Question: This year Amber purchased a factory to process and package landscape mulch. Approximately 25 percent of management time, space, and expenses are spent on this

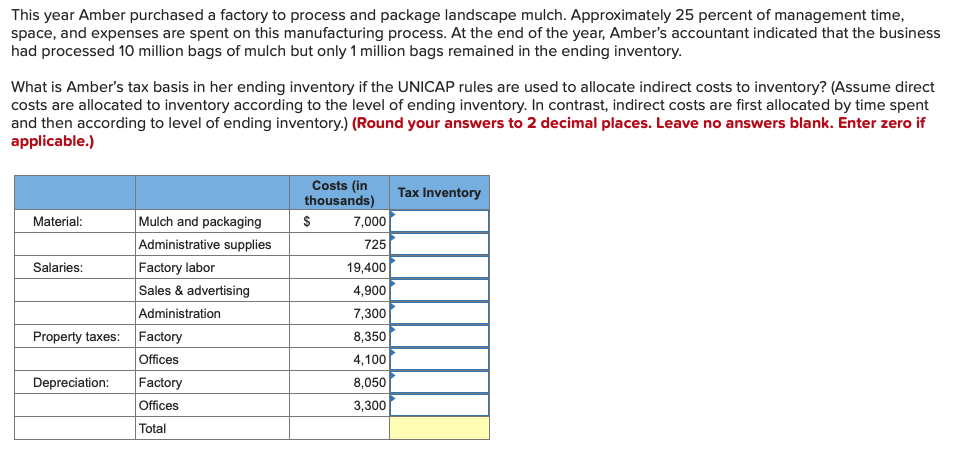

This year Amber purchased a factory to process and package landscape mulch. Approximately 25 percent of management time, space, and expenses are spent on this manufacturing process. At the end of the year, Amber's accountant indicated that the business had processed 10 million bags of mulch but only 1 million bags remained in the ending inventory. What is Amber's tax basis in her ending inventory if the UNICAP rules are used to allocate indirect costs to inventory? (Assume direct costs are allocated to inventory according to the level of ending inventory. In contrast, indirect costs are first allocated by time spent and then according to level of ending inventory.) (Round your answers to 2 decimal places. Leave no answers blank. Enter zero if applicable.) Tax Inventory Material: Costs (in thousands) $ 7,000 725 19,400 4,900 7,300 Salaries: Mulch and packaging Administrative supplies Factory labor Sales & advertising Administration Factory Offices Factory Offices Total Property taxes: 8,350 Depreciation: 4,100 8,050 3,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts