Question: This was all the information that was provided to me. 3 . A. Three European put options on the same stock with the same time

This was all the information that was provided to me.

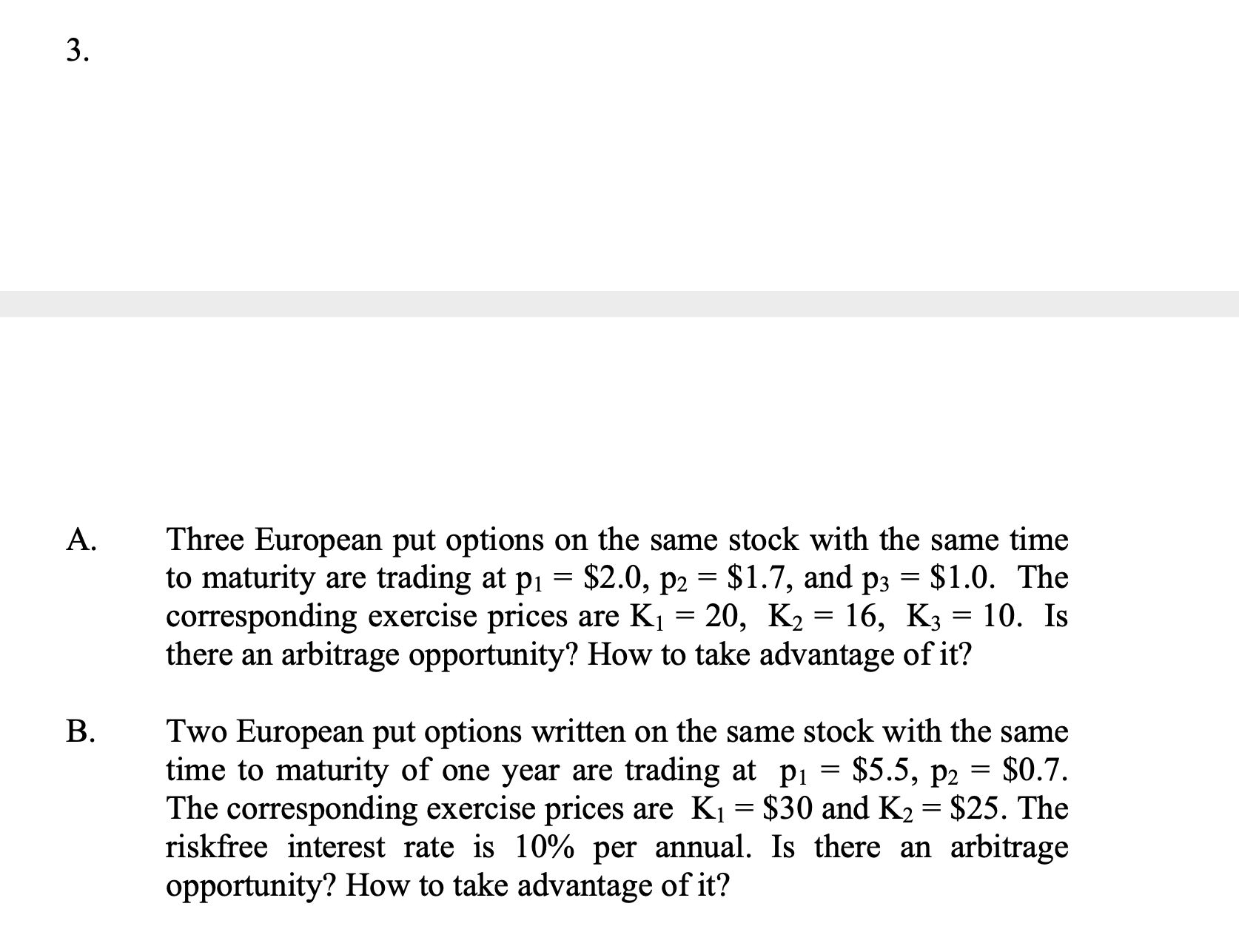

3 . A. Three European put options on the same stock with the same time to maturity are trading at P1 = $2.0, p2 = $1.7, and p3 = $1.0. The corresponding exercise prices are K1 = 20, K2 = 16, K3 = 10. Is there an arbitrage opportunity? How to take advantage of it? B. Two European put options written on the same stock with the same time to maturity of one year are trading at pi = $5.5, P2 = $0.7. The corresponding exercise prices are Ki = $30 and K2 = $25. The riskfree interest rate is 10% per annual. Is there an arbitrage opportunity? How to take advantage of it? 3 . A. Three European put options on the same stock with the same time to maturity are trading at P1 = $2.0, p2 = $1.7, and p3 = $1.0. The corresponding exercise prices are K1 = 20, K2 = 16, K3 = 10. Is there an arbitrage opportunity? How to take advantage of it? B. Two European put options written on the same stock with the same time to maturity of one year are trading at pi = $5.5, P2 = $0.7. The corresponding exercise prices are Ki = $30 and K2 = $25. The riskfree interest rate is 10% per annual. Is there an arbitrage opportunity? How to take advantage of it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts