Question: This was all the information given in the question. On January 5, 2014, Cressent Vetition Corp (CVT) made an acquisition bid of $128 per share

This was all the information given in the question.

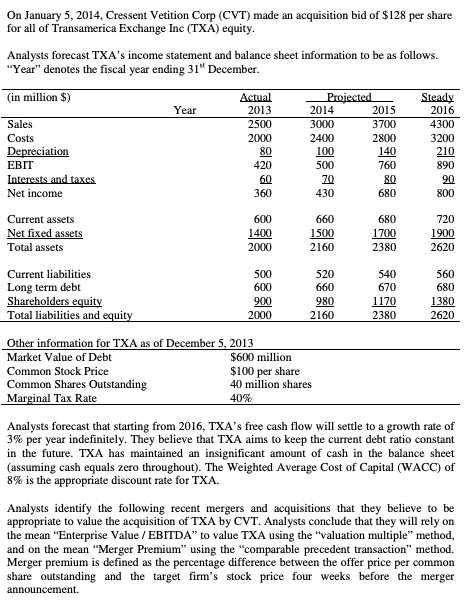

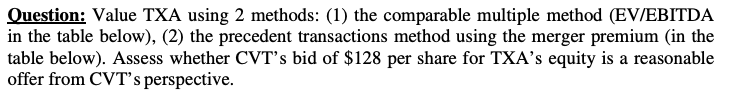

On January 5, 2014, Cressent Vetition Corp (CVT) made an acquisition bid of $128 per share for all of Transamerica Exchange Inc (TXA) equity. Analysts forecast TXA's income statement and balance sheet information to be as follows. "Year" denotes the fiscal year ending 31" December. 670 (in million $) Actual Proiected Steady Year 2013 2014 2015 2016 Sales 2500 3000 3700 4300 Costs 2000 2400 2800 3200 Depreciation 80 100 140 210 EBIT 420 500 760 890 Interests and taxes 60 70 80 90 Net income 360 430 680 800 Current assets 600 660 680 720 Net fixed assets 1400 1500 1700 1900 Total assets 2000 2160 2380 2620 Current liabilities 500 520 540 560 Long term debt 600 660 680 Shareholders equity 900 980 1170 1380 Total liabilities and equity 2000 2160 2380 2620 Other information for TXA as of December 5, 2013 Market Value of Debt $600 million Common Stock Price $100 per share Common Shares Outstanding 40 million shares Marginal Tax Rate 40% Analysts forecast that starting from 2016, TXA's free cash flow will settle to a growth rate of 3% per year indefinitely. They believe that TXA aims to keep the current debt ratio constant in the future. TXA has maintained an insignificant amount of cash in the balance sheet (assuming cash equals zero throughout). The Weighted Average Cost of Capital (WACC) of 8% is the appropriate discount rate for TXA. Analysts identify the following recent mergers and acquisitions that they believe to be appropriate to value the acquisition of TXA by CVT. Analysts conclude that they will rely on the mean Enterprise Value / EBITDA to value TXA using the "valuation multiple" method, and on the mean Merger Premium" using the "comparable precedent transaction" method. Merger premium is defined as the percentage difference between the offer price per common share outstanding and the target firm's stock price four weeks before the merger announcement. Question: Value TXA using 2 methods: (1) the comparable multiple method (EV/EBITDA in the table below), (2) the precedent transactions method using the merger premium (in the table below). Assess whether CVT's bid of $128 per share for TXA's equity is a reasonable offer from CVT's perspective. Effective date Dec 14, 2013 Sep 11, 2013 Aug 30, 2013 May 18, 2013 Mar 21, 2013 Acquirer Target Northern Xe Inc Solar Spring Sys Bates Express Inc Pa Intercontinental Carson Electron Avolent Corp Turino Elposo Barrier Excess Old Exploration Topa Expedition EV/EBITDA Merger premium 11.35 25% 8.56 29% 13.66 30% 10.88 25% 13.15 26%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts