Question: This window shows your responses and what was marked correct and incorrect from your previous attempt. On June 30, 2016, Slick Rocks, Inc., purchased 9,900

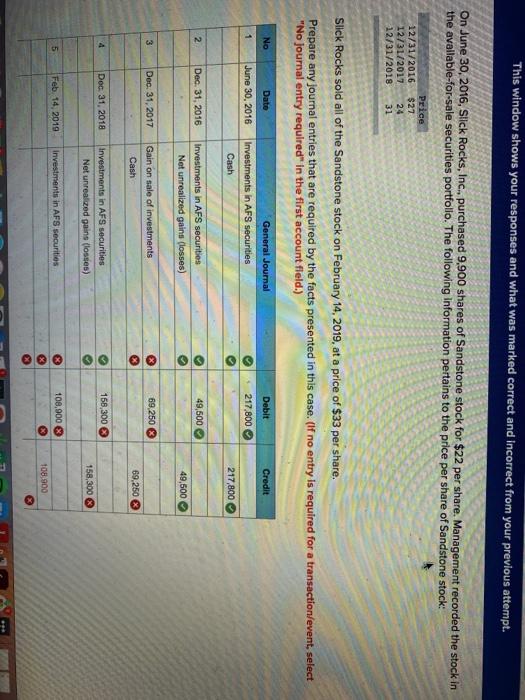

This window shows your responses and what was marked correct and incorrect from your previous attempt. On June 30, 2016, Slick Rocks, Inc., purchased 9,900 shares of Sandstone stock for $22 per share. Management recorded the stock in the avallable-for-sale securities portfolio. The following Information pertains to the price per share of Sandstone stock: 12/31/2016 12/31/2017 12/31/2018 Price $27 24 31 Slick Rocks sold all of the Sandstone stock on February 14, 2019, at a price of $33 per share. Prepare any journal entries that are required by the facts presented in this case. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Date General Journal Debit Credit 1 June 30, 2016 Investments in AFS securities 217,800 Cash 217,800 2 Dec 31, 2016 49,500 Investments in AFS securities Net unrealized gains (losses) 49,500 3 Dec 31, 2017 692503 Gain on sale of investments Cash 69.250 Dec 31, 2018 158,300 Investments in AFS securities Net unrealized gains (losses) o 158,300 5 Feb 14, 2019 Investments in AFS securities 3 108,9003 108.900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts