Question: This year Clark leased a car to drive between his office and various work sites. Clark carefully recorded that he drove the car 2 3

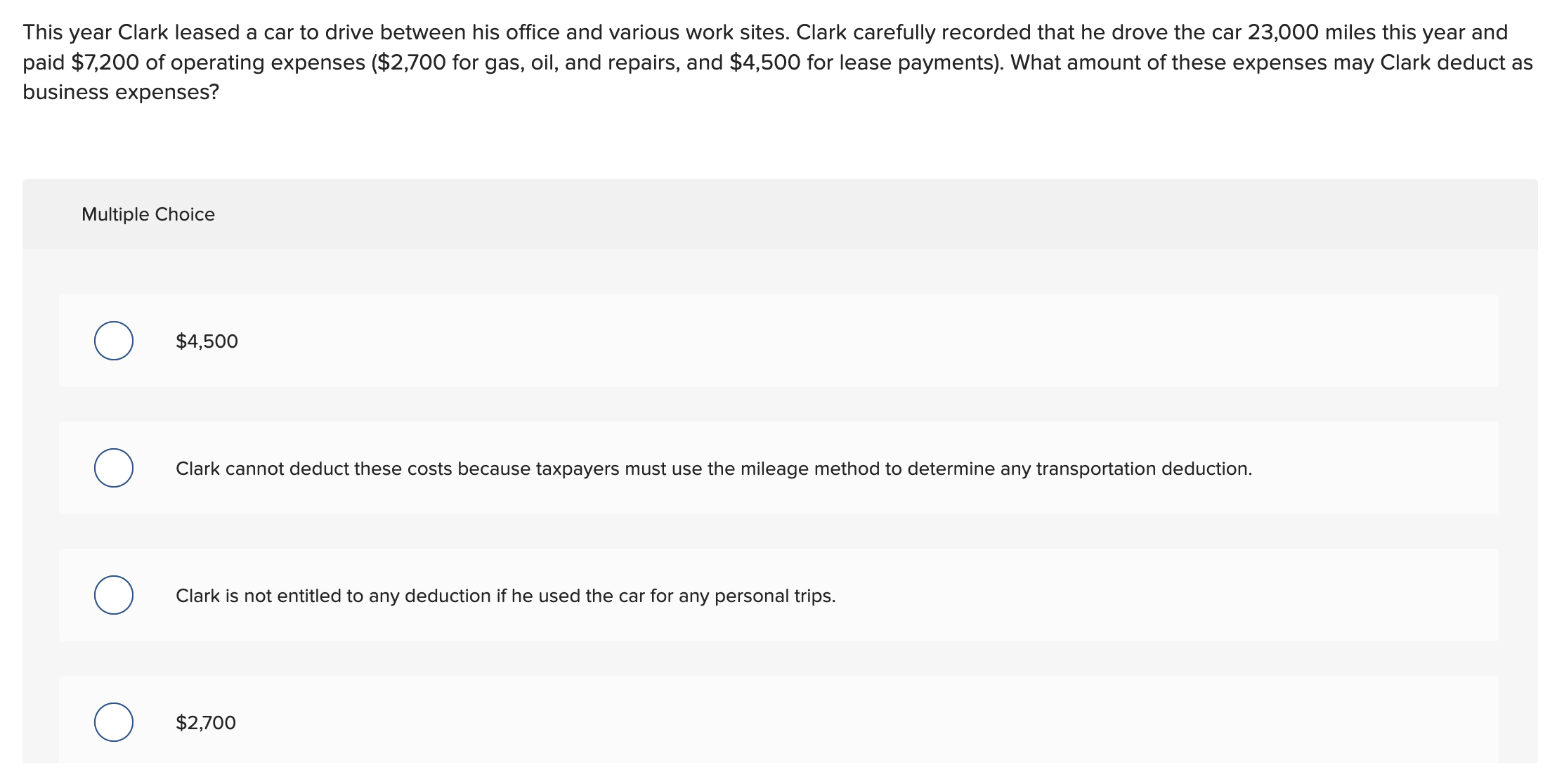

This year Clark leased a car to drive between his office and various work sites. Clark carefully recorded that he drove the car miles this year and paid $ of operating expenses $ for gas, oil, and repairs, and $ for lease payments What amount of these expenses may Clark deduct as business expenses?

Multiple Choice

$

Clark cannot deduct these costs because taxpayers must use the mileage method to determine any transportation deduction.

Clark is not entitled to any deduction if he used the car for any personal trips.

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock