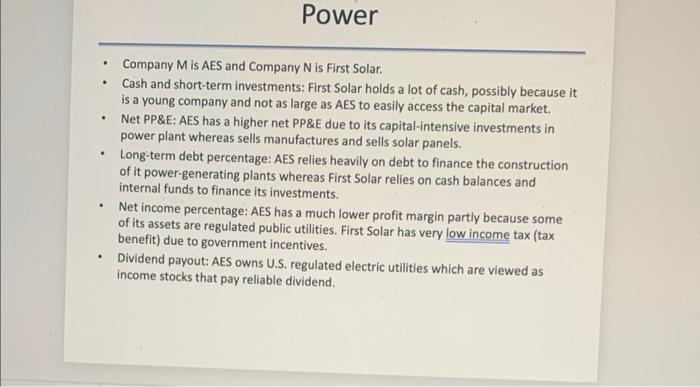

On this assignment. you are to state and explain 2 ratios per industry that you used to identify the respective companies in the industry. You may use one ratio for multiple industries, provided it is applicable to distinguish between the compaies in the industries. - Company M is AES and Company N is First Solar. - Cash and short-term investments: First Solar holds a lot of cash, possibly because it is a young company and not as large as AES to easily access the capital market. - Net PP\&E: AES has a higher net PP\&E due to its capital-intensive investments in power plant whereas sells manufactures and sells solar panels. - Long-term debt percentage: AES relies heavily on debt to finance the construction of it power-generating plants whereas First Solar relies on cash balances and internal funds to finance its investments. - Net income percentage: AES has a much lower profit margin partly because some of its assets are regulated public utilities. First Solar has very tax (tax benefit) due to government incentives. - Dividend payout: AES owns U.S. regulated electric utilities which are viewed as income stocks that pay reliable dividend. On this assignment. you are to state and explain 2 ratios per industry that you used to identify the respective companies in the industry. You may use one ratio for multiple industries, provided it is applicable to distinguish between the compaies in the industries. - Company M is AES and Company N is First Solar. - Cash and short-term investments: First Solar holds a lot of cash, possibly because it is a young company and not as large as AES to easily access the capital market. - Net PP\&E: AES has a higher net PP\&E due to its capital-intensive investments in power plant whereas sells manufactures and sells solar panels. - Long-term debt percentage: AES relies heavily on debt to finance the construction of it power-generating plants whereas First Solar relies on cash balances and internal funds to finance its investments. - Net income percentage: AES has a much lower profit margin partly because some of its assets are regulated public utilities. First Solar has very tax (tax benefit) due to government incentives. - Dividend payout: AES owns U.S. regulated electric utilities which are viewed as income stocks that pay reliable dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts