Question: This was all the information given but heres an example... . 2) A firm is undertaking a project with the following details provided. The project

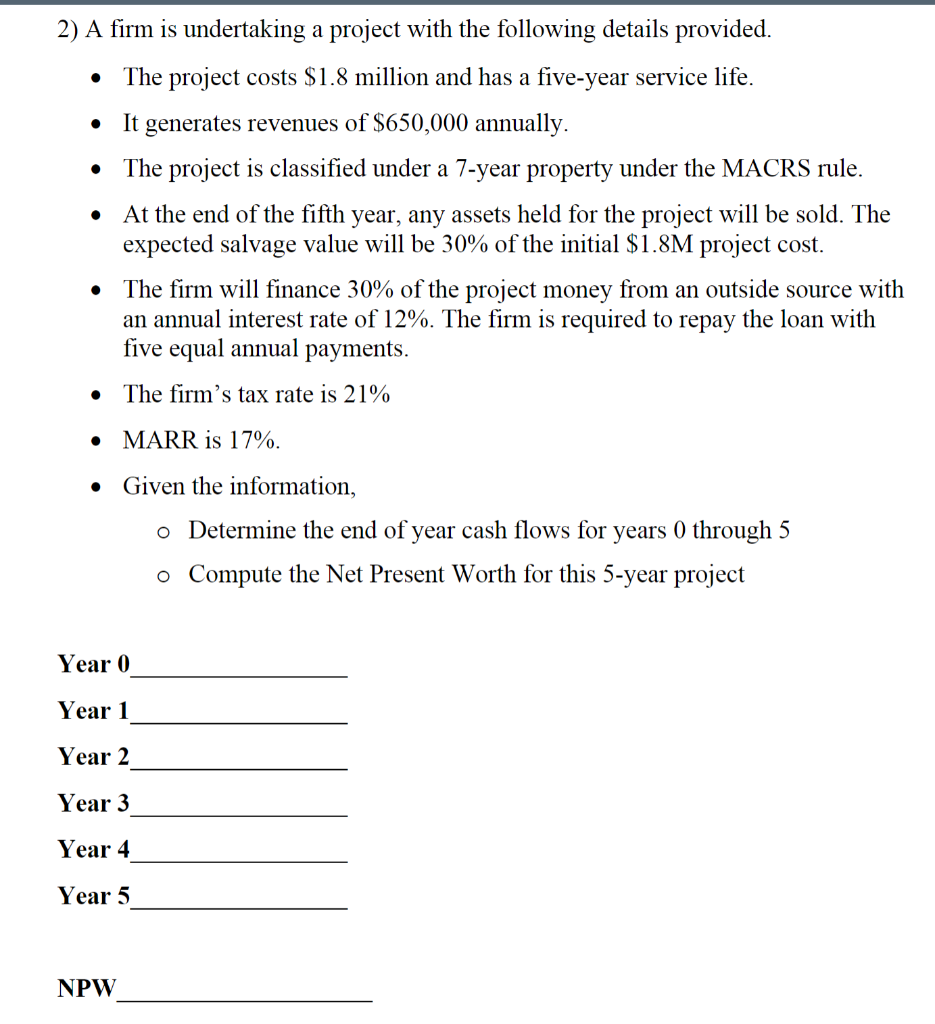

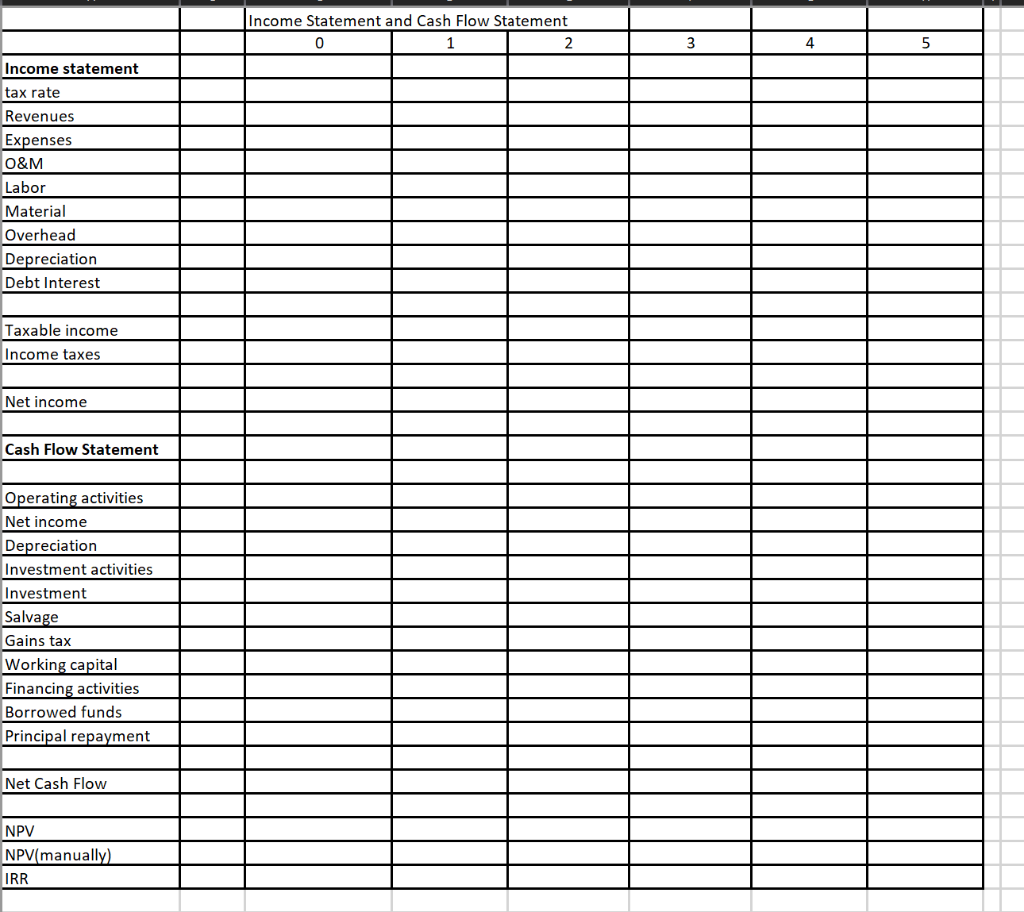

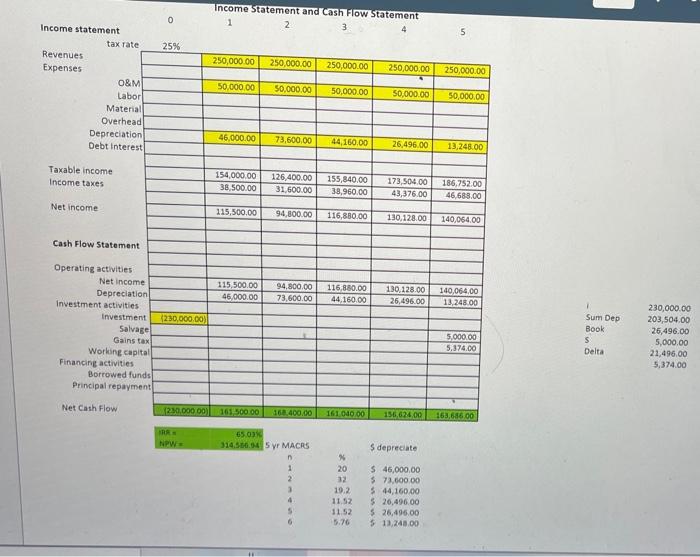

. 2) A firm is undertaking a project with the following details provided. The project costs $1.8 million and has a five-year service life. It generates revenues of $650,000 annually. The project is classified under a 7-year property under the MACRS rule. At the end of the fifth year, any assets held for the project will be sold. The expected salvage value will be 30% of the initial $1.8M project cost. The firm will finance 30% of the project money from an outside source with an annual interest rate of 12%. The firm is required to repay the loan with five equal annual payments. The firm's tax rate is 21% MARR is 17%. Given the information, o Determine the end of year cash flows for years 0 through 5 o Compute the Net Present Worth for this 5-year project Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 NPW Income Statement and Cash Flow Statement 0 2 3 4 5 Income statement tax rate Revenues Expenses O&M Labor Material Overhead Depreciation Debt Interest Taxable income Income taxes Net income Cash Flow Statement Operating activities Net income Depreciation Investment activities Investment Salvage Gains tax Working capital Financing activities Borrowed funds Principal repayment Net Cash Flow NPV NPV(manually) IRR 0 Income Statement and Cash Flow Statement 1 2 3 4 5 25% 250,000.00 250,000.00 250,000.00 250,000.00 250,000.00 Income statement tax rate Revenues Expenses O&M Labor Material Overhead Depreciation Debt interest 50,000.00 50,000.00 50,000.00 50,000.00 50,000.00 46.000.00 73,600,00 44. 160.00 26.496.00 13,248.00 Taxable income Income taxes 154,000.00 38,500.00 126,400.00 31,600.00 155,840.00 38,960,00 173,504.00 43,376.00 186,752.00 46.683.00 Net income 115,500.00 94,800.00 116,880,00 130.128.00 140,064.00 Cash Flow Statement 115,500.00 46,000.00 94,800.00 73,600.00 116.880.00 44,160.00 130.128.00 26,496.00 140,064,00 13,248.00 (230.000,00) Operating activities Net Income Depreciation Investment activities Investment Salvage Gains tax Working capital Financing activities Borrowed funds Principal repayment 1 Sum Dep Book s Delta 5,000.00 5.174.00 230,000.00 203,504.00 26,496.00 5,000.00 21,496.00 5,374.00 Net Cash Flow 230,00000161500.00 162.400.00 161040.00 136,624.00 163,686,00 RA NPW s deprecate 65.00 314.500.54 5yr MACRS n 1 2 3 4 5 20 32 19.2 11.52 11.52 5.76 $ 46,000.00 $ 73,600.00 544,160.00 5 26,496.00 $ 26,496.00 $ 13,243.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts