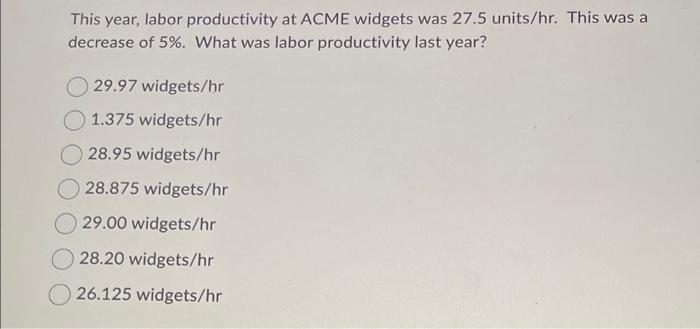

Question: This year, labor productivity at ACME widgets was 27.5 units /hr. This was a decrease of 5%. What was labor productivity last year? 29.97 widgets

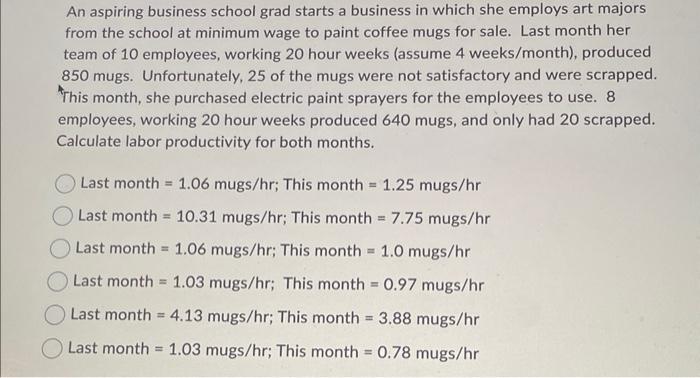

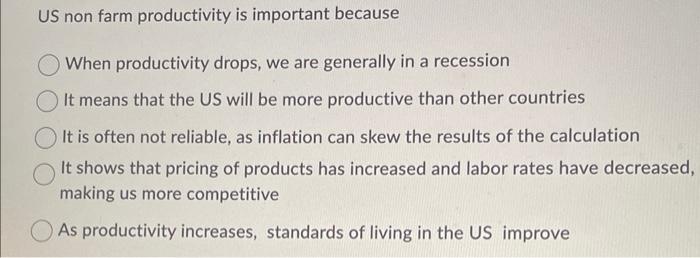

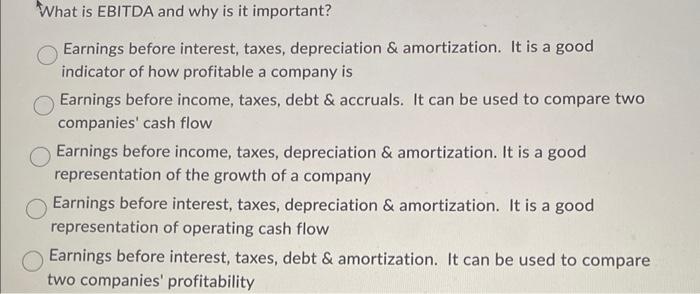

This year, labor productivity at ACME widgets was 27.5 units /hr. This was a decrease of 5%. What was labor productivity last year? 29.97 widgets /hr 1.375 widgets/hr 28.95 widgets/hr 28.875 widgets /hr 29.00 widgets /hr 28.20 widgets /hr 26.125 widgets/hr An aspiring business school grad starts a business in which she employs art majors from the school at minimum wage to paint coffee mugs for sale. Last month her team of 10 employees, working 20 hour weeks (assume 4 weeks/month), produced 850 mugs. Unfortunately, 25 of the mugs were not satisfactory and were scrapped. This month, she purchased electric paint sprayers for the employees to use. 8 employees, working 20 hour weeks produced 640 mugs, and only had 20 scrapped. Calculate labor productivity for both months. Last month =1.06 mugs /hr; This month =1.25 mugs /hr Last month =10.31 mugs /hr; This month =7.75 mugs /hr Last month =1.06 mugs /hr; This month =1.0 mugs /hr Last month =1.03 mugs /hr; This month =0.97 mugs /hr Last month =4.13 mugs /hr; This month =3.88 mugs /hr Last month =1.03 mugs /hr; This month =0.78 mugs /hr US non farm productivity is important because When productivity drops, we are generally in a recession It means that the US will be more productive than other countries It is often not reliable, as inflation can skew the results of the calculation It shows that pricing of products has increased and labor rates have decreased making us more competitive As productivity increases, standards of living in the US improve What is EBITDA and why is it important? Earnings before interest, taxes, depreciation & amortization. It is a good indicator of how profitable a company is Earnings before income, taxes, debt \& accruals. It can be used to compare two companies' cash flow Earnings before income, taxes, depreciation \& amortization. It is a good representation of the growth of a company Earnings before interest, taxes, depreciation & amortization. It is a good representation of operating cash flow Earnings before interest, taxes, debt \& amortization. It can be used to compare two companies' profitability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts