Question: This year, Hermine paid $ 1 3 , 0 0 0 of investment interest expense. She also earned $ 4 , 5 0 0 in

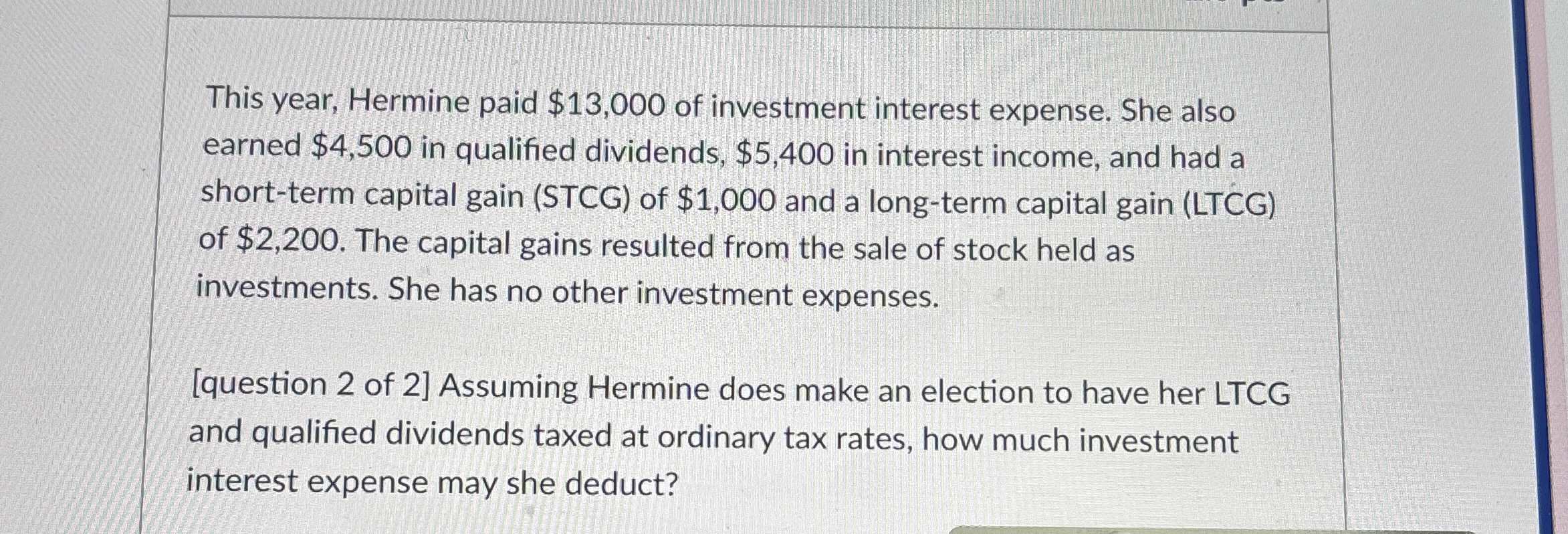

This year, Hermine paid $ of investment interest expense. She also earned $ in qualified dividends, $ in interest income, and had a shortterm capital gain STCG of $ and a longterm capital gain LTCG of $ The capital gains resulted from the sale of stock held as investments. She has no other investment expenses.

question of Assuming Hermine does make an election to have her LTCG and qualified dividends taxed at ordinary tax rates, how much investment interest expense may she deduct?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock