Question: This was all the given information. b. Using your computations in Part (a), explain which of these five portfolios is moat likely to be the

This was all the given information.

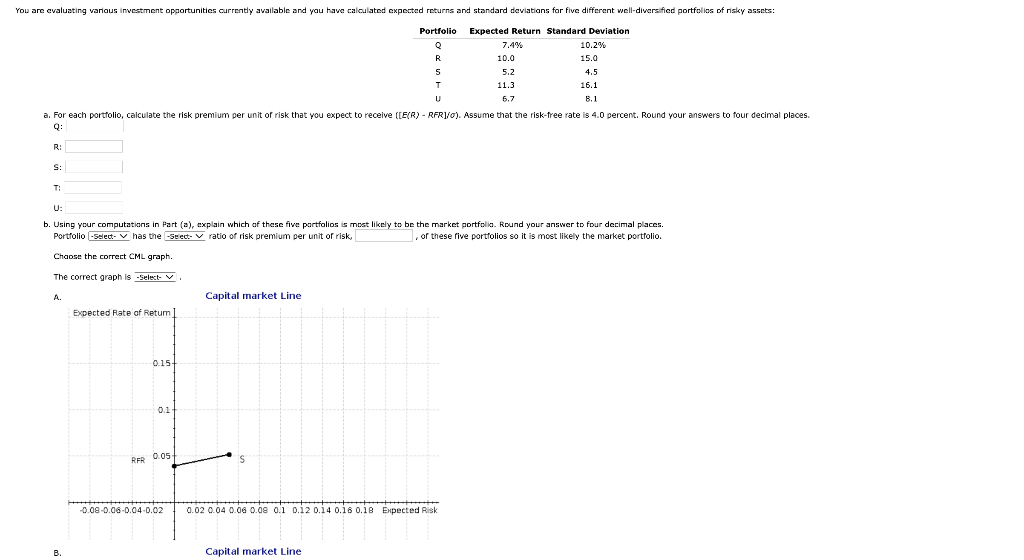

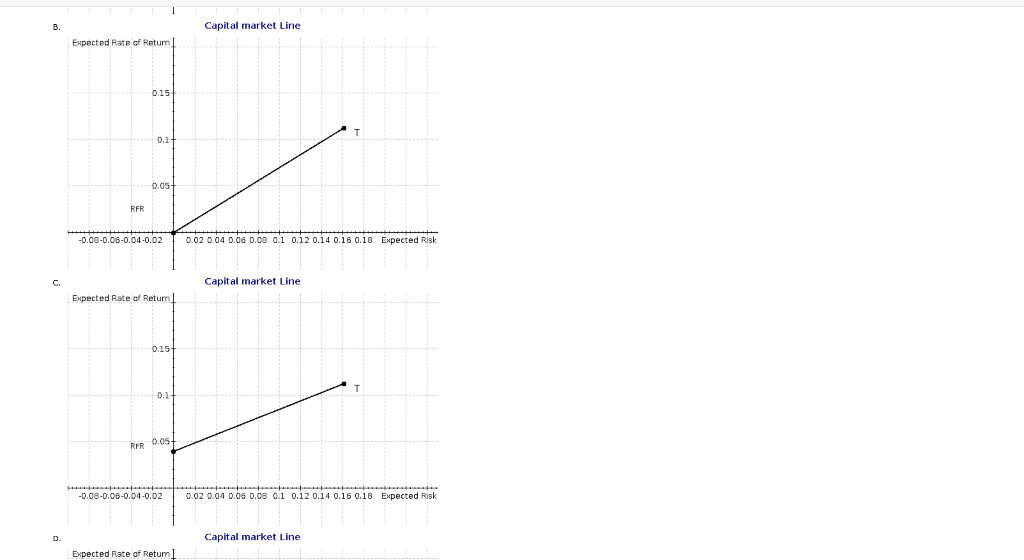

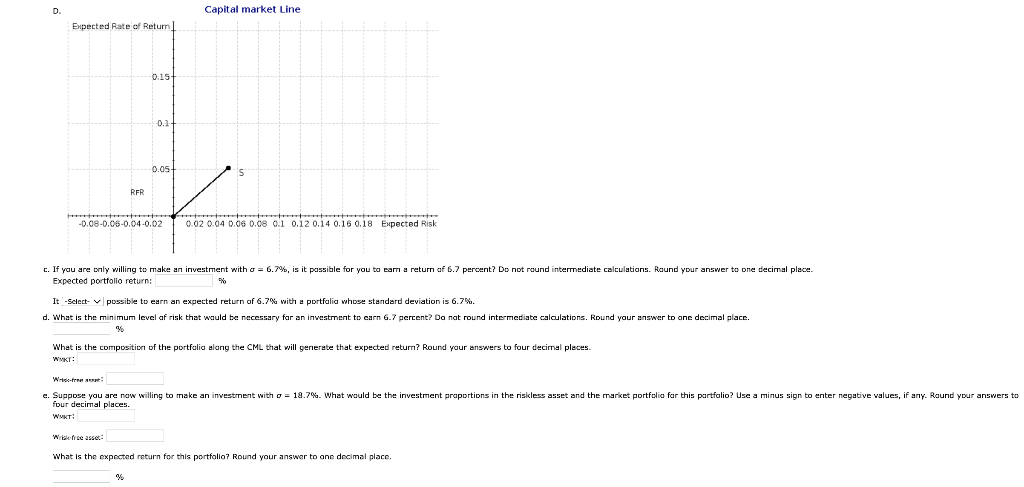

b. Using your computations in Part (a), explain which of these five portfolios is moat likely to be the market portfolia. Round your answer to four decimal places. Portfolio has the ratio of risk premium per unit of risk, of these five portfolios so it is most likely the market portfolio. Chaose the correct CML graph. The correct graph is B. Capital market Line c Capital market Line D. Capital market Line Expected Rate of Retum I Expected portfolio return: It -Select- possible to earn an expected return of 6.7% with a portfalia whose standard deviation is 6.7%. os What is the composition of the portfalia alang the CML that will generate that expected return? Round rour answers to four decimal pleces. Wwit: Wridi-tren amest four decimal places. 'WMKT' Withe frese ssse: What is the expected roturn for this pertfolio? Round your answer to ane docimal place. % b. Using your computations in Part (a), explain which of these five portfolios is moat likely to be the market portfolia. Round your answer to four decimal places. Portfolio has the ratio of risk premium per unit of risk, of these five portfolios so it is most likely the market portfolio. Chaose the correct CML graph. The correct graph is B. Capital market Line c Capital market Line D. Capital market Line Expected Rate of Retum I Expected portfolio return: It -Select- possible to earn an expected return of 6.7% with a portfalia whose standard deviation is 6.7%. os What is the composition of the portfalia alang the CML that will generate that expected return? Round rour answers to four decimal pleces. Wwit: Wridi-tren amest four decimal places. 'WMKT' Withe frese ssse: What is the expected roturn for this pertfolio? Round your answer to ane docimal place. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts