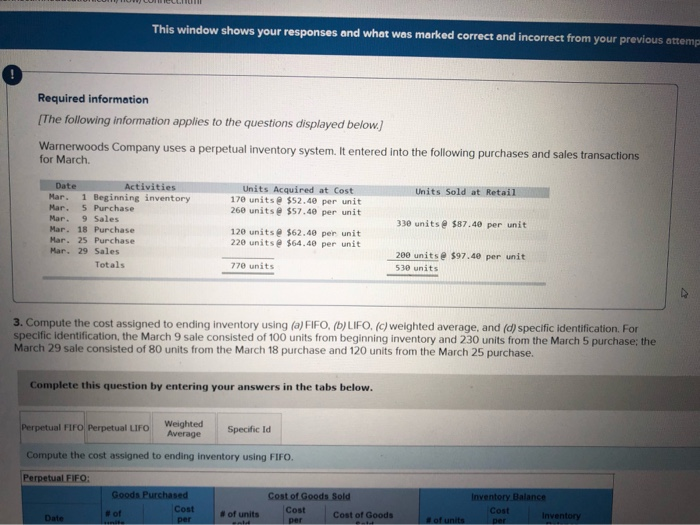

Question: This window shows your responses and what was marked correct and incorrect from your previous attem Required information The following information applies to the questions

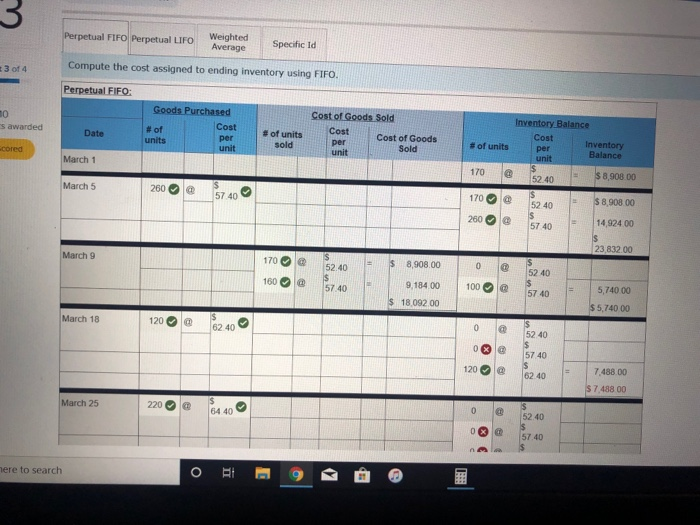

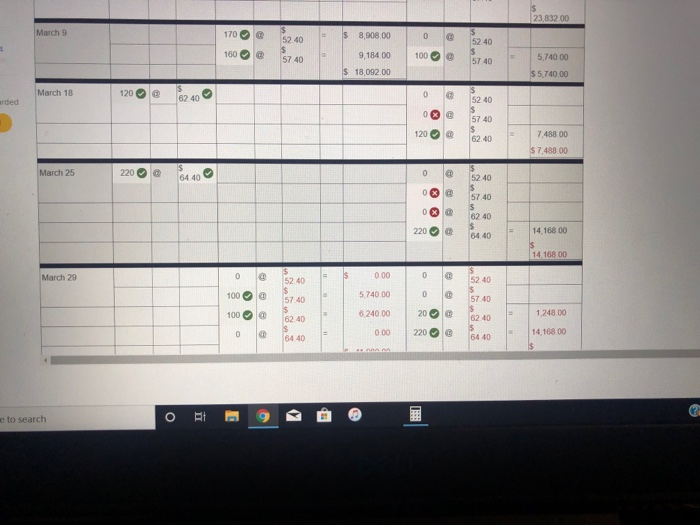

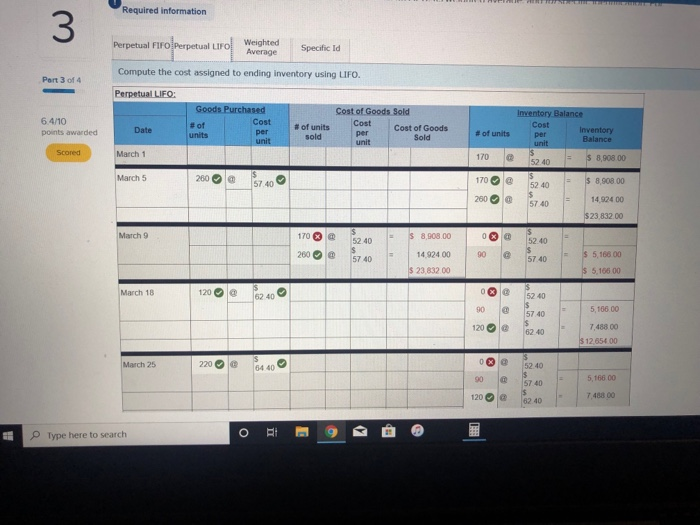

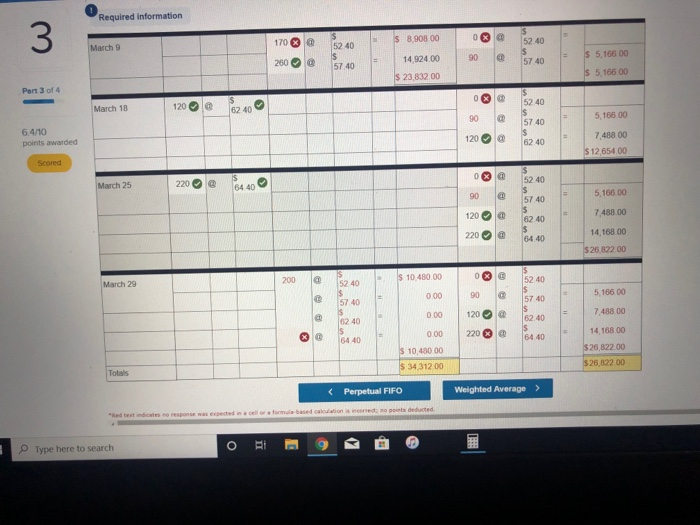

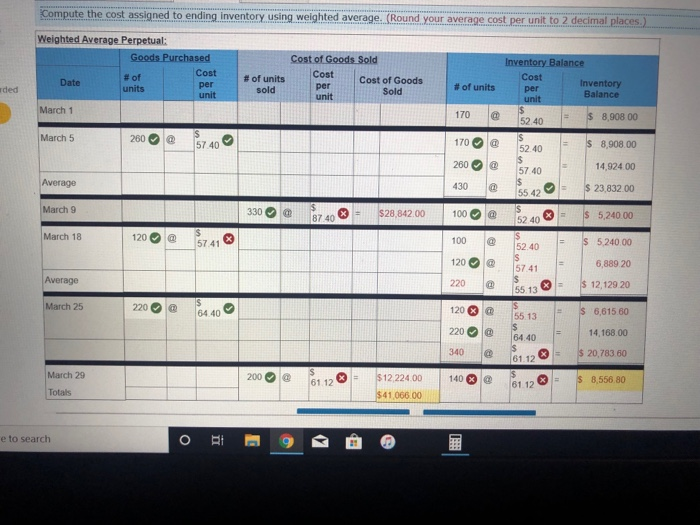

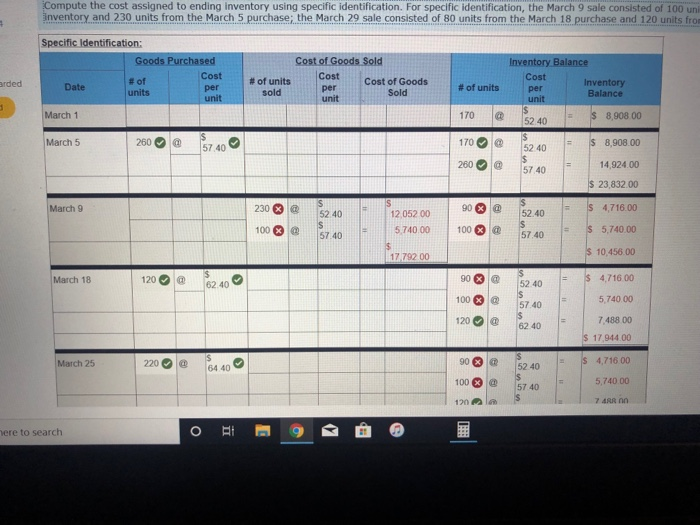

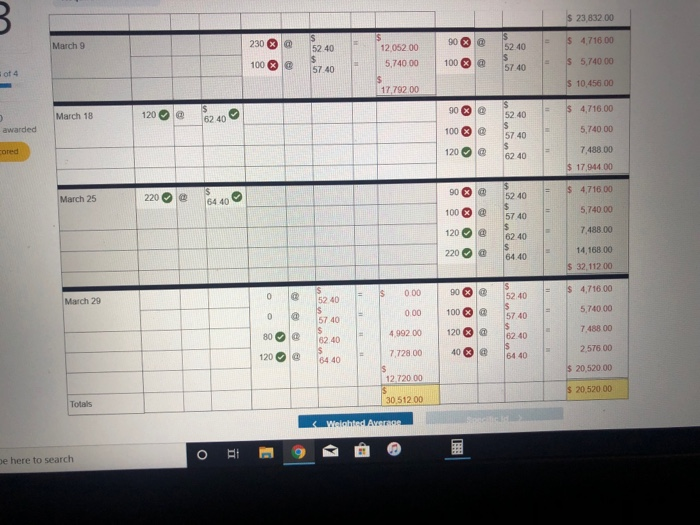

This window shows your responses and what was marked correct and incorrect from your previous attem Required information The following information applies to the questions displayed below. Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March Units Sold at Retail Units Acquired at Cost 170 units @ $52.40 per unit 260 units @ $57.40 per unit Date Activities Mar. 1 Beginning inventory Mar. 5 Purchase Mar. 9 Sales Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales Totals 330 units@ $87.40 per unit 120 units@ $62.40 per unit 220 units@ $64.40 per unit 200 units@ $97.40 per unit 530 units 770 units 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO. (c) weighted average, and (d) specific identification. For specific identification, the March 9 sale consisted of 100 units from beginning inventory and 230 units from the March 5 purchase: the March 29 sale consisted of 80 units from the March 18 purchase and 120 units from the March 25 purchase. Complete this question by entering your answers in the tabs below. Perpetual Firo Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to ending Inventory using FIFO. Perpetual FIFO: Goods Purchased Inventory Balance of Cost Date Cost of Goods Sold Cost Cost of Goods pero # of units Cost Inventory per 23.832 00 March 9 170 @ 52 40 $ 8,908,00 52.40 160 @ 57.40 100 9,184 00 $ 18,092.00 57 40 5.740.00 $ 5.740.00 March 18 120 @ 62.40 0 @ arded 52.40 57 40 120 @ 62.40 7.488 00 $ 7.488 00 March 25 2200 600 5240 10$ 57.40 62.40 64.40 14.168 00 14.168 00 March 29 000 5240 5.740.00 57 40 100 6/240.00 1 248 00 62.40 O 0.00 14.10800 64.40 64.40 e to search Required information Weighted Perpetual Foro Perpetual LITO Average Specific Id Compute the cost assigned to ending Inventory using LIFO. Part 3 of 4 Perpetual LIFO: 64/10 Goods Purchased #of Cost units Cost of Goods Sold # of units Cost Cost of Goods per sold Sold Inventory Balance Cost Inventory per Balance points awarded Date # of units unit Scored March 1 170 @ 2.40 = $ 8,908.00 March 5 280 @ $7.40 @ = 170 200 $2.40 57.40 le 5 $ 8,908.00 14.92400 $23.832.00 March 9 8.908.00 170 20 200 @ @ $ $2.40 5740 o 90 $2.40 57.40 $ 5.168.00 14.924 00 $ 23,832.00 $ 5.166 00 March 18 120 @ 62.40 52 40 $ 5, 106 00 5740 6240 7.488 00 312 65400 March 25 220 @ 4400 52.40 00 5,106 00 120 @ 90 7. 4 00 Type here to search Compute the cost assigned to ending Inventory using weighted average. (Round your average cost per unit to 2 decimal places.) Weighted Average Perpetual: Goods Purchased # of Cost Date units per unit March 1 # of units sold Cost of Goods Sold Cost per Cost of Goods Sold ded unit March 5 260 @ 57400 Average March 9 330 @ 740 - $28,842.00 Inventory Balance Cost Inventory # of units per Balance unit 170 @ 2.40 $ 8,908 00 170 @ 52.40 $ 8,908.00 260 57.40 14,924.00 430 @ 520 $ 23,832.00 1000 @ $240 - S 5.240.00 $ 5.240.00 100 52.40 120 @ 741 6,889 20 220 @ $ 12,129 20 120 @ @ 220 @ 340 @ = $ 20,783.60 140 @ $ 8,556 80 March 18 120 @ 5741 Average March 25 2200 4 40 5513 - 55,615 50 6440 - 14,168 00 March 29 200 @ 61.12 = $12 224.00 $41,066.00 81.12- Totals e to search Compute the cost assigned to ending inventory using specific identification. For specific identification, the March 9 sale consisted of 100 un inventory and 230 units from the March 5 purchase; the March 29 sale consisted of 80 units from the March 18 purchase and 120 units from Specific Identification: Goods Purchased # of Cost Date units unit March 1 arded Cost of Goods Sold # of units Cost Cost of Goods sold per Sold unit Inventory Balance Cost Inventory Balance per # of units per unit 170 5240 $ 8,908 00 March 5 260 @ 6740 $ 8,908.00 170 260 @ @ 57.40 14,924.00 $ 23,832.00 March 9 230 @ S 52.40 52.40 4,716.00 12 052 00 5 740.00 90 100 @ @ 100% @ 57.40 57.40 $ 5,740.00 17,792.00 $ 10,456.00 March 18 120 @ 6240 52.40 $ 4,716.00 $ 57.40 5,740.00 7.488 00 $ 17,944.00 March 25 220 @ 84.40 4,716.00 52.40 57.40 5,740 00 7 4RR ON here to search $ 23,832.00 - 5471600 March 9 230 $240 - 12,082.00 52.40 100 5,740 00 100 57.40 @ 57405 ,740 00 17,79200 $ 10.456 00 March 18 120 @ 62.40 52.40 4.716.00 awarded 90 100 120 5,740.00 @ $ 7,488.00 $ 17944.00 March 25 $ 220 @ 4.716 00 6440 5,740.00 OOOO POD 7.488.00 14, 168.00 $ 32 112 00 March 29 0.00 $ 4,716.00 52.40 5740 000 5.740.00 100 57.40 . 4.99200 120 7.48800 33 6240 S 6440 7.728.00 2576 00 $ 20,520.00 12.720.00 $ 20.520 00 Totals 30,512.00 Weiched Ant e here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts