Question: This was an expert answer from earlier!! Please help! This was an expert answer from earlier!! Please help! Atlanta Company is preparing its manufacturing overhead

This was an expert answer from earlier!! Please help! This was an expert answer from earlier!! Please help!

This was an expert answer from earlier!! Please help!

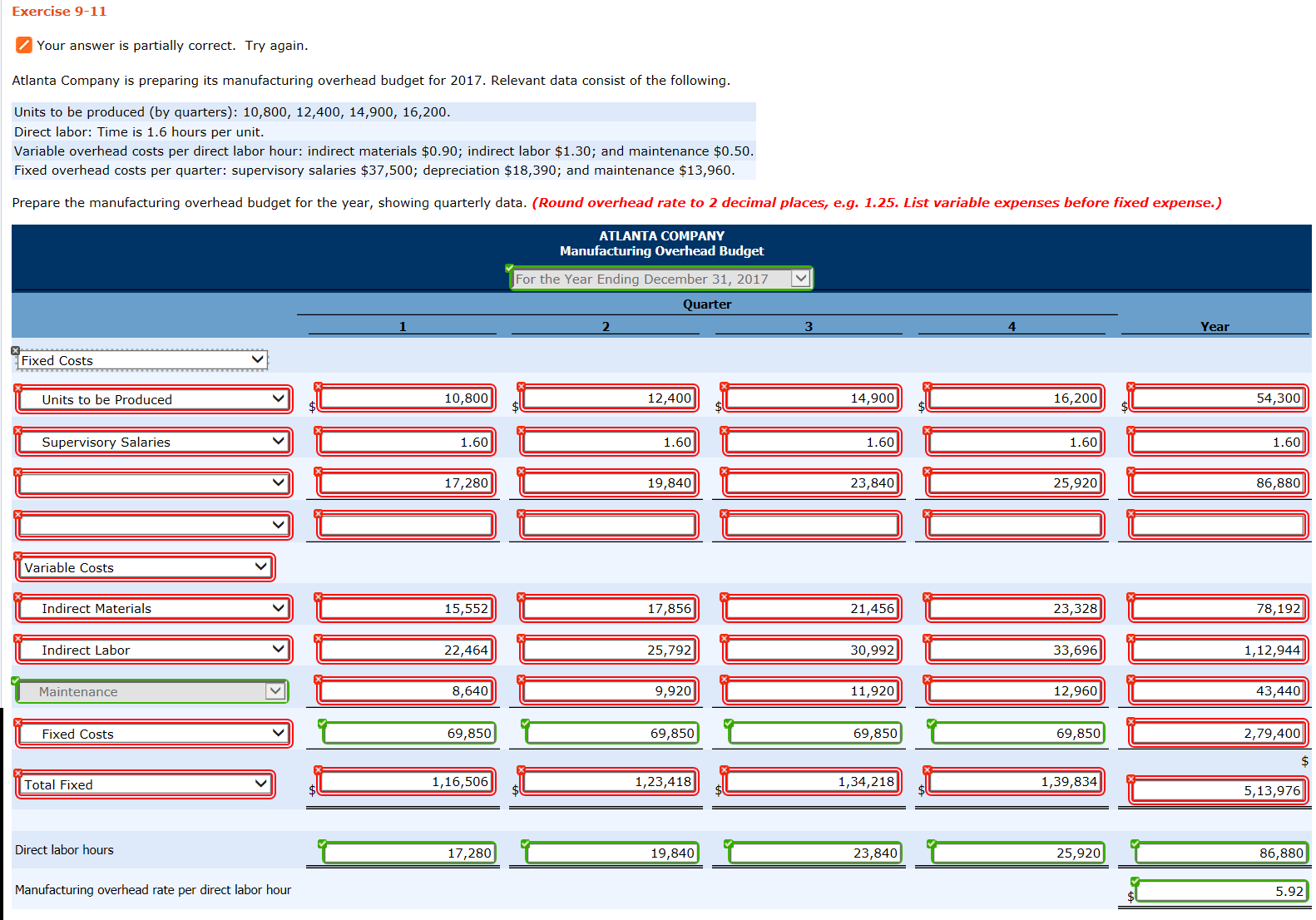

Atlanta Company is preparing its manufacturing overhead budget for 2017. Relevant data consist of the following. Units to be produced (by quarters): 10,800, 12,400, 14,900, 16,200. Direct labor: Time is 1.6 hours per unit. Variable overhead costs per direct labor hour: indirect materials $0.90; indirect labor $1.30; and maintenance $0.50. Fixed overhead costs per quarter: supervisory salaries $37,500; depreciation $18,390; and maintenance $13,960. Prepare the manufacturing overhead budget for the year, showing quarterly data. (Pound overhead rate to 2 decimal places, e.g. 1.25. List variable expenses before fixed expense.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts